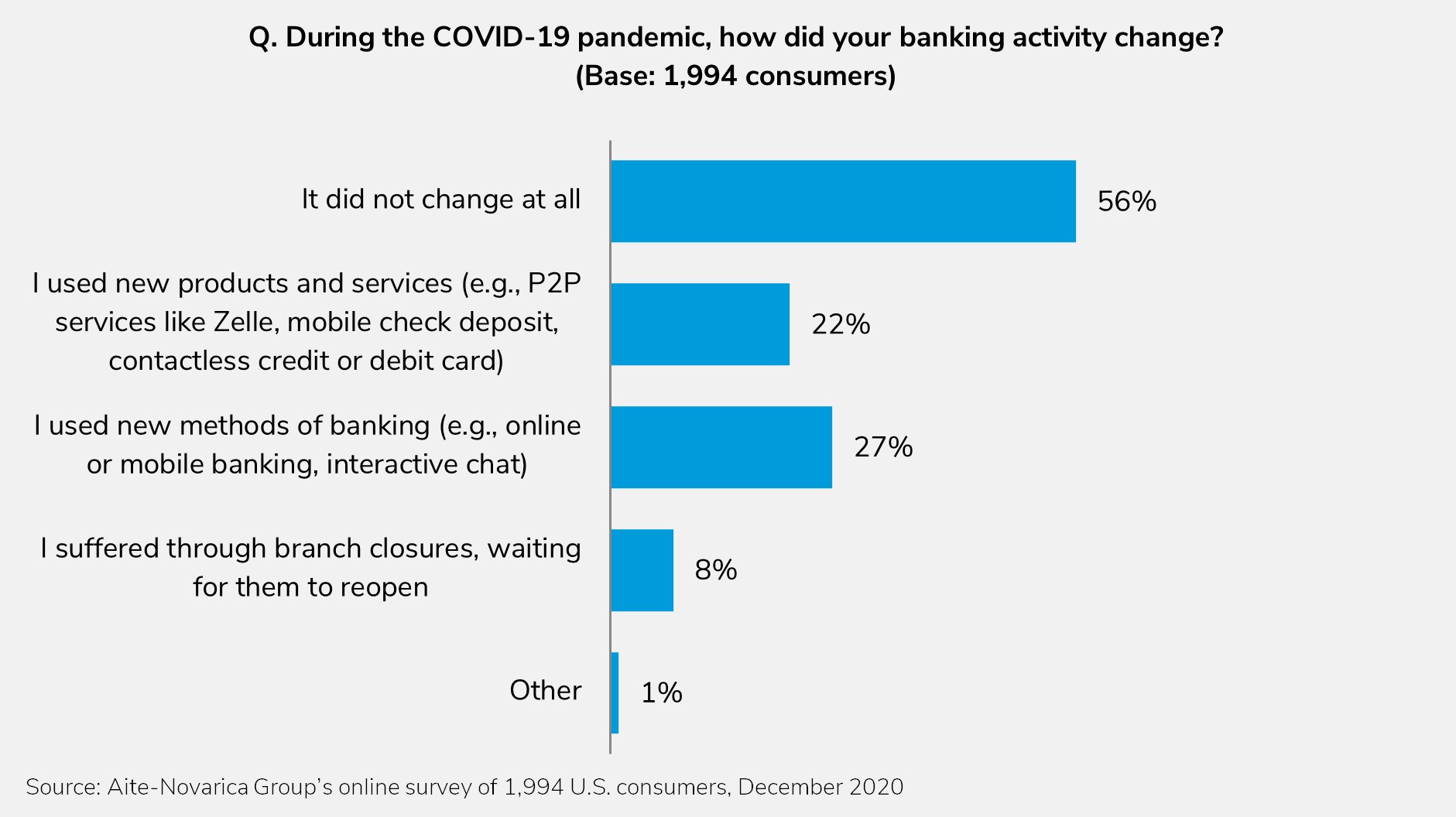

March 29, 2022 – In recent years, many U.S. consumers have migrated to digital channels through a desire to use them or because they were forced to use them by the COVID-19 pandemic. To attract new customers in a digital environment, firms must offer an easy, fast onboarding process so consumers don’t get frustrated and abandon the process. Firms that make the onboarding process easy for consumers—whether it be for a credit card application, opening a checking account, or opening a healthcare account—will enjoy a competitive advantage.

This Impact Report, sponsored by Prove, explores the experience of three firms that have deployed the Prove Pre-Fill solution: what led them to implement Pre-Fill, the implementation experience, the lessons they learned, and the results they have achieved. Aite-Novarica Group conducted interviews with executives from Prove as well as five executives from three companies that have implemented Prove’s Pre-Fill product and have observed improved results in their client onboarding process.

This 23-page Impact Report contains seven figures and one table. Clients of Aite-Novarica Group’s Fraud & AML service can download this report and the corresponding charts.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.