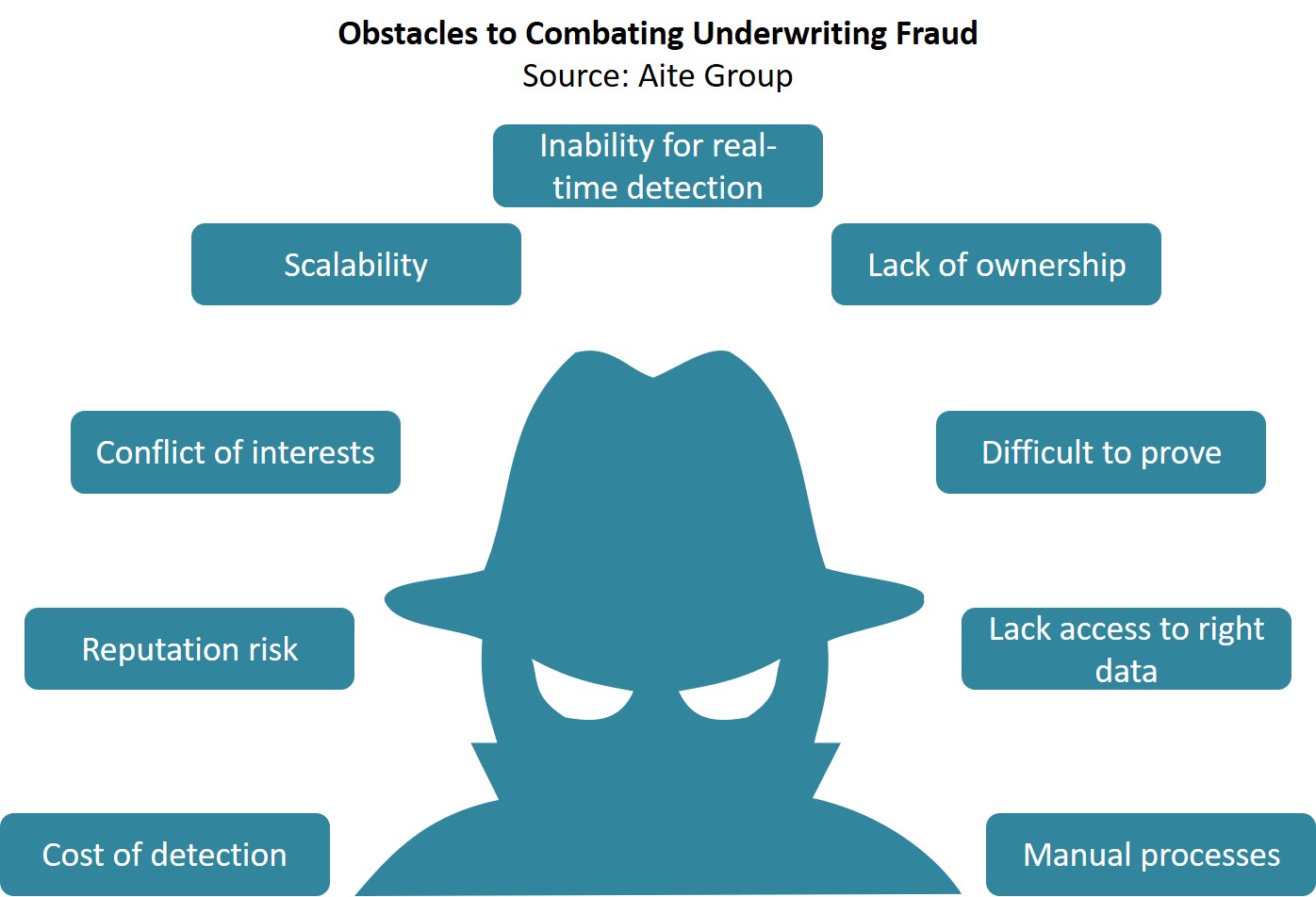

Boston, April 28, 2021 –The full scale of insurance fraud is unknown. By nature, fraud is intended to go undetected, and if fraudulent behavior is not discovered right away, an insurer may never know it occurred. Fraud is prevalent throughout the entire insurance life cycle. Historically, the focus has been on detecting and preventing claims fraud. Today, insurance companies recognize that fraud frequently begins during the initial application process, and they are investing more in technologies to combat underwriting fraud.

This report covers the different types of underwriting fraud and the challenges with detecting this problem increasingly plaguing insurance companies. The report can also help carriers evaluate the tools, techniques, and advanced technologies that vendors have developed to prevent underwriting fraud. This Impact Report is based on 24 interviews conducted in February and March 2021 with underwriting executives at insurance carriers in the United States, industry experts on the topic of insurance fraud, and executives at insurance-focused anti-fraud technology vendors in North America and Europe.

This 41-page Impact Report contains four figures and six tables. Clients of Aite Group’s Fraud & AML or Property & Casualty Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions BAE Systems, Betterview, Cape Analytics, Carpe Data, CRIF Decisions Solutions, Daisy Intelligence, Fenris Digital, Flyreel, Fraud Sniffr, FRISS, Insurance and Mobility Solutions (IMS), LexisNexs Risk Solutions, Mohawk, Octo Telematics, Quantexa, SAS, Shift Technology, Skopenow, TransUnion, TrueMotion, Verisk, and Zesty.ai.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.