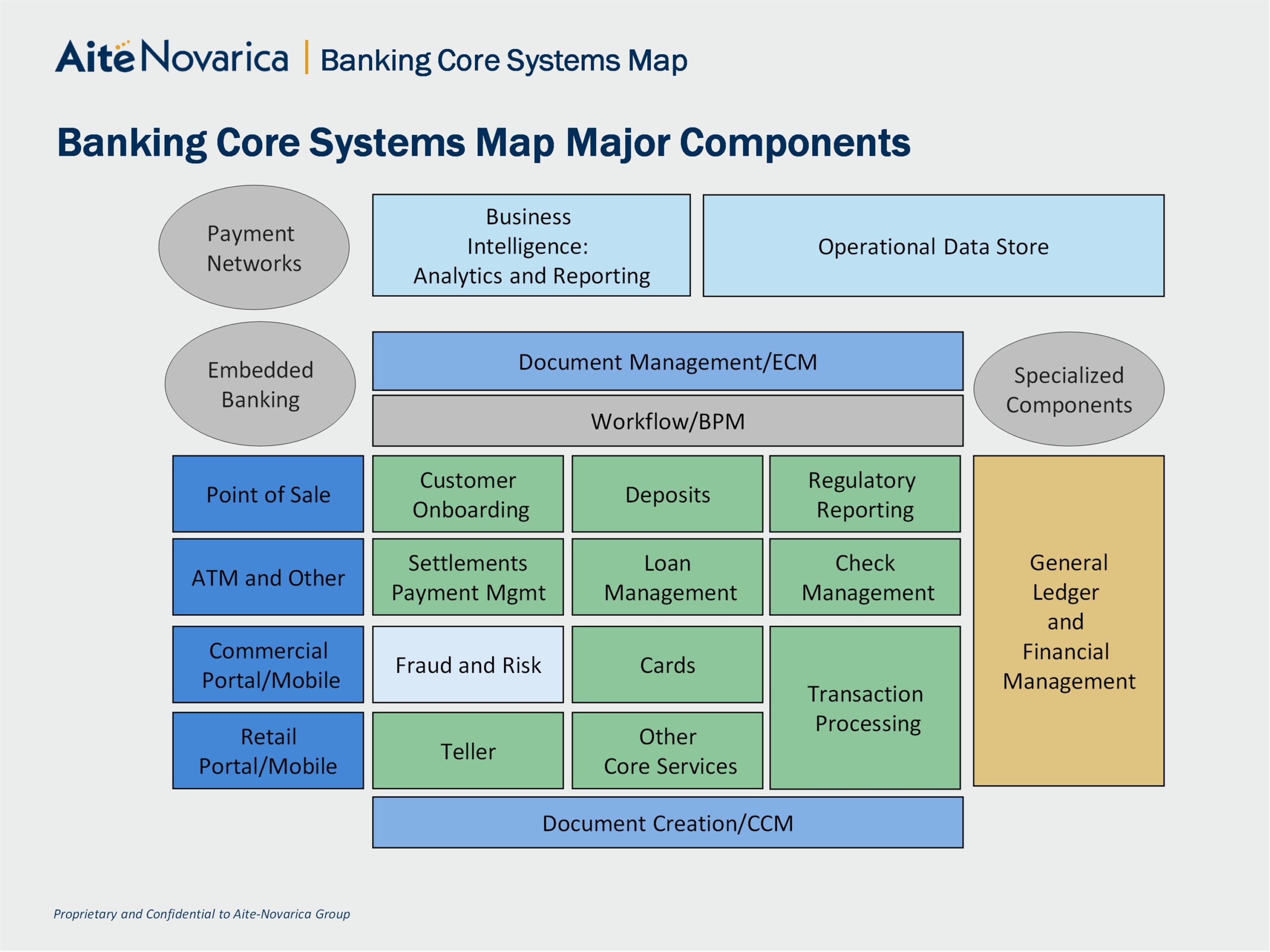

April 20, 2022 –Banking systems are undergoing dramatic changes in the 2020s to respond to expectations around digitization, support for cryptocurrency, changing regulations, competition from nontraditional players, and best practices in partner ecosystem connectivity. A structured approach, leveraging a core system map framework like those of other financial service segments (e.g., insurance, wealth management), will provide the logical foundation for a reference architecture.

This report presents a common frame of reference for bank IT executives to discuss their application portfolios and how they embed them into a reference architecture, by illustrating a core systems map with a high-level look at the major functionalities of each element. The research methods Aite-Novarica Group used to develop the banking core systems map include best practices learned in discussions with banking and insurance IT executives as well as methodologies deployed successfully in large and small financial services firms.

This 67-page Impact Report contains 24 figures and 22 tables. Clients of Aite-Novarica Group’s Community Banking service can download this report and the corresponding charts.

This report mentions Apple, Bill.com, Bitcoin Depot, Bitnovo, BitVending, Clover, Cryptospace, Diebold Nixdorf, Dwolla, Google, Lightspeed, LS Retail, Mad Mobile, Mastercard, MishiPay, MuleSoft, Nium, Oliver, OpenPayd, Oracle, Popmoney, Revel, Scandit, Shopify, SmartPay, Square, Stripe, Trovata, Venmo, Visa, and Zelle.

About the Author

Mitch Wein

Mitch Wein is an Executive Principal in the Insurance Practice at Datos Insights. He has expertise in international IT leadership and transformation as well as technology strategy for banking, insurance (life, annuities, personal, commercial, specialty), and wealth management. Prior to joining Datos Insights, Mitch served in senior technology management positions at numerous financial institutions. At Bankers Trust (now Deutsche Bank), he automated...