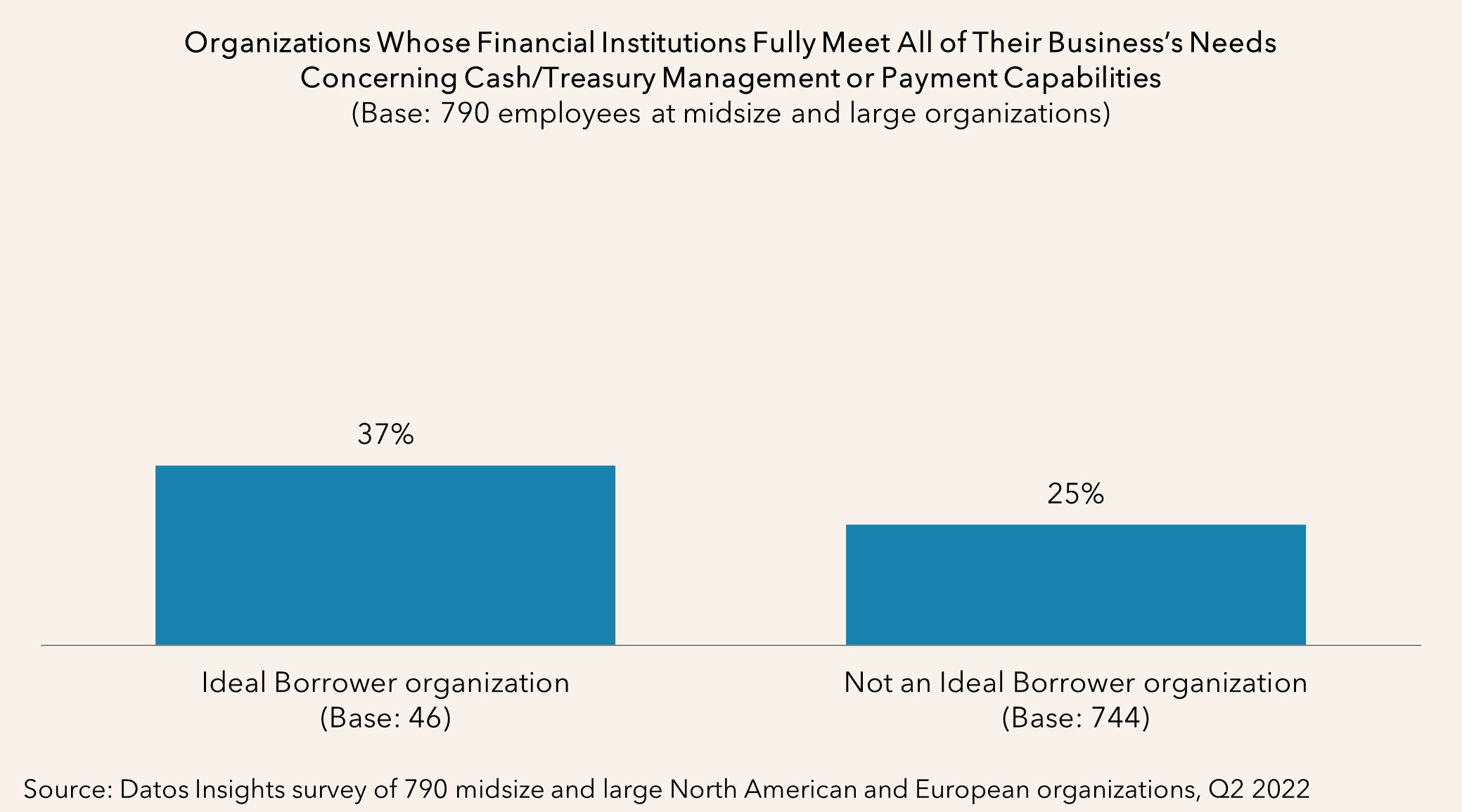

The Ideal Borrower boosts returns to business-lending institutions. They differ from typical borrowers in their consumption of payments services, experiences of treasury management (TM), and attitudes about environmental, social, and governance issues. FIs can learn from them to determine how to best tune product roadmaps, prioritize organizational goals, and optimize the client experience.

This report examines Ideal Borrowers, what makes them different, and what they mean for business-lending FIs. It is based on an online survey of 790 employees of midsize and large organizations in seven North American and European countries (Canada, France, Germany, Italy, Spain, the U.K., and the U.S.) that Datos Insights performed in Q2 2022. It will be useful to treasury management executives in charge of products, strategy, payments, and onboarding, as well as the vendors that provide systems that optimize, among other things, credit onboarding, TM onboarding, TM servicing, and the payment rails FIs make available to their borrowers.

Clients of Datos Insights’ Commercial Banking & Payments service can download this report.

This report mentions Zelle.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...