Fintech firms continue to pressure legacy players globally by providing more banking, payments, and lending products and services and by showing growth and demand. The innovative firms featured in this Fintech Spotlight are leveraging technology to connect with customers more effectively. They are offering more choices in how to pay for things, enabling capabilities that remove friction from everyday banking and payments processes.

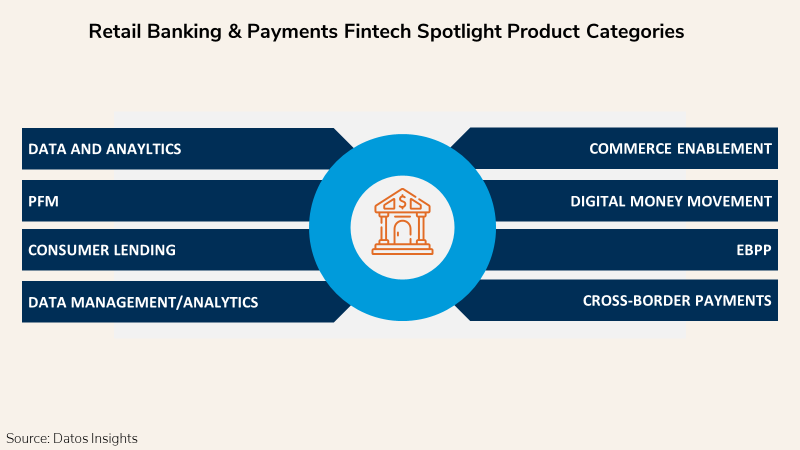

The Retail Banking & Payments Fintech Spotlight is a series of quarterly reports that look at select emerging fintech vendors active in the banking space. The spotlight series provides insight into interesting vendors with strong unique selling points and innovative approaches as partners or competitors. This report profiles the following fintech firms: 10x Banking, Flexcharge, Highline, Mashgin, Oscilar, Plinqit, and TerraPay.

Clients of Datos Insights’ Retail Banking & Payments service can download this report.

This report mentions 4Front Credit Union, Alipay, Alterra, Amazon, Apache Kafka, Aramark, Bank of Montreal, Bankjoy, BlackRock, BP, the Canadian Pension Plan Investment Board, ChoiceOne Bank, Circle K, Compass Group, Costanoa Ventures, CU*Answers, Delaware North, FAB&T, Facebook, FINTOP Capital, FIS, FlexCar, Foundation Capital, Founders, Google, HMSHost, International Finance Corporation, Invest Detroit, Jack Henry and Associates, JAM FINTOP, JPMorgan Chase, Jump Capital, Levy, LinkedIn, Lumin, Matrix Partners, Nationwide, NEA, Partech Africa, Ping An, Prime Ventures, Q2, Slope, Sodexo, Super, The Milford Bank, Timberland Bank, Uber, Visa, West Community Credit Union, Western Union, and Westpac.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.