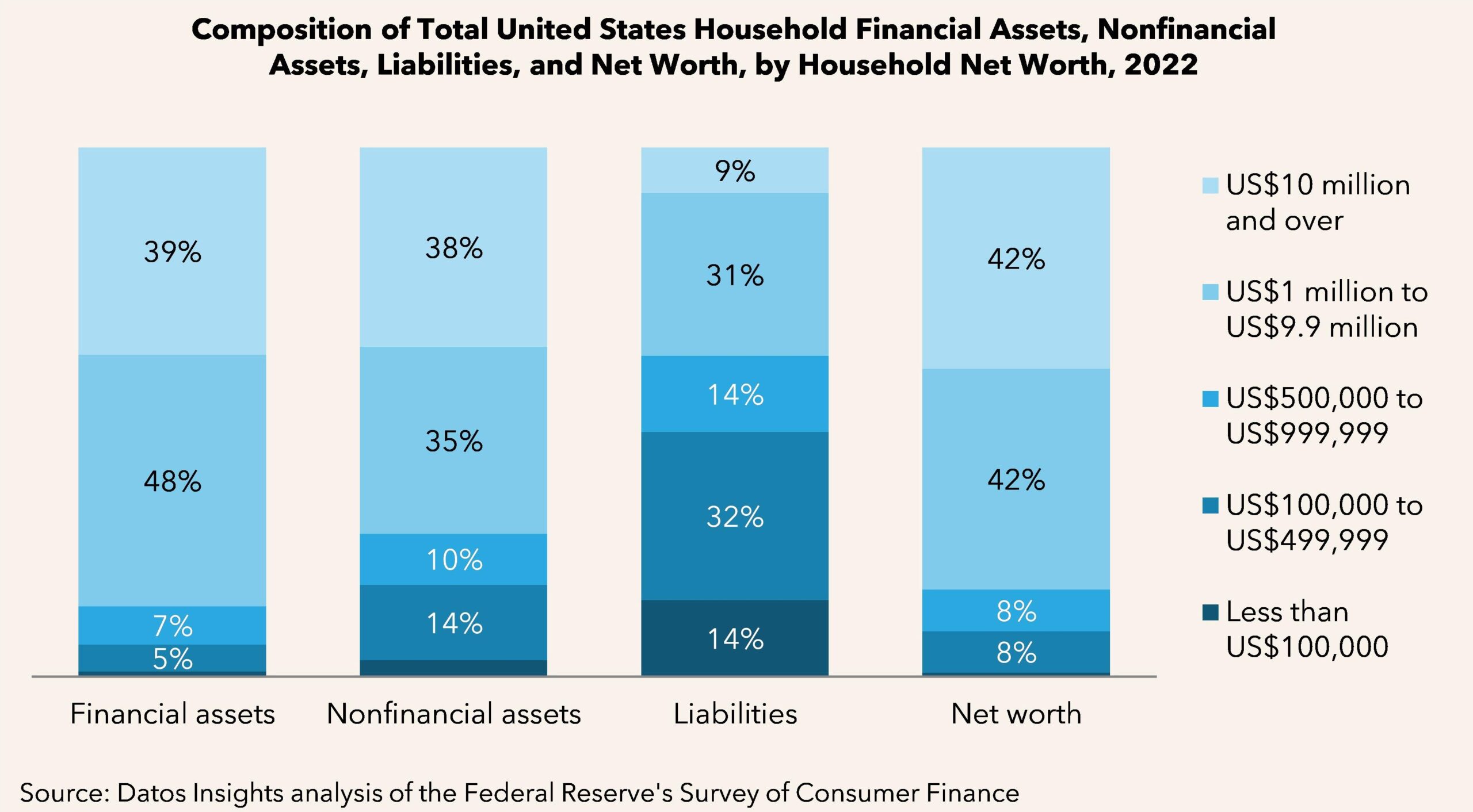

Wealth management continues to evolve from pure investment management and living and dying on alpha to the comprehensive management of all aspects of the household balance sheet. Managing the totality of a household’s financial life requires an in-depth understanding of the type of financial assets, nonfinancial assets, and various forms of debt that households across the affluence spectrum navigate to achieve their financial goals.

Based on the latest Datos Insights proprietary analysis of the 2022 Survey of Consumer Finance, this report examines the balance sheets of United States households, from the wealthiest to those struggling to develop financial stability. It provides a quantitative overview of the balance sheets of United States households to help wealth managers serve evolving client needs. It includes proportions of ownership and total and average assets held in financial products, nonfinancial assets, and various forms of debt.

Clients of Datos Insights’ Wealth Management service can download this report.

This report mentions The Federal Reserve, Bureau of Economic Analysis, U.S. Census Bureau, and the Internal Revenue Service.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.