March 9, 2023 – A strong ability to process orders in milliseconds ensures execution at the best price. To access liquidity in market venues and route orders for best execution, sell-side firms require robust, reliable, and scalable connectivity with the execution venues. The fixed income market also trades on the bilateral method between the two parties; thus, fixed income trading ecosystems must support firm-specific complex workflows. Sell-side firms are scaling their fixed income trading systems to meet the demand for electronic and bilateral trading.

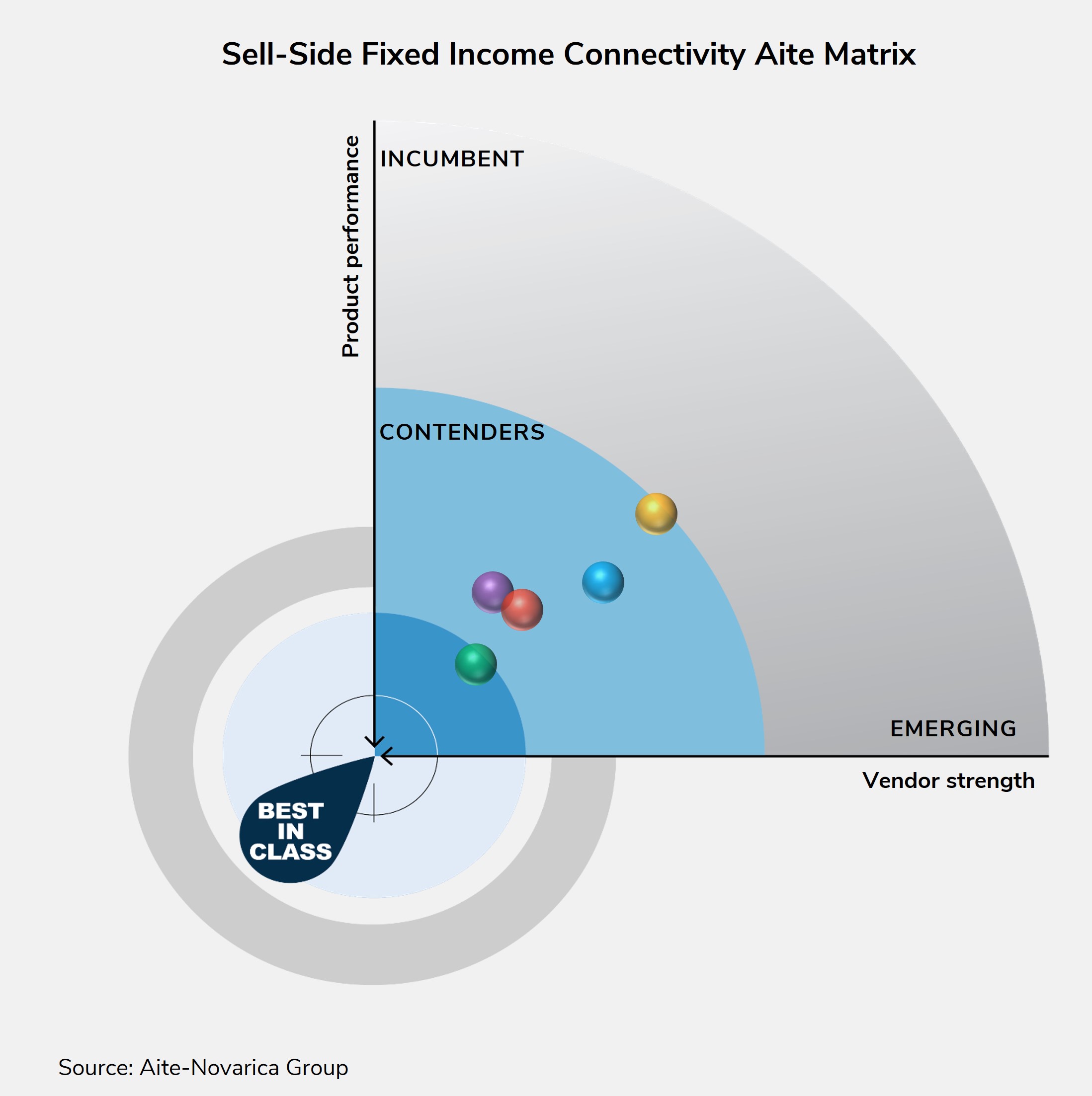

Leveraging the Aite Matrix, a proprietary Aite-Novarica Group vendor assessment framework, this Impact Report evaluates the overall competitive position of six vendors, focusing on vendor stability, client strength, product features, and client services. This report profiles AxeTrading, Bloomberg L.P., Broadway Technologies, ION, and SoftSolutions.

Clients of Aite-Novarica Group’s Capital Markets service can download this report.

This report mentions AxeTrading, Bloomberg L.P., Broadway Technologies, ION, LIST, and SoftSolutions.

About the Author

Vinod Jain

Vinod Jain is a Strategic Advisor who supports the efforts of the Capital Markets team at Datos Insights, focusing on distributed ledger technology, tokenization, central bank digital currencies, stablecoins, cryptocurrencies, private markets (equity and credit), institutional trading operations, post-trade processing, surveillance (trade, market, and communication), and regulatory compliance across equity, fixed income, and OTC derivatives. Vinod brings to Datos Insights over...