Boston, March 7, 2019 – Despite the myriad benefits they provide to the U.S. economy and their communities, small businesses are challenged daily in their efforts to stay afloat. The majority of their purchase volume is generated by debit card, credit card, and check, making cash flow a critical pain point, and they often work with business lenders to cover cash flow shortages. Can acquirers/processors and business lenders evolve their payment strategies to include real-time payments for the timely disbursement of funds to small businesses?

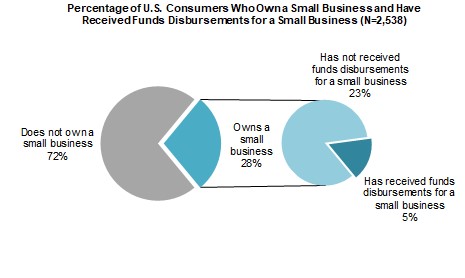

This report examines U.S. small-businesses’ demand for real-time payments and payment method preferences. It is based on a quantitative consumer study commissioned by Ingo Money and conducted by Aite Group in Q2 2018. The online study included U.S. consumers age 18 or older who received a funds disbursement in the 12-month period from June 2017 to May 2018.

This 24-page Impact Note contains 17 figures and four tables. Clients of Aite Group’s Wholesale Banking & Payments or Retail Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Allstate, Amazon, Apple, FIS, Lyft, Mastercard, Samsung, The Clearing House, Uber, Venmo, Visa, Vocalink, and Zelle.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.