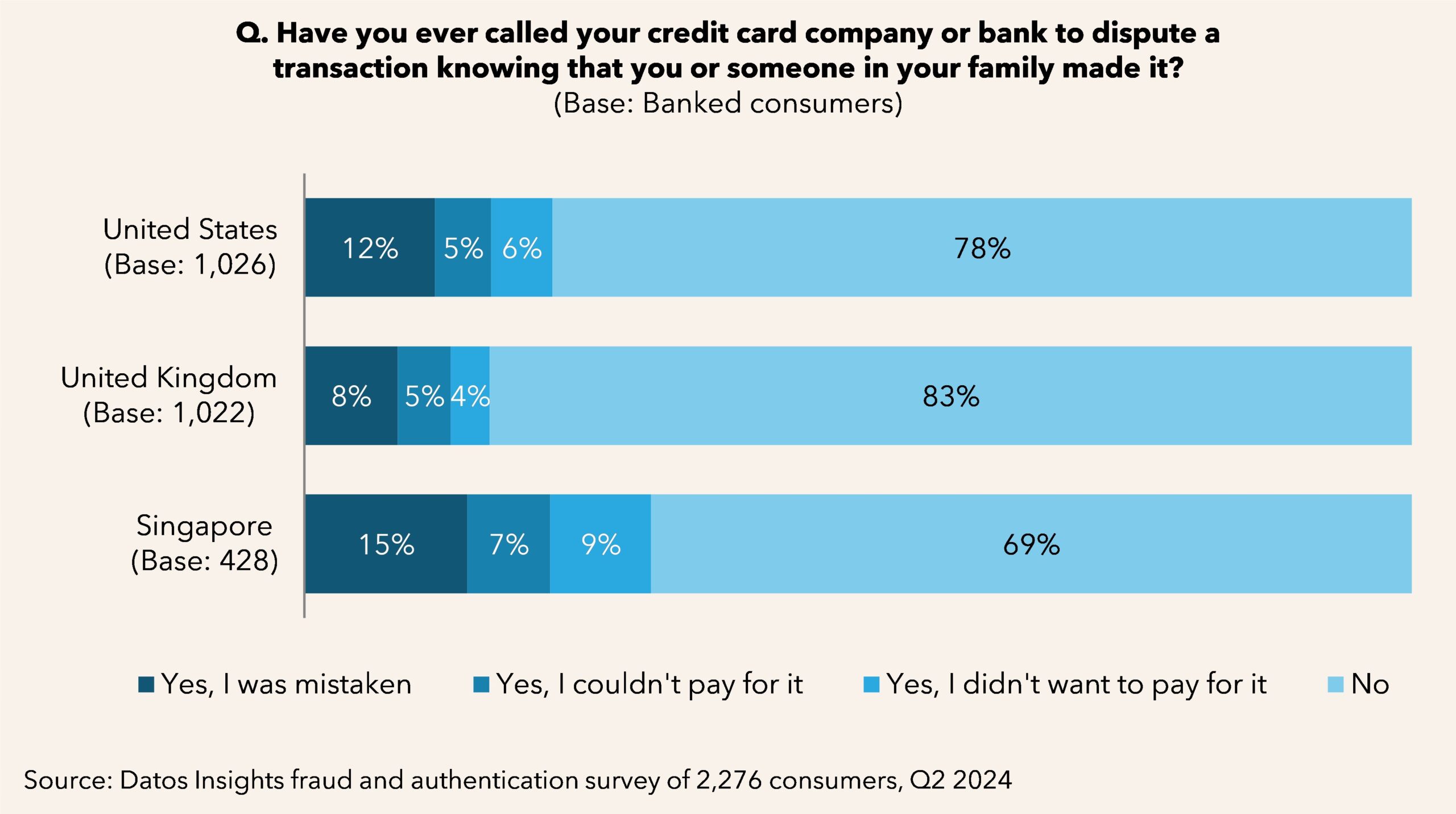

First-party fraud, when consumers falsely dispute transactions they know they authorized, has become a growing concern in the payments ecosystem. Financial institutions and merchants expend considerable resources to process these dispute claims and often assume financial liability for wrongly disputed transactions.

This report examines the scale of first-party fraud within the area of credit and debit card payments, analyzes the current efforts deployed by FIs and merchants to mitigate it, and provides insights into how firms can begin to solve this conundrum. It is based on qualitative and quantitative interviews with FIs, merchants, and consumers across multiple countries in 2024 as well as interviews with card-issuing and acquiring processors with significant global card transaction volume.

Clients of Datos Insights’ Retail Banking & Payments and Fraud & AML services can download this report.

This report mentions Ethoca, Mastercard, Verifi, and Visa.

About the Author

Ron van Wezel

Ron van Wezel is a Strategic Advisor in Retail Banking & Payments for Datos Insights, providing research and advisory services to clients globally. His coverage includes payments, open banking, and digital transformation. Ron is a renowned expert in payments and digital banking. He brings to Datos Insights over 30 years of experience in product development and innovation, advising clients on a...