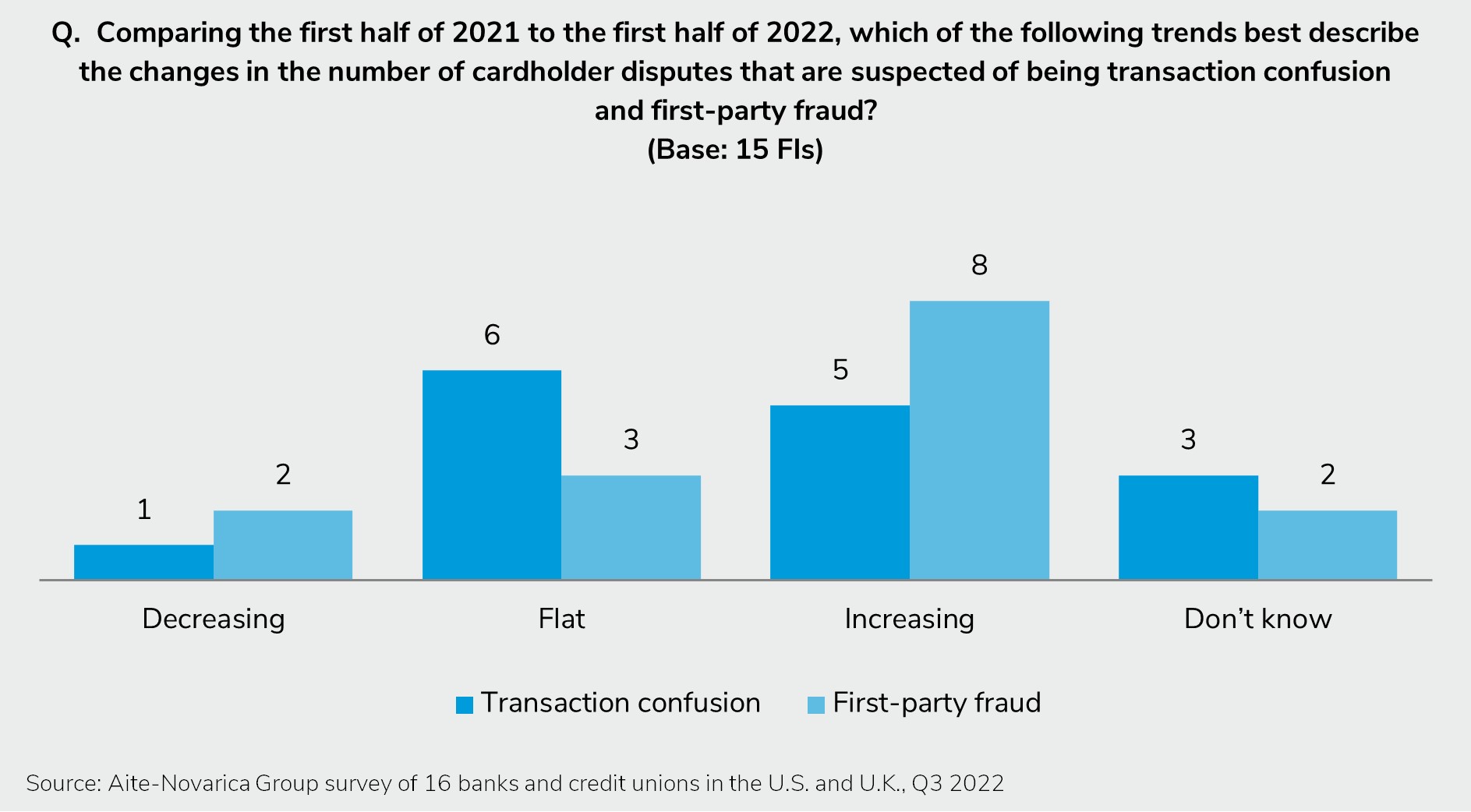

November 3, 2022 –Fighting fraudsters is tough work for FIs and merchants; that job becomes harder when the fraudster is a customer.Financial institutions and merchants in the U.S. and the U.K. experience significant first-party fraud chargeback rates, leading to high operational costs and write-offs.

For this report, commissioned by Ethoca, a Mastercard company, Aite-Novarica Group conducted qualitative interviews with 17 FIs and quantitative interviews with 302 merchants in the U.S. and U.K. This report delves into the trends in first-party fraud and a potential approach to address the issue through improved collaboration between FIs and merchants.

This 32-page Impact Report contains 16 figures and two tables. Clients of Aite-Novarica Group’s Fraud & AML service can download this report and the corresponding charts.

About the Author

Jim Mortensen

Jim Mortensen is a Strategic Advisor in Datos Insights’ Fraud & AML practice, covering identity, fraud, and data security issues. Jim has been in the financial services industry for over 30 years, delivering fraud prevention, identity verification, and credit underwriting solutions to top-tier financial institutions both domestically and internationally. Through his experience in the industry, he has developed a substantial...