In 2022, U.S. consumers sent US$69.5 billion to individuals across the border. Consumers largely leveraged electronic payments to send money cross-border, although some generations used cash more than others. PayPal’s Xoom and Western Union were the two top services used to send money, and trust was the most important factor when choosing a service—more so than cost.

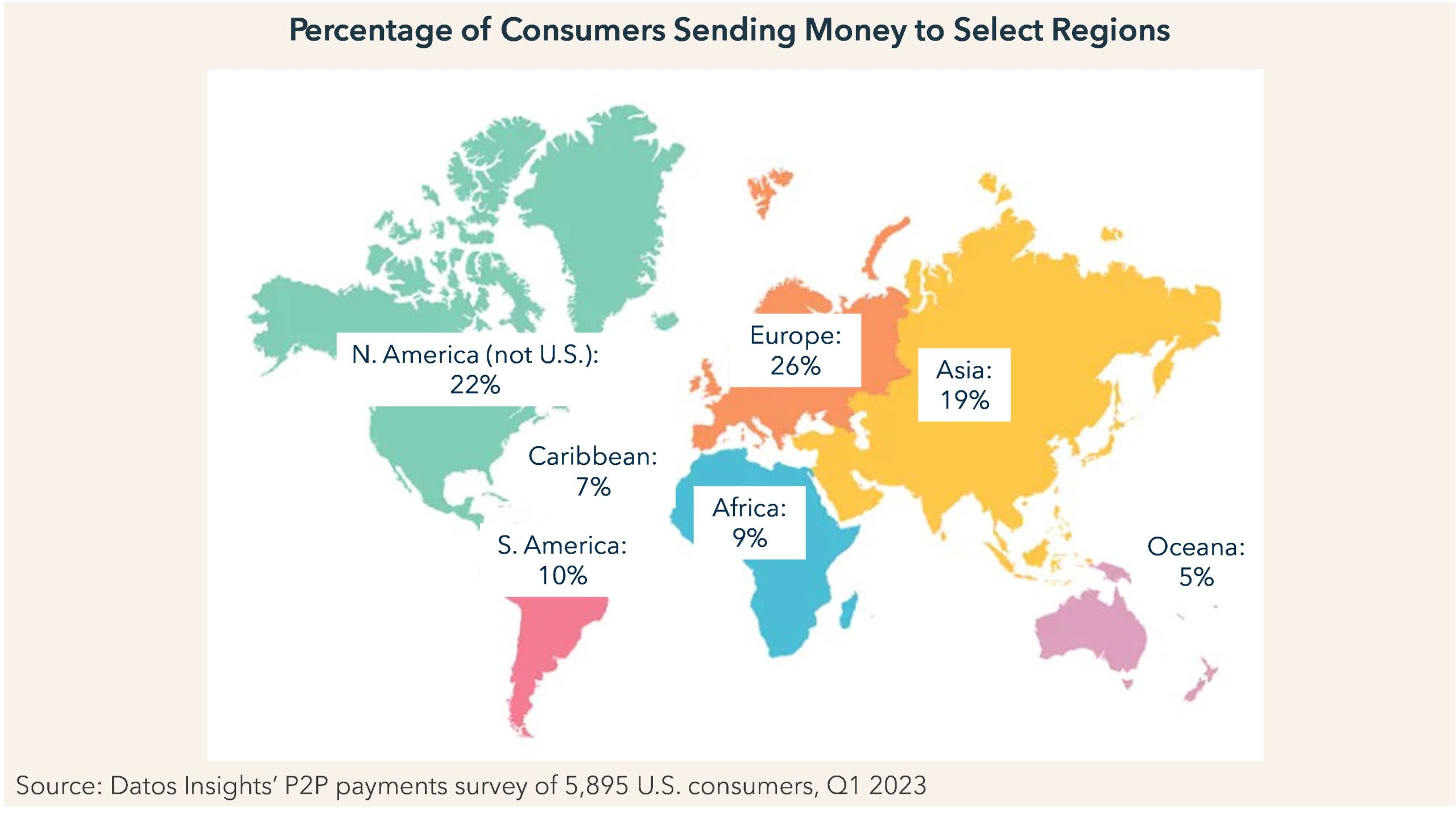

This report highlights key findings from a Datos Insights’ P2P payments survey. This survey was conducted so payment providers can better support their customers, grow their payment volume, and understand how money leaves the United States. Datos Insights surveyed 5,895 consumers in the U.S. in Q1 2023 to better understand their attitudes and preferences when giving, sending, or paying money to other individuals (also referred to as P2P payment in this study).

Clients of Datos Insights’ Retail Banking & Payments service can download this report.

This report mentions MoneyGram, PayPal (Xoom), Walmart, Western Union, and Wise.

About the Author

Ariana-Michele Moore

Ariana-Michele Moore is an Advisor in Datos Insights' Retail Banking & Payments practice. Ariana covers a variety of topics supporting the practice. Prior to a career break, Ariana was a senior analyst in Celent’s retail banking group. Her research focused on topics such as payment fraud, identity theft, identity verification, payroll cards, stored value cards, biometrics, smart cards, contactless payments,...