While these functions came to market at different times over the past 10 years, recent innovations from vendors are bringing them together into a single, unified solution. A strong benefit of this combined solution is that it is a passive authenticator running in the background, unbeknownst to the end user. As such, it provides strong fraud detection and a positive user experience.

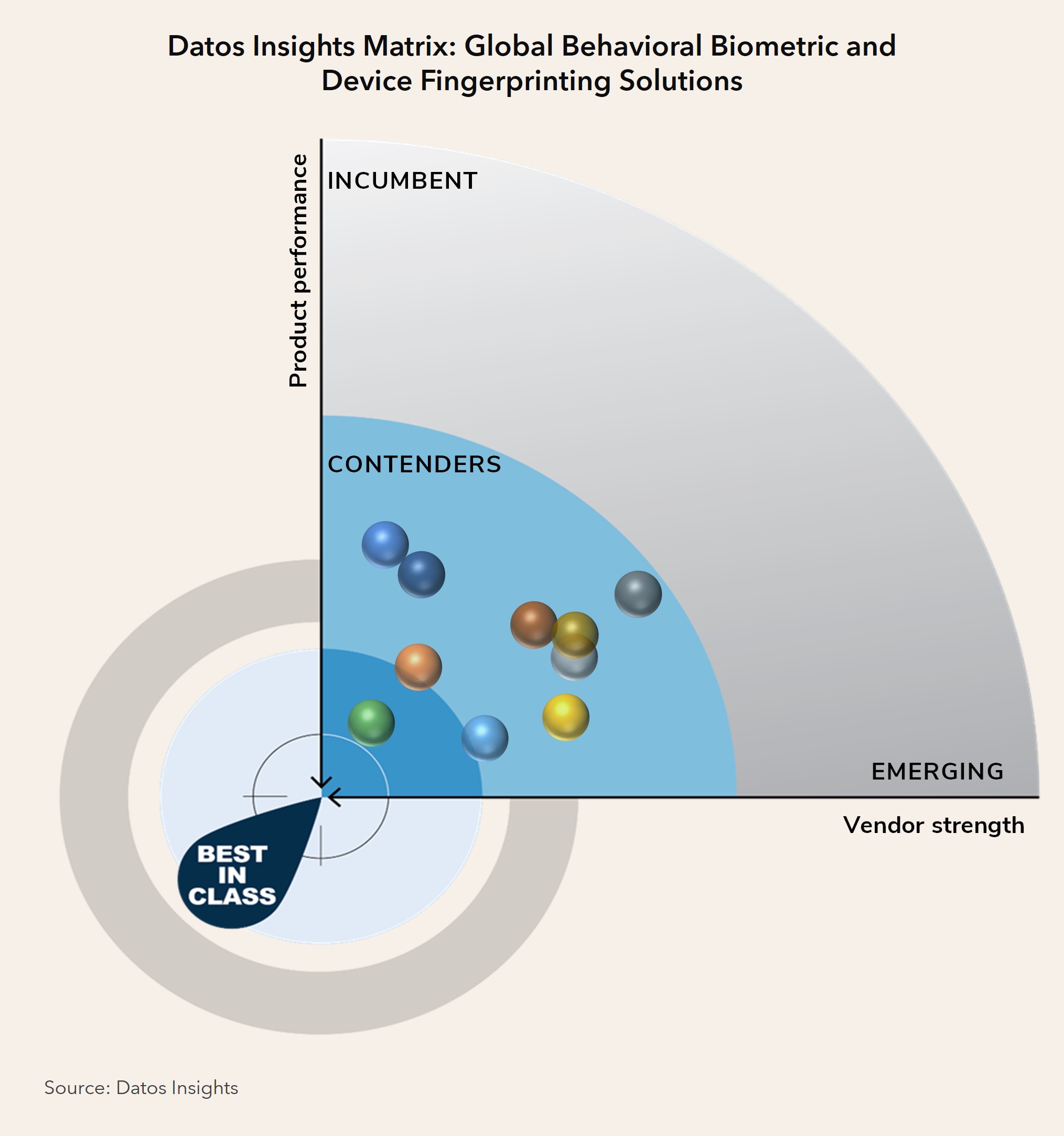

This report evaluates the overall competitive position of 10 vendors, focusing on vendor stability, client strength, product features, and client services. This report profiles Accertify, BioCatch, Callsign, DataVisor, Feedzai, LexisNexis Risk Solutions, Mastercard (NuData), Sardine, ThreatMark, and XTN Cognitive Security.

Clients of Datos Insights’ Fraud & AML service can download this report.

This report mentions Addi, Adobe, Affirm, AirAsia, Airbase, Al-Rajhi, American Express, Arkose Labs, Barclays, Blackhawk Network, Bill.com, Block, Blockchain.com, Booking.com, Brex, CaixaBank, Cajamar, Capital One, Capitec, Cheseapeake Bank, Chime, Citi, DropBox, Ekata, Electronic Arts, Entersekt, F5, First Bank of Colorado, GitHub, Honey, HSBC, Intuit, Itau, The Knoble, KutxaBank, Lloyds, Microsoft, Motion Auto, NASA FCU, National Australia Bank, Nedbank, Neo Financial, NeuroID, Novo, OpenAI, OppFI, Paygilant, PayPal, PLUSCARD, Prove, Raiffeisen, RELX, Revelock, Roblox, Singapore Airlines, Snap, Sony Interactive, Square, SurfPay, Standard Bank Group, Task Rabbit, Tenpo Fintech Chile, Telecom Argentina, TransUnion, Twilio, Union Digital, Visa, X, and ZeePay.

About the Author

Gabrielle Inhofe

Gabrielle Inhofe is a Senior Associate with Datos Insights’s Fraud & AML team. Her primary interests include cryptocurrency, artificial intelligence, and EU policy. Prior to joining Datos Insights, Gabrielle worked in Strategy and Global Regulations at cybersecurity company OneSpan, where she wrote the 2022 Global Financial Regulations Report. Gabrielle has a Masters in Advanced European and International Studies from the...

Other Authors

David Mattei

David Mattei is a Strategic Advisor at Datos Insights in the Fraud & AML practice. David has over 15 years of experience in the payments industry designing, building, and launching fraud and dispute systems. Fraud constantly poses financial and reputational risks to parties on both sides of a transaction, and David's customers have included merchants and financial institutions, giving him...

Jim Mortensen

Jim Mortensen is a Strategic Advisor in Datos Insights’s Fraud & AML practice, covering identity, fraud, and data security issues. Jim has been in the financial services industry for over 30 years, delivering fraud prevention, identity verification, and credit underwriting solutions to top-tier financial institutions both domestically and internationally. Through his experience in the industry, he has developed a substantial...