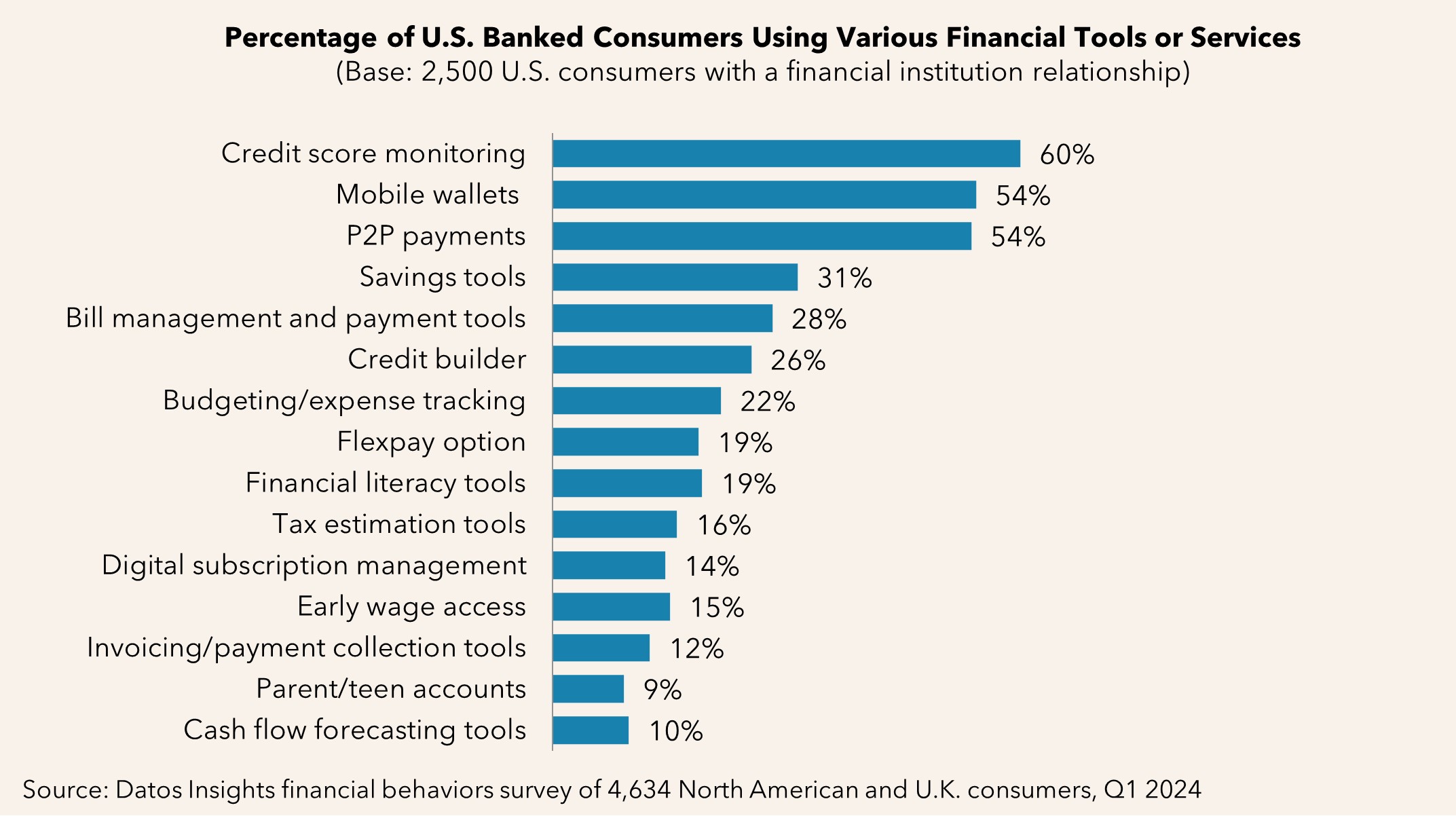

Most consumers have similar structures to their financial lives. For example, 97% of banked consumers have a checking account, 80% have a savings account, and 82% have at least one credit card. Most consumers use financial tools or apps like credit score monitoring. However, their financial goals, behaviors, and attitudes toward financial service companies can vary greatly.

This reports dives into underlying factors that influence consumer behavior, such as financial goals. It also offers insight into a consumer’s financial life by way of their accounts, the tools and services they use, and how they use various channels to conduct their financial lives. This report is based on a Q1 2024 survey of 2,500 banked U.S. customers.

Clients of Datos Insights’ Retail Banking & Payments service can download this report.

About the Author

Ariana-Michele Moore

Ariana-Michele Moore is a Strategic Advisor in Datos Insights' Retail Banking & Payments practice. Ariana covers a variety of topics supporting the practice. Prior to a career break, Ariana was a senior analyst in Celent’s retail banking group. Her research focused on topics such as payment fraud, identity theft, identity verification, payroll cards, stored value cards, biometrics, smart cards, contactless...