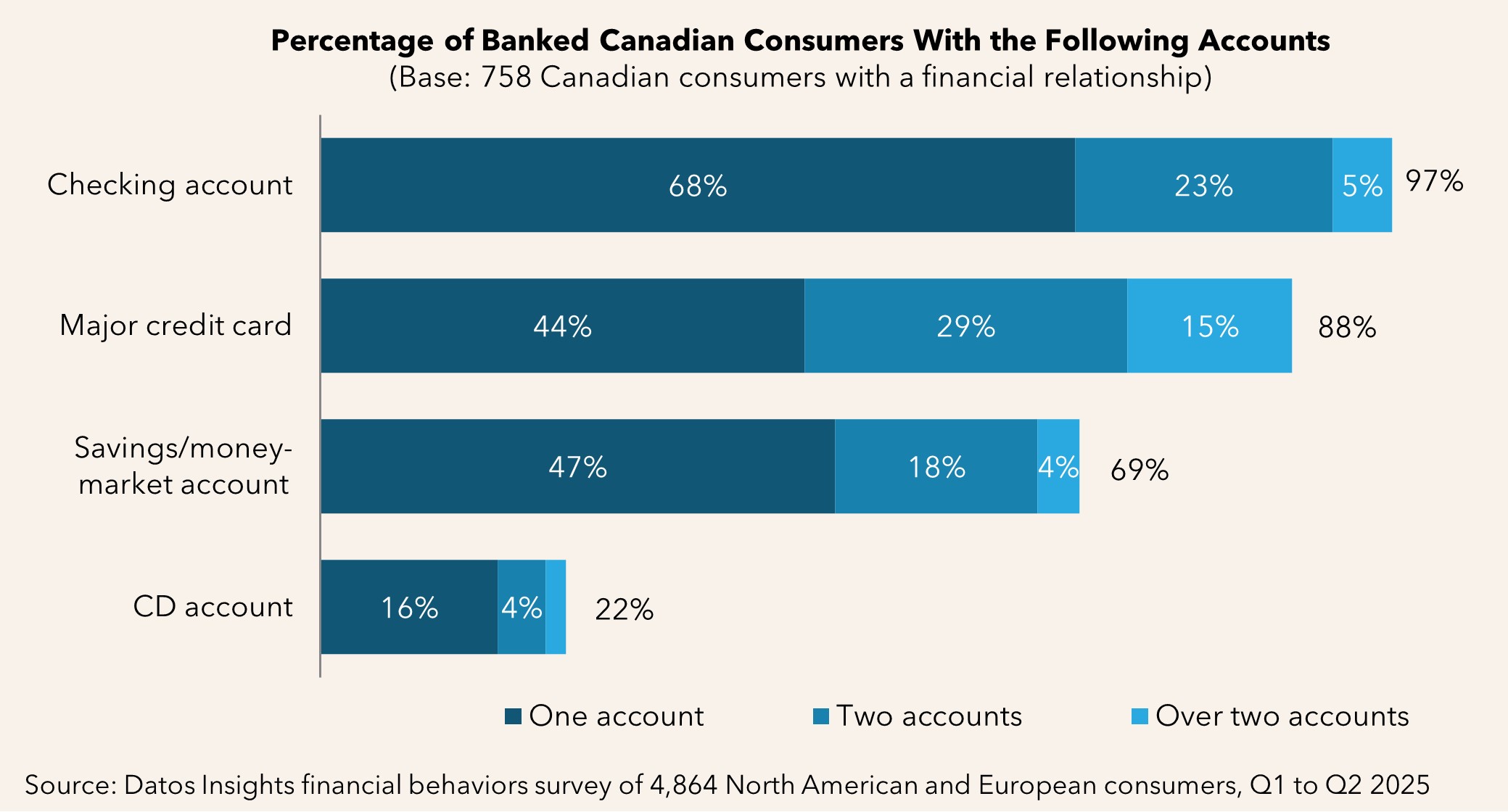

Datos Insights’ analysis of Canadian banking preferences reveals a complex landscape in which traditional banking products remain universal but consumers are diversifying relationships across multiple institutions and demonstrating dramatic generational divides in technology adoption. These conditions create sophisticated yet fragmented financial relationships that prioritize best-in-class solutions over single-institution loyalty.

This report examines the financial behaviors, preferences, and goals of banked Canadian consumers based on a comprehensive Datos Insights survey of 4,864 consumers in the U.S., Canada, and select European countries conducted in Q1 and Q2 2025. The findings provide financial service providers with valuable insights into account ownership patterns, financial relationships, channel preferences, and technological adoption across different demographic segments.

Clients of Datos Insights’ Retail Banking & Payments service can download this report.

About the Author

Ariana-Michele Moore

Ariana-Michele Moore is a Strategic Advisor in Datos Insights' Retail Banking & Payments practice. Ariana covers a variety of topics supporting the practice. Prior to a career break, Ariana was a senior analyst in Celent’s retail banking group. Her research focused on topics such as payment fraud, identity theft, identity verification, payroll cards, stored value cards, biometrics, smart cards, contactless...