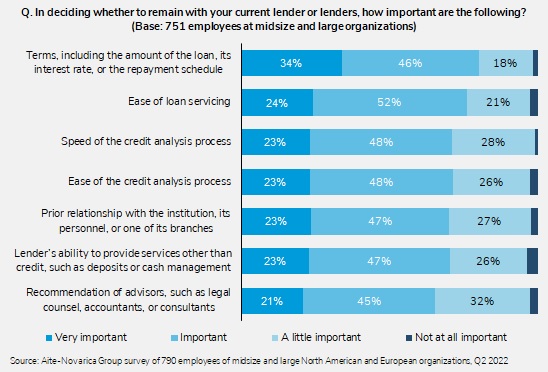

August 30, 2022 – Vigorous competition in the marketplace means customized terms must often budge in various areas. Complex terms mean that loan servicing is labor-intensive, scale resistant, and error-prone. The capital that must be set aside for each loan in case it becomes troubled means that many noncredit services must be cross-sold to earn an acceptable risk-adjusted return on capital. In short, commercial lending lines of business must excel in many areas in order to succeed.

This report explores the voice of the borrowing enterprise, including how they borrow, their priorities when deciding where to borrow, their propensity to switch, and their sentiments about technology. It is based on an online survey of 790 employees of midsize and large organizations in seven North American and European countries (Canada, France, Germany, Italy, Spain, U.K., and the U.S.) that Aite-Novarica Group undertook in Q2 2022.

This 26-page Impact Report contains 11 figures and one table. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions Brex.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...