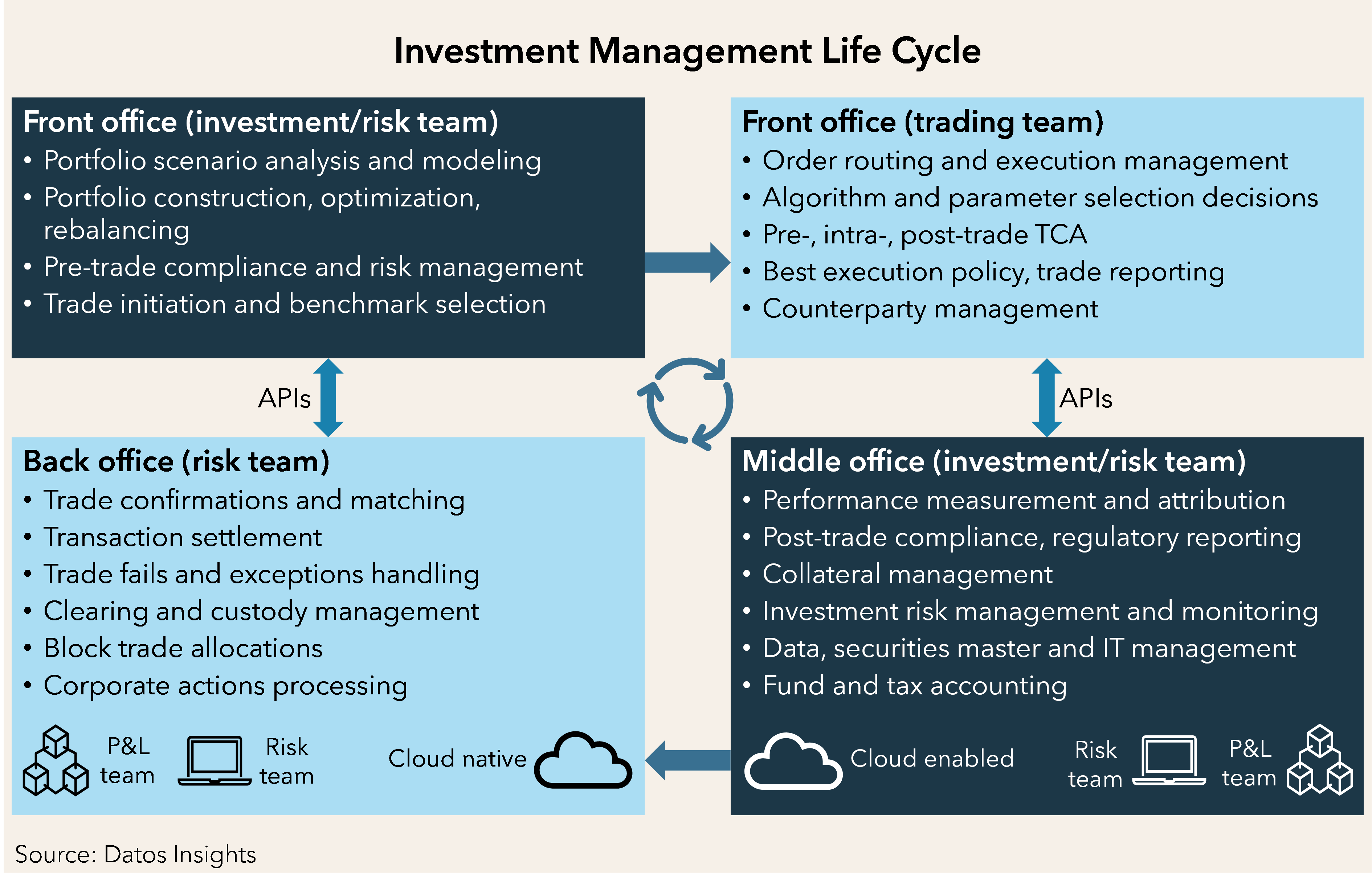

Investment managers, buy-side firms and clients, institutional firms, and wealth management entities are reengineering front-to-back investment technology but still need to integrate legacy systems with the new tech. Now, vendors and open-source resources are offering additional code module accelerators—building blocks to accelerate the development of new applications and link value-added development with legacy systems. However, technology must be fitted correctly, and investment managers’ needs vary, requiring different combinations of build, buy, integrate, and connect.

This report provides an overview of the reengineering of the investment management life cycle and current technology accelerators catalyzing the process. Datos Insights engaged directly with the vendors involved with aspects of component architecture and FDC3 within capital markets and investment managers to get insights along with direct briefings of the product capabilities. This report draws on direct market contact, vendor briefings, and previous Data Insights research and team research gathered in spring 2024.

This report profiles AdapTable Tools, Adaptive Financial Consulting, Appian, Box Technology, Camunda, Finbourne, Genesis Global, Here (formerly OpenFin), InterOps.io, Lab49, MDX Technology, Ness Digital Engineering, and Velox.

Clients of Datos Insights’ Capital Markets service can download this report.

About the Author

James Wolstenholme

Jay started his career in capital markets as a project manager and developer in the financial futures department, specializing in S&P 500 program trading arbitrage. He designed and built electronic program trading interfaces at Salomon Brothers, later acquired by Citi Group, and then worked on prime brokerage, security finance, fixed income, and commodity projects. Jay was head of North America...