March 29, 2022 –Banks wanting to sell payment solutions to businesses may fail to satisfy the operational requirements of accounts payable, resulting in missed targets for implementations, usage, and adoption. However, by understanding the needs and operating constraints of AP, banks can avoid roadblocks and increase the likelihood of adoption and unrealized return on investment.

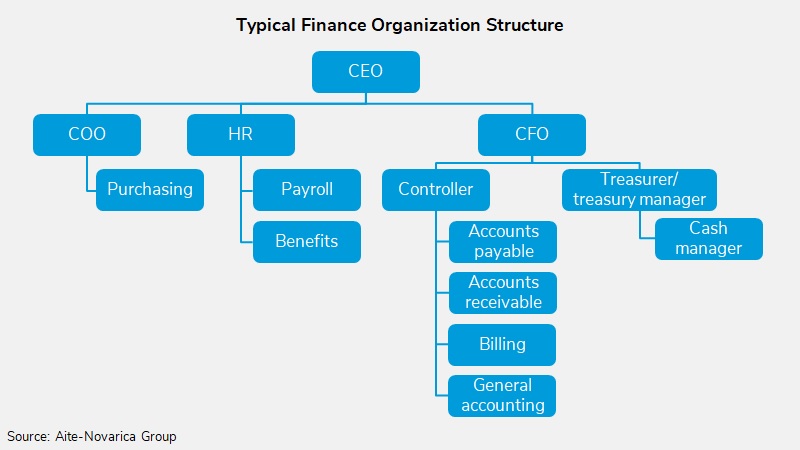

This Impact Report summarizes how the AP function processes B2B or commercial payments, identifies what will trigger this department’s objections to new solutions and services, and includes a matrix of key considerations for assessing and ranking commercial payments offerings. Aite-Novarica Group has profiled the AP function as operating within U.S. businesses earning between US$50 million and US$200 million in annual revenue. This range serves as a reliable baseline and framework of the forces, business requirements, processes, and unwritten rules of adoption that anchor B2B payments.

This 24-page Impact Report contains nine figures. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.