July 7, 2022 –Buy now, pay later (BNPL) is a relatively new payment method, but its use has already become common among consumers across various demographic and financial profiles. As the use of BNPL has skyrocketed, BNPL providers are seeing growing credit losses, prompting industry players to advocate greater scrutiny of BNPL lending. Now, regulators are taking a closer look at BNPL, and lenders are seeking to understand how BNPL use might affect borrowers’ ability to meet other financial obligations.

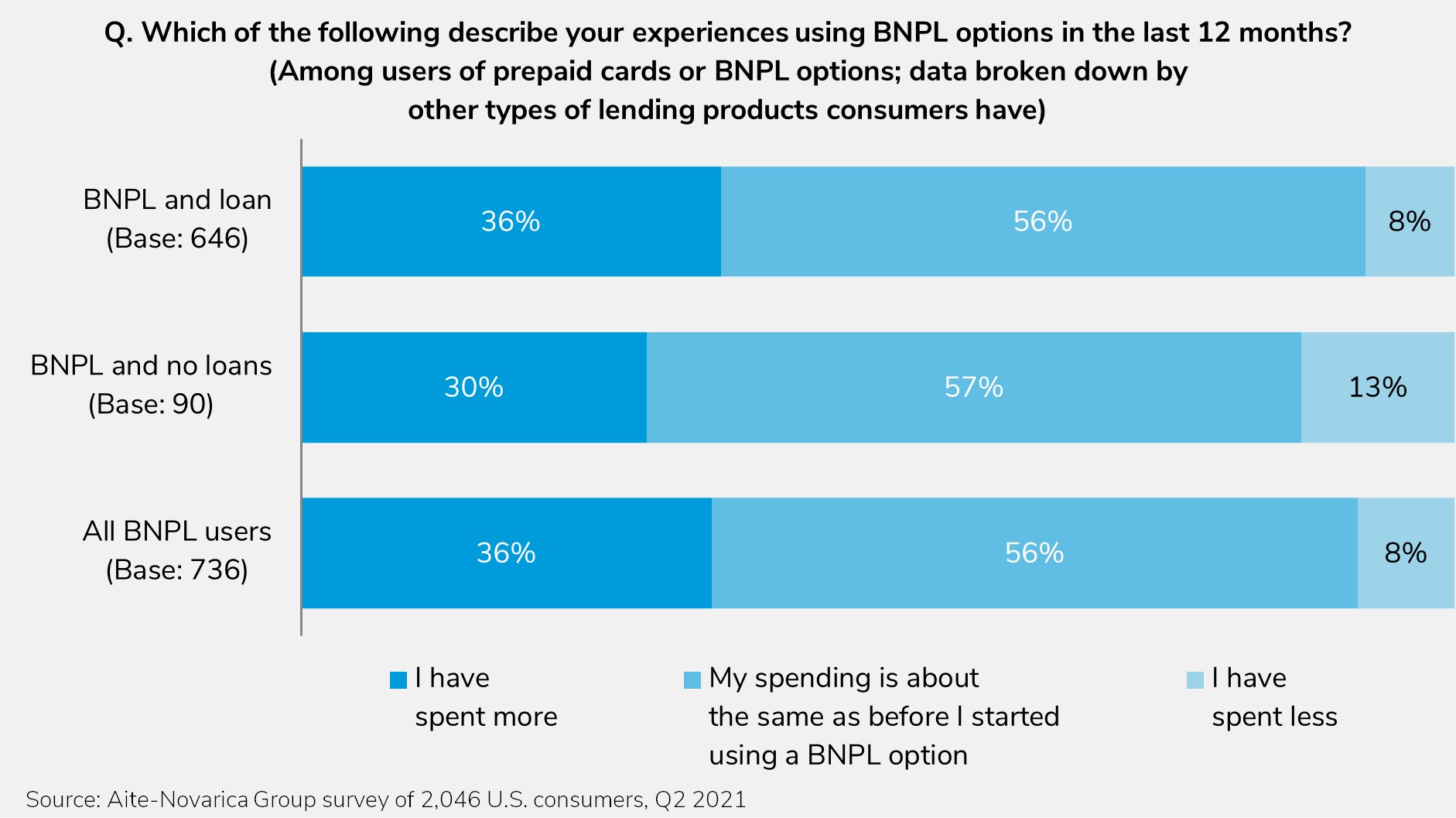

This Impact Report provides insight into the moves credit reporting agencies and regulators are making to enable greater visibility into BNPL lending and to protect borrowers and lenders. It is based on Aite-Novarica Group interviews with executives from leading organizations in the credit bureau and credit scoring industry and a 2021 Aite-Novarica Group U.S. online survey of 2,046 users of prepaid cards or BNPL solutions.

This 23-page Impact Report contains five figures and two tables. Clients of Aite-Novarica Group’s Retail Banking & Payments service can download this report and the corresponding charts.

This report mentions Equifax, Experian, and TransUnion.

About the Author

Ariana-Michele Moore

Ariana-Michele Moore is a Strategic Advisor in Datos Insights' Retail Banking & Payments practice. Ariana covers a variety of topics supporting the practice. Prior to a career break, Ariana was a senior analyst in Celent’s retail banking group. Her research focused on topics such as payment fraud, identity theft, identity verification, payroll cards, stored value cards, biometrics, smart cards, contactless...