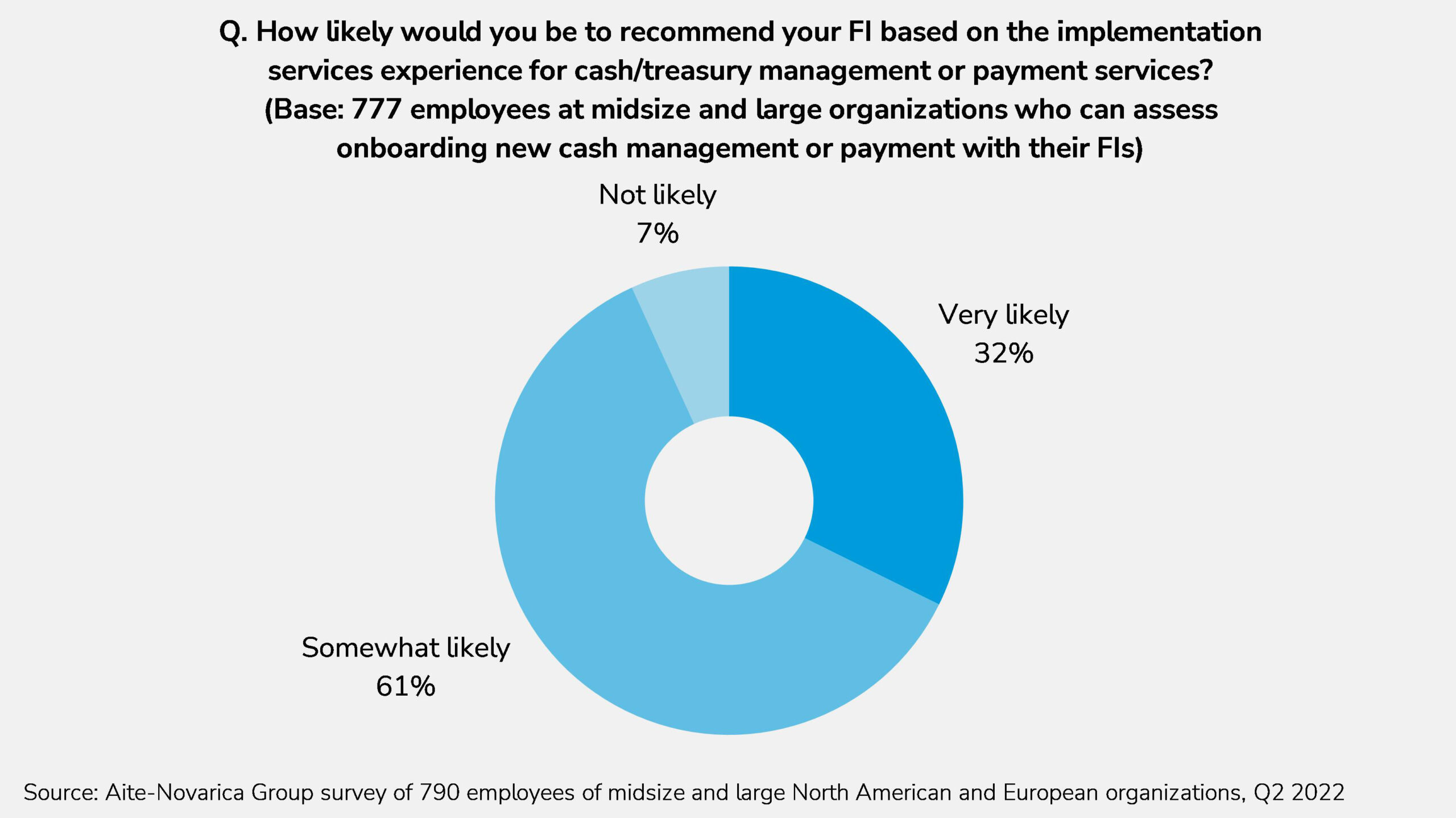

March 7, 2023 – When corporate clients, after entering a borrowing relationship with a financial institution, expand their relationship to treasury management, the onboarding experience is rarely a pleasant one. It tends to damage the corporate client’s business experience and the FI’s brand. Onboarding to noncredit services for borrowers is so pervasively bad, in fact, that 68% of global corporate clients are unlikely or only somewhat likely to recommend their FI based on its onboarding experience for treasury management or payment services.

This report profiles the features, functionality, and capabilities of commercial loan origination vendors that help FIs deliver a better onboarding experience for commercial borrowers. It is based on conversations Aite-Novarica Group has had with vendors and lenders during the second half of 2022 about the challenges commercial banking operations face when onboarding borrowers to noncredit services in the CLO space, as well as the author’s extensive knowledge of FIs’ lending practices. This report profiles the following vendors: Able, Abrigo, Finastra, and nCino.

Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.