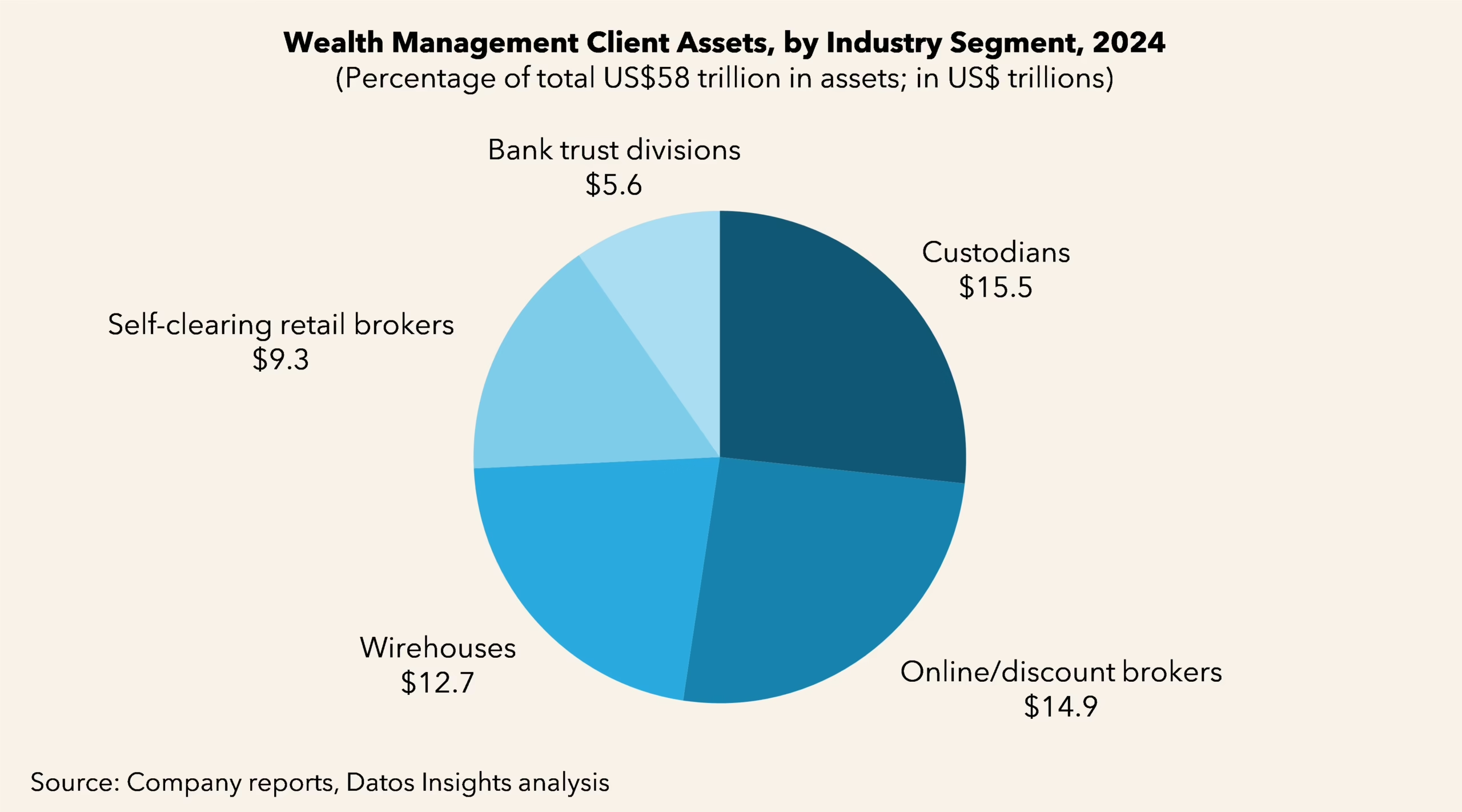

With US$58 trillion in client assets under management—a remarkable 18% increase from 2023—the U.S. wealth management industry appears to be thriving. Yet beneath this surface-level prosperity, transformative forces are reshaping competitive dynamics, redistributing market share, and redefining how Americans manage their wealth.

This report draws on annual reports, regulatory filings, news sources, and company press releases from dozens of incumbents in the wealth management ecosystem. Datos Insights developed client asset estimates through a detailed analysis of disclosures and trends across industry segments.

This report mentions Altruist, Ameriprise, Apex Clearing, Atria Wealth Solutions, Axos Advisor Services, Baird, Bank of America, Bank of the West, Bessemer Trust, BlackRock, BMO Bank, BNY Mellon, BNY Pershing, BNY Wealth, Capgemini, Charles Schwab, Chase Investment Services, CI Financial, Citibank, Credit Suisse, Datos Insights, Edward Jones, Envestnet, Equity Advisor Solutions, E*TRADE, Fidelity, First Clearing, First Republic, FNZ, Focus Financial, Goldman Sachs, Hightower, Hilltop Securities, Interactive Brokers, J.P. Morgan Chase, LPL Financial, Merrill Edge, Merrill Lynch, MoneyGuide, Morgan Stanley, Morningstar, National Advisors Trust, Northern Trust, Oppenheimer & Co., Orion, PNC Bank, Raymond James, RBC Wealth Management, Robinhood, Salesforce, SEI, SouthState Bank, Stifel Nicolaus, StoneX, TD Ameritrade, TradePMR, U.S. Bank, UBS, Vanguard, Wedbush Securities, Wells Fargo, and Wells Fargo Advisors.

About the Author

Gregory O'Gara

Greg O'Gara serves as a Strategic Advisor for Datos Insights' Wealth Management practice, focusing on research and analysis of the North American wealth management industry. He has strong expertise in financial advisor technology, platform architecture, and investment delivery models, with specialized knowledge in custody and clearing operations, retail trading ecosystems, investor engagement, and regulatory frameworks. His advisory work helps firms...