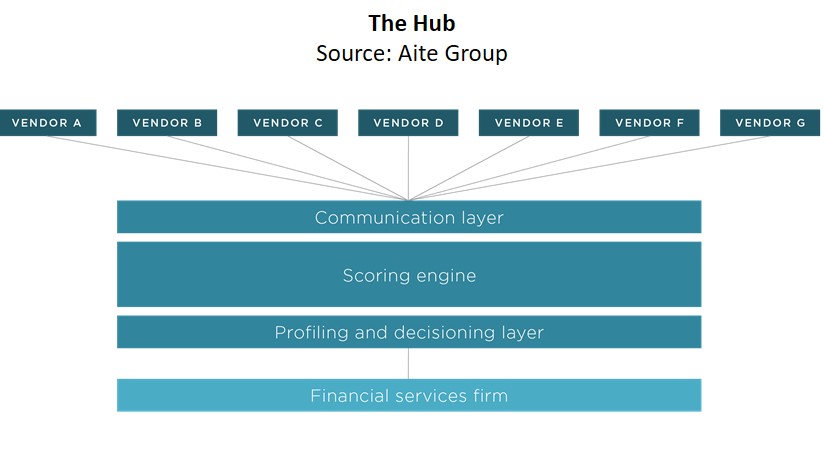

Boston, December 4, 2019 – Hubs are a buzzy concept in risk and authentication, and with financial services firms so interested in these capabilities, the vendor landscape is increasingly crowded. Fraud detection and authentication hubs enable a business to access multiple detection or authentication point solutions and provide a risk engine to integrate the results, and orchestration hubs offer a risk engine that ingests and analyzes clients’ data in order to contextualize risk and authentication decisions. Can these hubs help financial institutions and fintech firms keep pace with the steadily escalating threat environment while enabling excellent customer experiences?

This Impact Report sets forth the key functional elements and details the capabilities of multiple vendors that have offerings in this arena. It is based on Aite Group’s ongoing conversations with financial services executives and vendors about orchestration platforms and on vendors’ responses to Aite Group’s requests for information. Twenty-six vendors participated in the research: ACI Worldwide, BAE Systems, BioCatch, Bottomline Technologies, CA (a Broadcom company), Early Warning Services, Entersekt, Equifax, Experian, Featurespace, Feedzai, FICO, GBG, Gemalto (a Thales company), GIACT, IBM, IdentityMind, IDology, LexisNexis Risk Solutions, Nice Actimize, OneSpan, SAS, Simility (a PayPal service), Transmit Security, TransUnion, and TSYS.

This 42-page Impact Report contains four figures and seven tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.