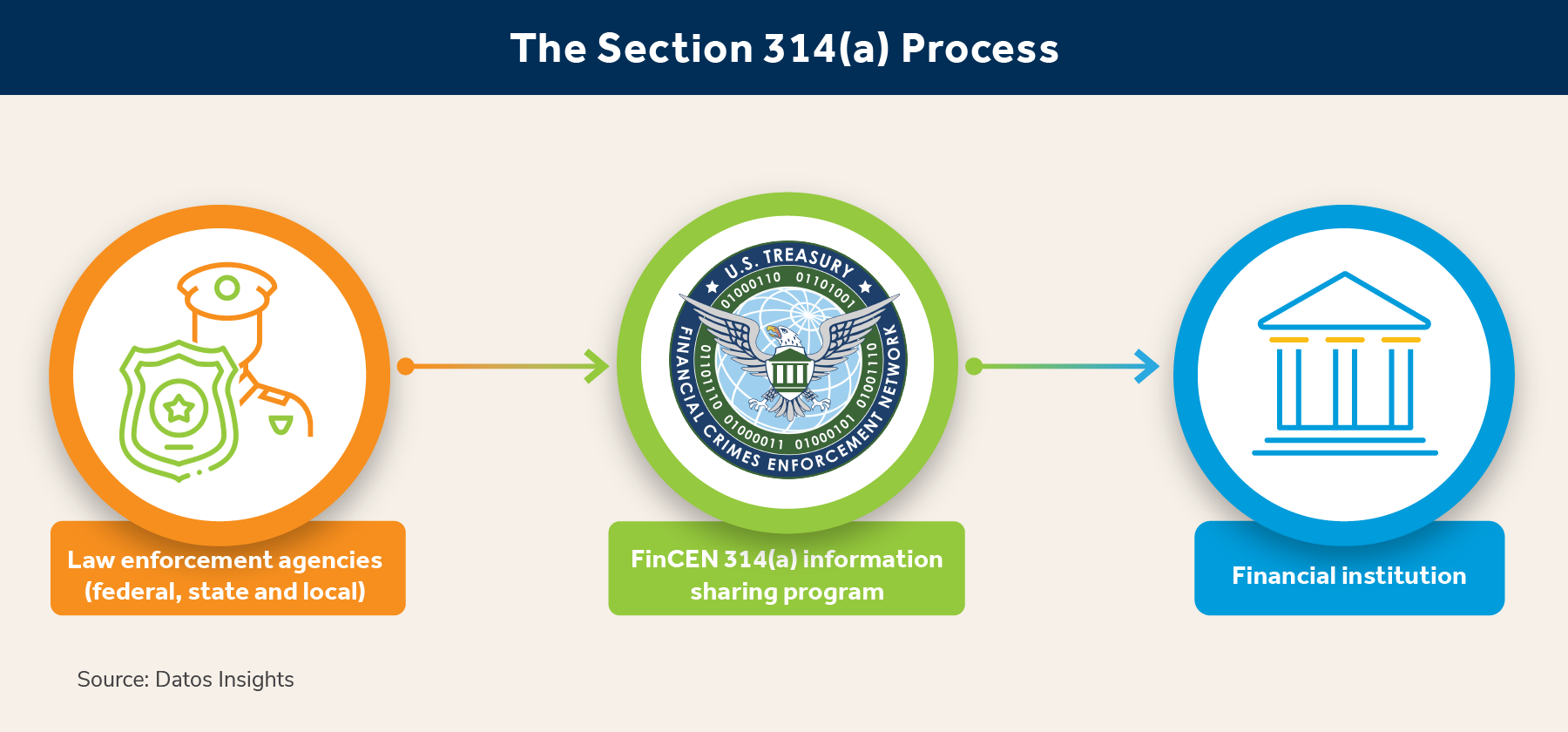

The U.S. has had Section 314 of the USA PATRIOT Act in place for more than 20 years, but great strides have not been made to share information in that time frame. The Financial Crimes Enforcement Network manages the program under Section 314 and has released multiple pieces of guidance over the years. Despite this, confusion still exists across the financial services industry, and many financial institutions choose not to share information.

This report provides an explanation of Section 314 of the USA PATRIOT Act, including Section 314(a) and 314(b) and subsequent guidance. It is based on desk research, the advisor’s experience and expertise, interviews with vendors that have developed solutions to support information sharing, and a survey of 19 AML executives at FIs in the U.S. and Canada.

Clients of Datos Insights’ Fraud & AML service can download this report.

This report mentions American Bankers Association, Duality Technologies, FCi2, and Verafin.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.