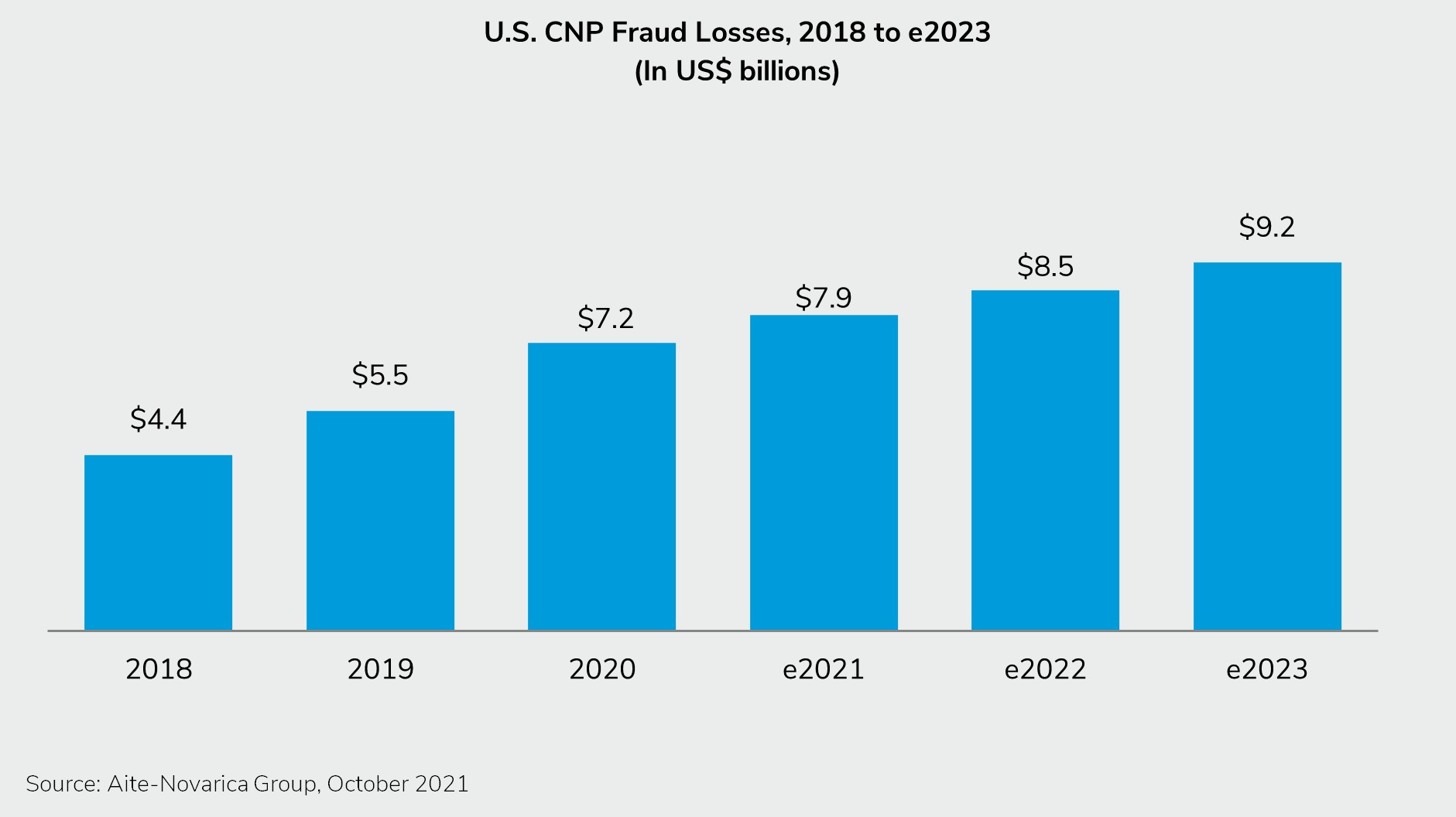

Boston, October 21, 2021 – Card-not-present transactionvolume has increased 25% to 30% from 2019 to 2020 as a result of the pandemic. Even prior to the pandemic, fraudsters focused heavily on CNP transactions as an easy avenue for fraud attacks. As a result, merchants, issuers, payments networks, and governments across the globe are looking for ways to stem the rising tide of CNP fraud. A key tool in their arsenals is 3DS.

This Impact Report delves into large issuers’ and merchants’ strategies with regard to 3DS and CNP fraud, and examines the successes as well as the opportunities for future improvement and evolution. For this research, sponsored by Outseer, Aite-Novarica Group interviewed 34 large issuers and issuing processors in North America, Europe, and the Asia-Pacific, and deployed a quantitative survey of 755 executives responsible for e-commerce payments or loss prevention strategies at midsize and large e-commerce merchants.

This 40-page Impact Report contains 23 figures and five tables. Clients of Aite-Novarica Group’s Retail Banking & Payments or Fraud & AML service can download this report and the corresponding charts.

About the Author

Julie Conroy

Julie Conroy serves as the Chief Insights Officer for Datos Insights. Prior to Julie’s tenure at Datos Insights, she had more than a decade of hands-on product management experience working with financial institutions, payments processors, and risk management companies. She spent a number of years as Vice President of Product Solutions with Early Warning Services, where her team managed a...

Other Authors

David Mattei

David Mattei is a Strategic Advisor at Datos Insights in the Fraud & AML practice. David has over 15 years of experience in the payments industry designing, building, and launching fraud and dispute systems. Fraud constantly poses financial and reputational risks to parties on both sides of a transaction, and David's customers have included merchants and financial institutions, giving him...

Ron van Wezel

Ron van Wezel is a Strategic Advisor in Retail Banking & Payments for Datos Insights, providing research and advisory services to clients globally. His coverage includes payments, open banking, and digital transformation. Ron is a renowned expert in payments and digital banking. He brings to Datos Insights over 30 years of experience in product development and innovation, advising clients on a...