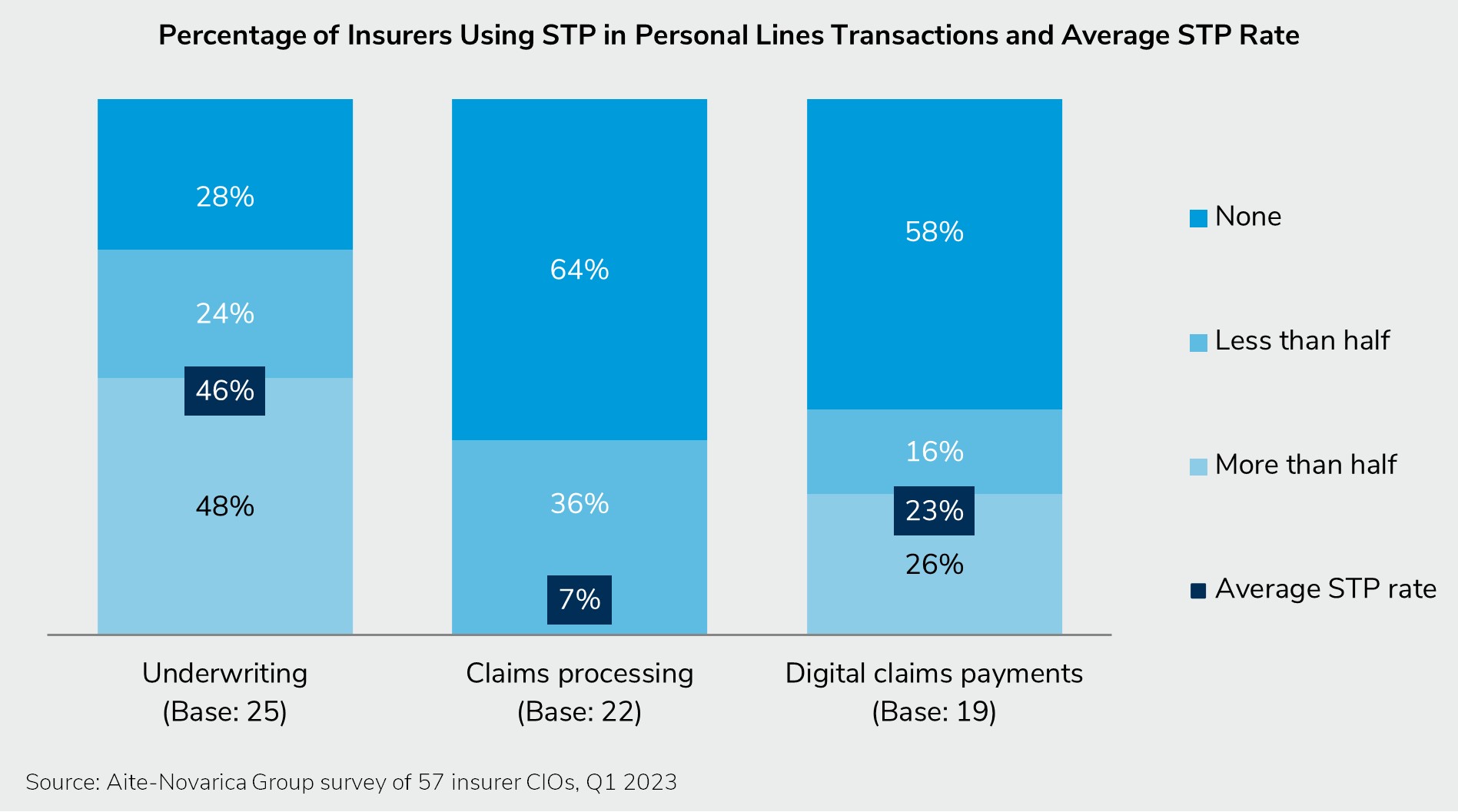

April 5, 2023 – Personal, individual life, annuities, and small commercial insurance lines are under cost pressures and are increasingly sold directly. Many insurers in these lines have enabled some level of STP. Rates in standard commercial and specialty lines are also rising as insurers create streamlined processes for certain tightly defined products. Insurers can use this report to benchmark their STP and digital claims payment rates. Solution providers can use this report to understand the extent to which insurers have automated these lines to better target prospective clients.

This Impact Report tracks STP and digital claims payment rates for seven major insurance lines of business. It provides an overview of technologies insurers have applied to enable STP. This report is based on a survey of and conversations with 57 insurer CIO members of the Aite-Novarica Group Insurance Technology Research Council conducted in the first quarter of 2023.

Clients of Aite-Novarica Group’s Life, Annuities, & Benefits and Property & Casualty services can download this report.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.