The vendors featured in this report seek to address challenges capital markets firms face by focusing on areas traditionally underserved by the current market for ESG data and ratings, such as diversity, equity, and inclusion, or the area of impact data that shows how a company’s products and activities directly affect society and the environment. The solutions highlighted herein aim to provide capital markets firms with unique data and capabilities to address their ESG-related investing and risk management activities.

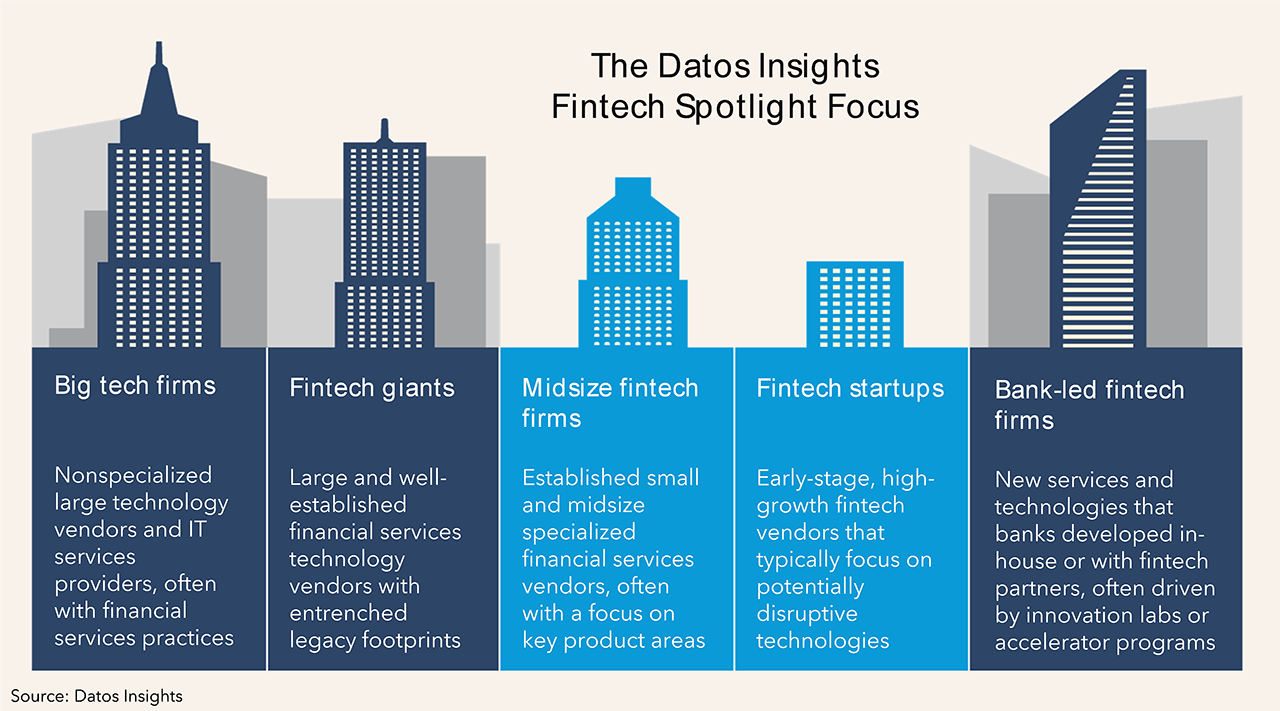

The Capital Markets Emerging Fintech Spotlight is a series of quarterly reports that look at select emerging fintech vendors active in the capital markets space. The spotlight series provides insight into interesting vendors with strong unique selling points and innovative approaches as partners or competitors. This report profiles the following fintech firms: Alygne, Denominator, impak Analytics, and Util.

Clients of Datos Insights’ Capital Markets service can download this report.

This report mentions BITA, Bloomberg, CBOE, Craft, Crux, Danske Bank, Degroof Petercam Asset Management, Eldrigde, Finastra, FINBOURNE, HSBC Ventures, Intercontinental Exchange (ICE), Luxembourg Stock Exchange, Oxford Science Enterprises, Manaos, MSCI, PGIM Quantitative Solutions, RIMES, SAP, Societe Generale, Snowflake, Sustainalytics, Titan Asset Management, and VEGA IM.

About the Author

Adler Smith

Adler Smith is an Advisor on the Capital Markets team at Datos Insights. Adler most recently served as an analyst at Burton-Taylor International Consulting, a boutique capital markets advisory firm, where he primarily covered the financial market data and ESG data industries. Adler holds a bachelor’s degree in Finance from the College of Charleston.