When it comes to churn in SMB banking, FIs do not have it easy. Optimization is required across the BX, noncredit services, onboarding, payment -rail provision, and delivery of services, both core and ancillary. Throw in a mixture of interaction channels, including APIs or mobile apps, and the crafting of an SMB market strategy gets complicated indeed.

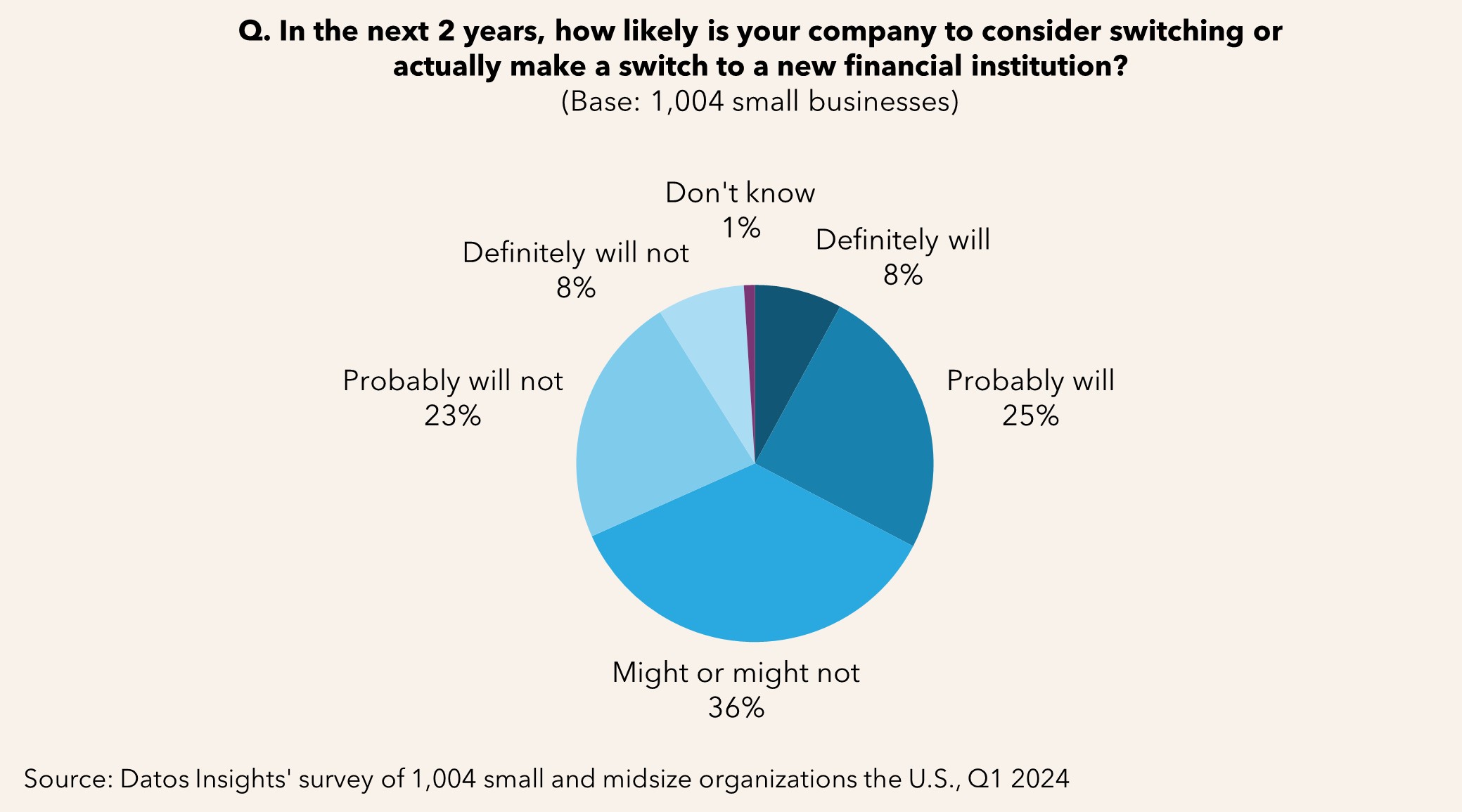

By examining American small to midsize businesses’ attitudes about changing primary financial institutions, Datos Insights presents in this report the primary attributes of SMBs more likely to change providers, commonly referred to as churn. It is based on a Datos Insights online survey of 1,004 small businesses in North America completed during Q1 2024.

Clients of Datos Insights’ Commercial Banking & Payments service can download this report.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...