The RIA channel of the wealth management industry has been consolidating under a wave of M&As and advisor recruitment for over a decade. While the news headlines focus on who bought who and who financed it, there are more far-reaching consequences of this secular trend that are impacting stakeholders. In this series of reports, Datos Insights uncovers insights from the current RIA M&A trend based on the perspectives of four key participants in M&A deals: acquirers, sellers, technology vendors, and financiers. From these four groups, industry stakeholders can learn where the opportunities and challenges lie ahead for their businesses.

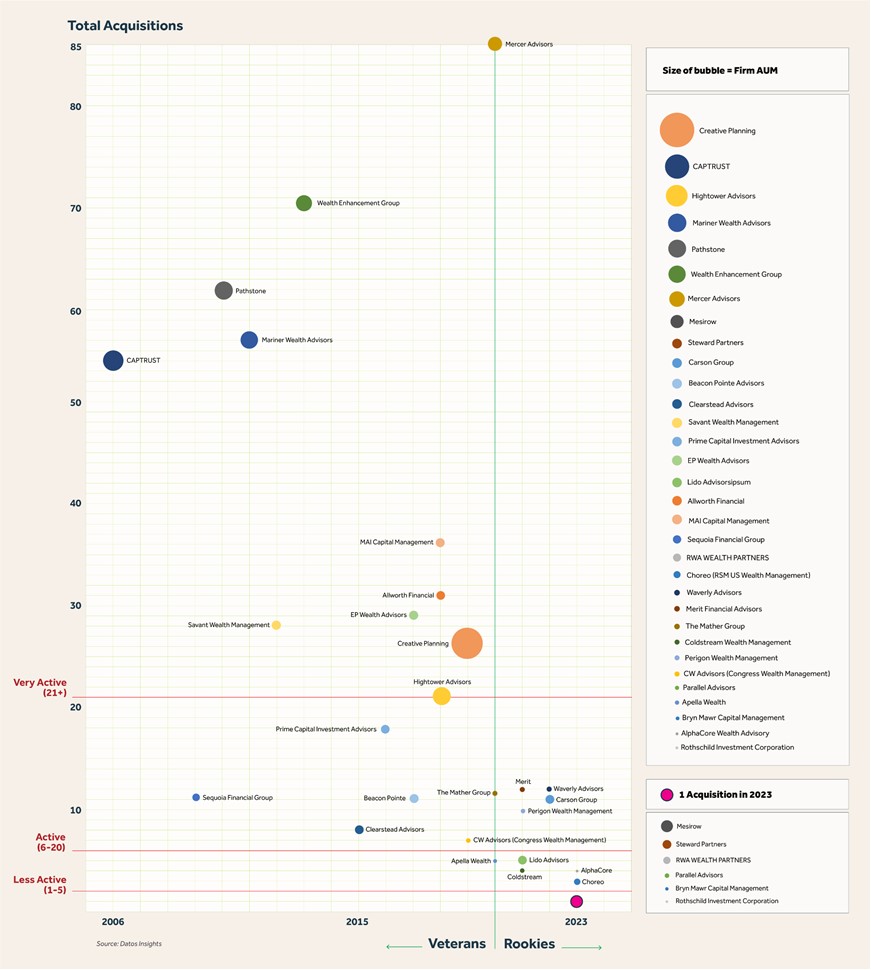

This report evaluates the proverbial stars of the M&A deal—the acquirers. By understanding their history, motivations, value proposition, long-term business objectives, and modus operandi, we can answer how RIA and non-RIA participants position themselves for future success. This report is based on a Datos Insights survey of 100 wealth management firms across the U.S., Canada, and the U.K., interviews with M&A specialists from five leading acquirers, and M&A deal press releases.

Clients of Datos Insights’ Wealth Management service can download this report.

This report mentions Abry Capital, Bain Capital, Beacon Pointe Advisors, Black Diamond, CAPTRUST, Carlyle, Carson Group, eMoney, Fidelity Investments, GTCR, KKR, Leonard Green & Associates, Long Ridge Equity Partners, Mariner Wealth Advisors, Prime Capital Investment Advisors, Salesforce, and Vestwell.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.