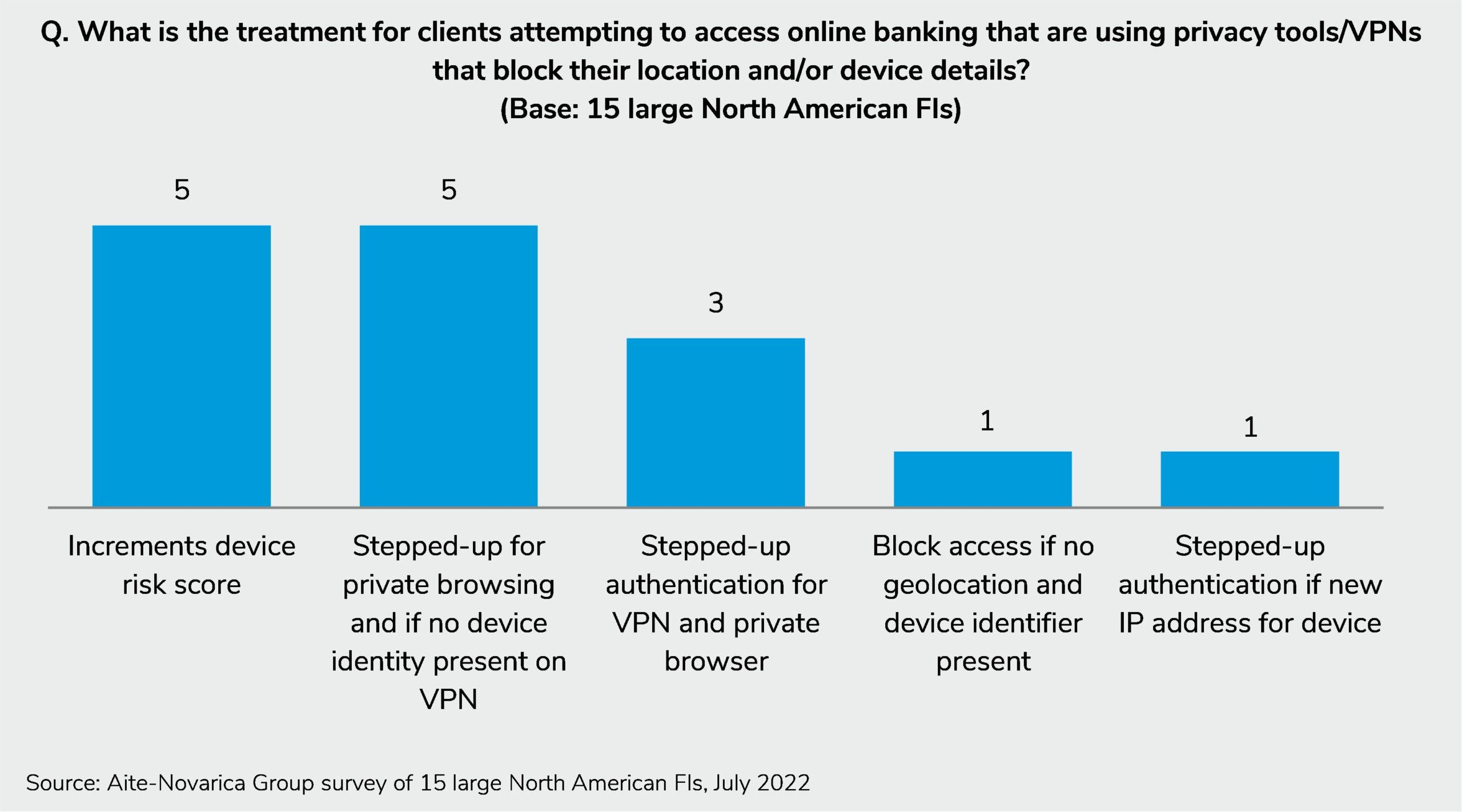

September 8, 2022 – VPNs and private browsers provide users privacy and security while online. At the same time, threat actors harness these tools to perpetrate financial crime and cybercrime. When customers seek to access online banking services through a VPN or private browser, important geolocation and device data are unavailable, complicating the authentication process.

This Impact Brief provides an overview of how 15 large North American FIs respond to customer attempts to access online banking while using VPNs and private browsers. It draws on Aite-Novarica Group’s July 2022 survey of fraud prevention executives at 15 large North American financial institutions.

Clients of Aite-Novarica Group’s Fraud & AML service can download this 12-page Impact Brief. To learn more about the topic covered in this Impact Brief, please contact us at [email protected].

About the Author

Gabrielle Inhofe

Gabrielle Inhofe is a Senior Associate with Datos Insights’s Fraud & AML team. Her primary interests include cryptocurrency, artificial intelligence, and EU policy. Prior to joining Datos Insights, Gabrielle worked in Strategy and Global Regulations at cybersecurity company OneSpan, where she wrote the 2022 Global Financial Regulations Report. Gabrielle has a Masters in Advanced European and International Studies from the...