June 28, 2023 – In the past 12 months, consumers have experienced a rapid volte-face in the availability and cost of credit. Additional pressure remains on banks in the U.S. and globally as markets work to determine if the banking system is, in fact, resilient. In times of tightening credit availability, wealth managers have several tools at their disposal to provide liquidity to their clients.

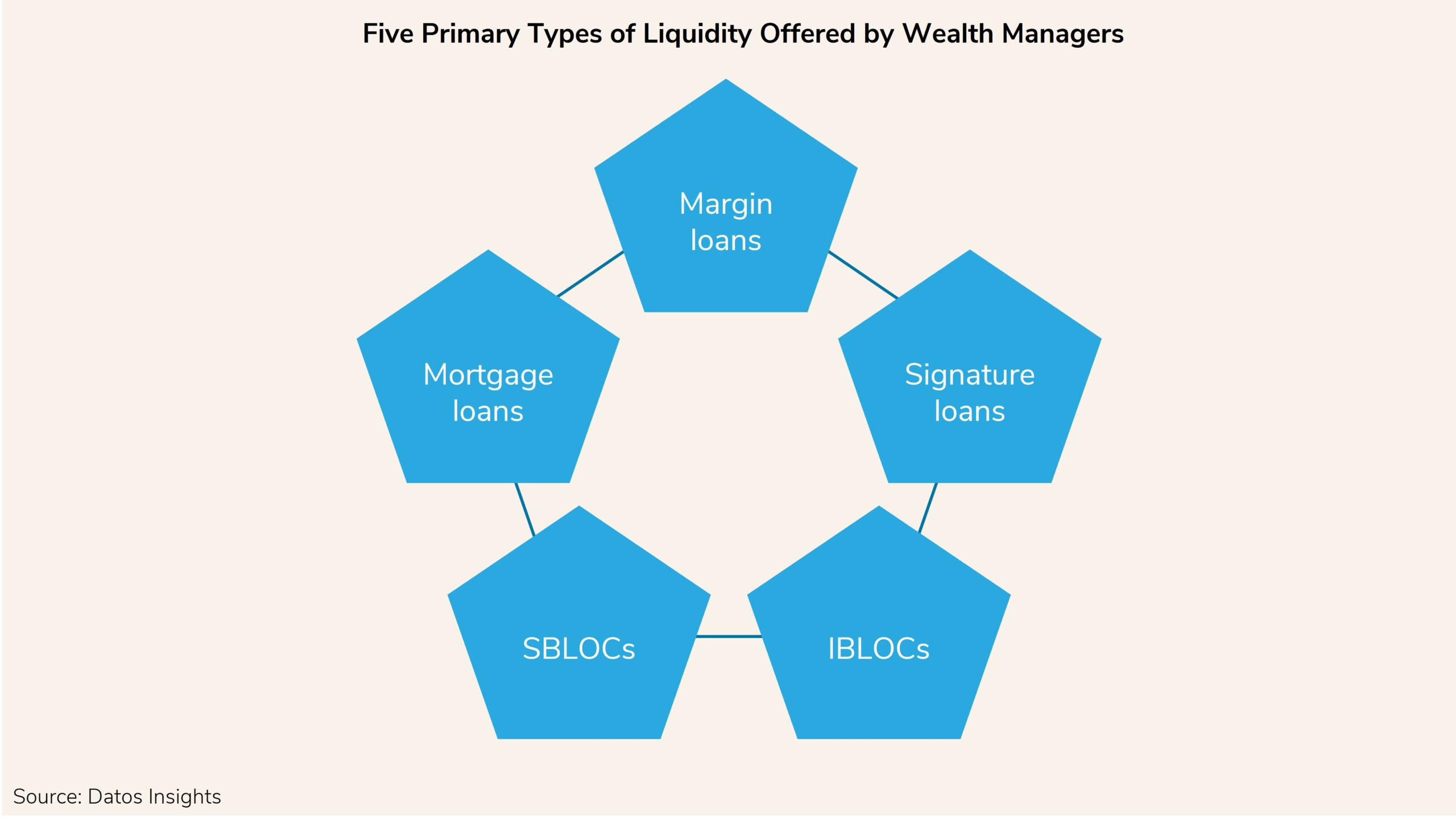

This report looks at some of these tools, including margin loans, securities-based lending, signature loans, real estate loans, and, in the case of insurance-focused wealth managers, insurance-backed lines of credit. It is based on interviews with or presentations by industry participants, including lending platform providers, funding aggregators, wealth manager home-office personnel, and individual financial advisors, conducted in Q1 2023 and data from a survey of 483 U.S.-based financial advisors in Q4 2021.

Clients of Datos Insights’ Wealth Management service can download this report.

This report mentions Addepar, Advisor Credit Exchange, Bancorp Solutions, Broadridge, Credit Suisse, Envestnet, First Republic Bank, Guardian Life, Mass Mutual Life, Mortgage Bankers Association, New York Life, Northwestern Mutual Life, Signature Bank, Silicon Valley Bank, Supernova, The Federal Reserve Bank, and UBS.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.