May 18, 2023 – Crowded, hypercompetitive, and cutting-edge in its embrace of new technologies, the marketplace for CLO is one of the most important spaces in commercial banking. But with a scarcity of talent, lenders need the productivity improvements available from CLO systems. The vendors in this space have expanded their roles on FIs’ enterprises to areas that include noncredit onboarding, loan servicing, and the origination of loans to small and midsize businesses.

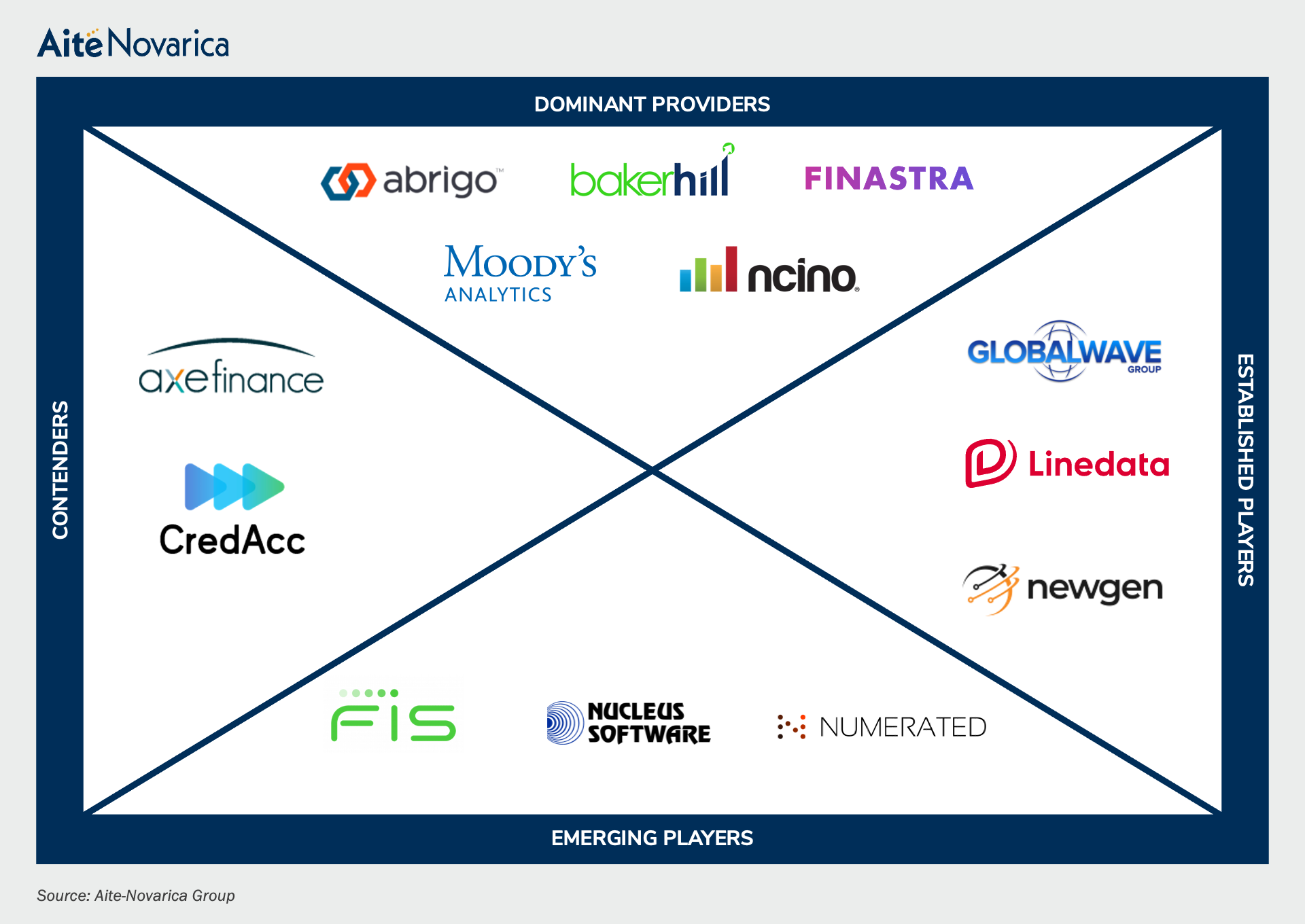

This report explores key trends within the CLO market and examines the ways technology is evolving to address new market needs and challenges after the wave of digitalization invoked by the pandemic. Participating vendors were required to complete a detailed product RFI, conduct a minimum 60-minute product demo, engage in technical discussions to verify the RFI responses, and provide three active client references. This report profiles the following vendors: Abrigo, Axe Finance, Baker Hill, Credacc, Finastra, Global Wave Group, Linedata, Moody’s Analytics, nCino, Newgen Software, Nucleus Software, and Numerated.

Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions FIS, Identifee, Intellect Design, Jack Henry & Associates, Q2, and Temenos.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...