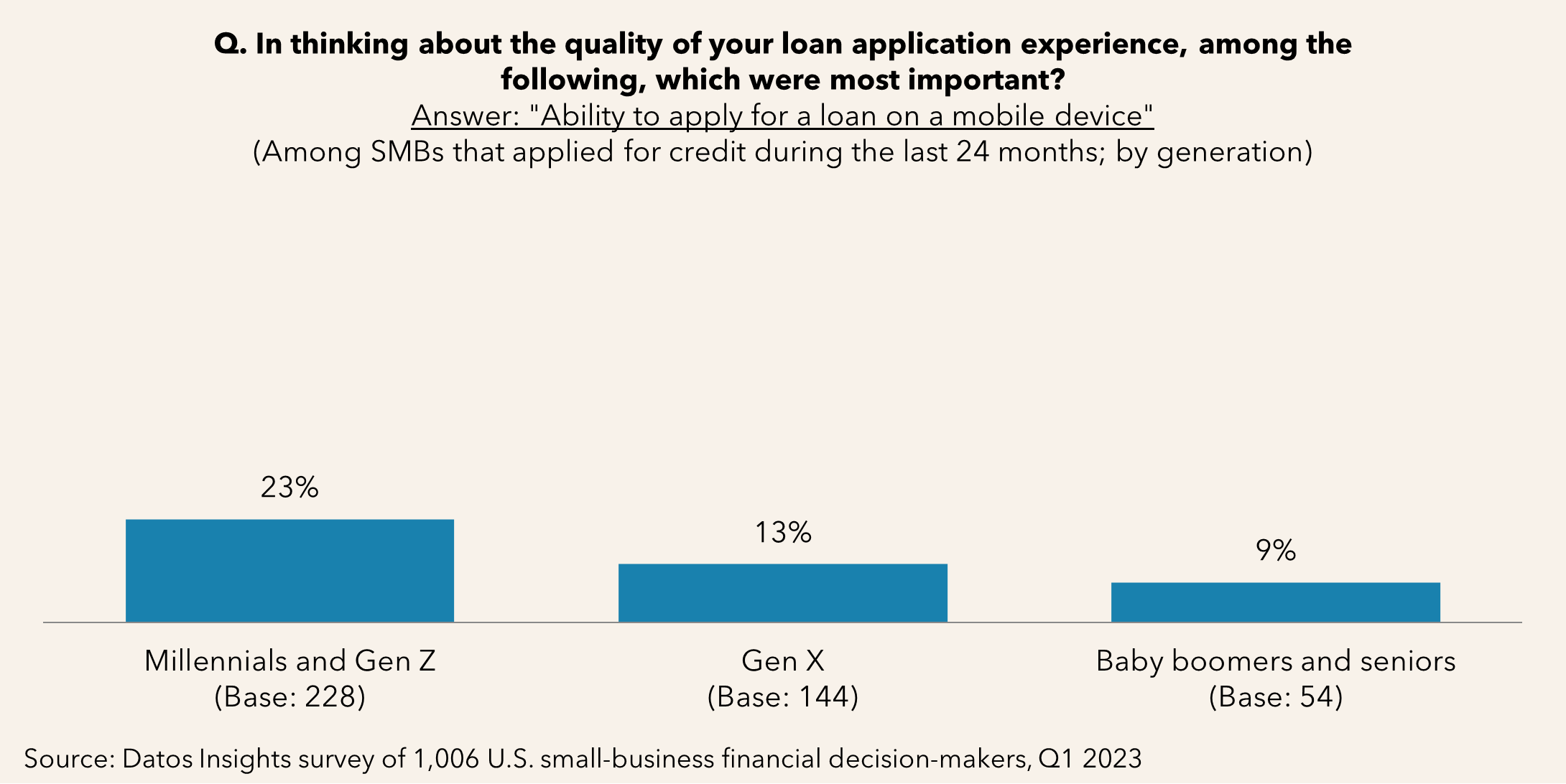

Each generation is different, especially in the magnitude of automation at hand during the formative years of their careers when workplace brains, skill sets, and habits were becoming hardwired. Millennials and Gen Zers were the first to arrive in the workplace having used the internet, mobile devices, and social networking long before they became knowledge workers. As such, small and midsize businesses run by millennials and Gen Zers present new challenges and opportunities to business-lending financial institutions compared to those run by their older counterparts.

This report compares how generational cohorts behave differently when shopping for credit for an SMB. Examined areas include influencers upon the process, aspects of the borrowing experience that are most important to them, and when they borrow relative to the financing need. The report is based primarily on a Q1 2023 Datos Insights online survey of 1,006 U.S.-based small businesses.

Clients of Datos Insights’ Commercial Banking & Payments service can download this report.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...