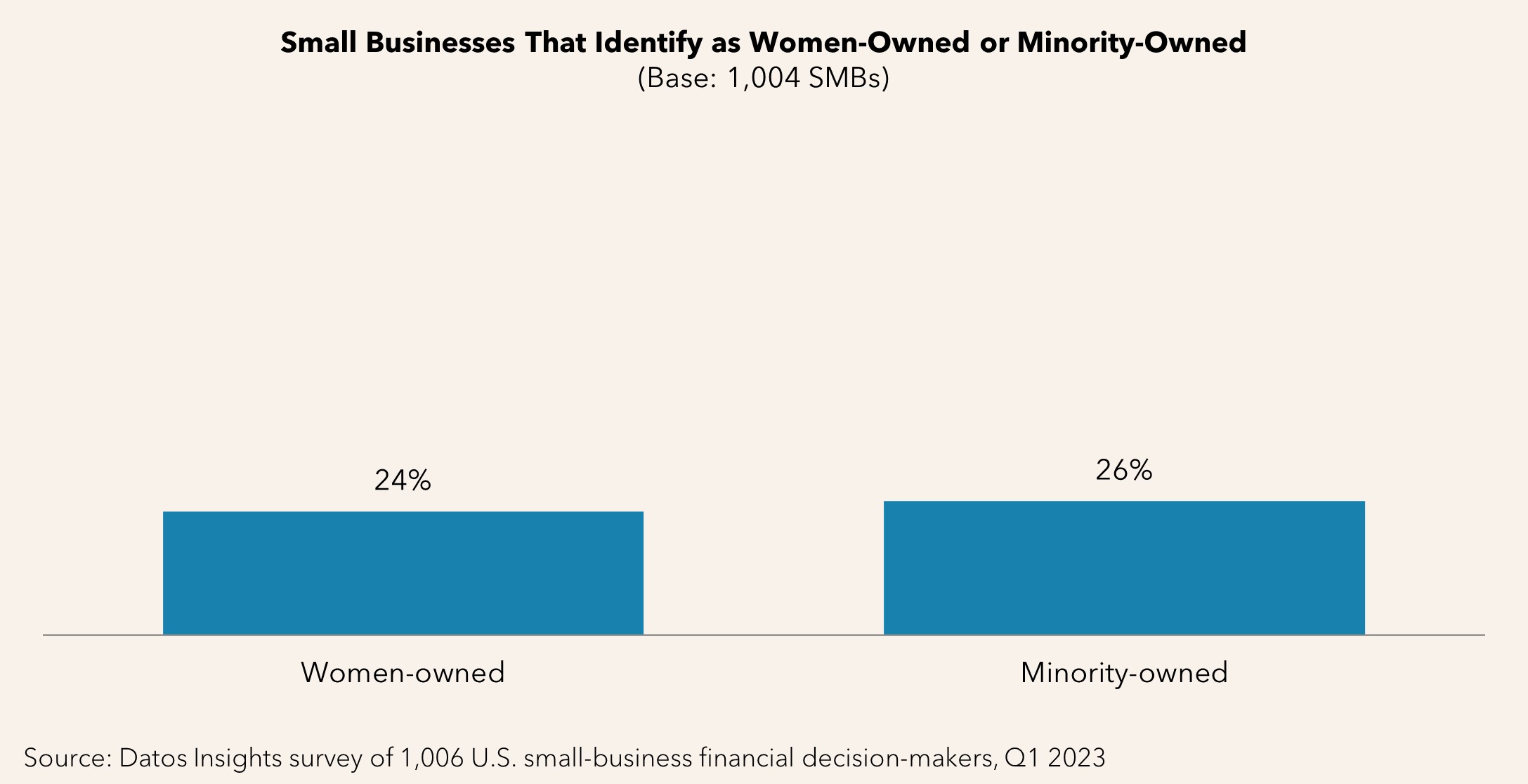

Among the 6.1 million SMBs in the U.S. as of 2020 are two significant opportunities for financial institutions (FIs): those owned by minorities and those owned by women. Business-lending FIs that pursue these segments as a growth opportunity will need to know the characteristics, preferences, and influencers of these business types and incorporate that knowledge into product offerings, the customer experience in general, and the borrowing experience in particular.

This report, based primarily on a Q1 2023 Datos Insights online survey of 1,006 U.S.-based small businesses, analyzes these SMBs to inform FIs’ outreach and go-to-market efforts focused on growing loan volume for these types of businesses. Vendors to these FIs can use this report to hone their capabilities and consulting to become trusted advisors as lending FIs seek to add environmental, social, and corporate governance-focused lending initiatives to their many mandates.

Clients of Datos Insights’ Commercial Banking & Payments service can download this report.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...