Boston, February 24, 2021 – If it wasn’t obvious before, the economic fallout from the pandemic made it abundantly clear: Many American households lack access to traditional forms of credit and deal with timing mismatches between when bills come due and when their paychecks arrive. A growing number of vendors are offering solutions such as earned wage access programs and installment loans to deal with these issues through employer partnerships. As with many types of emerging categories of financial solutions, there is some regulatory uncertainty in this space, and some aspects of these solutions appear quite consumer friendly while others spark consumer protection concerns.

This report is an update on how these solutions have evolved in the past 18 months. It offers an overview of the leading market participants as well as indications of where this market is today and how it might evolve. It is based on Aite Group’s in-depth interviews in Q3 2020 with executives from 14 companies offering one or more of these solutions in the United States.

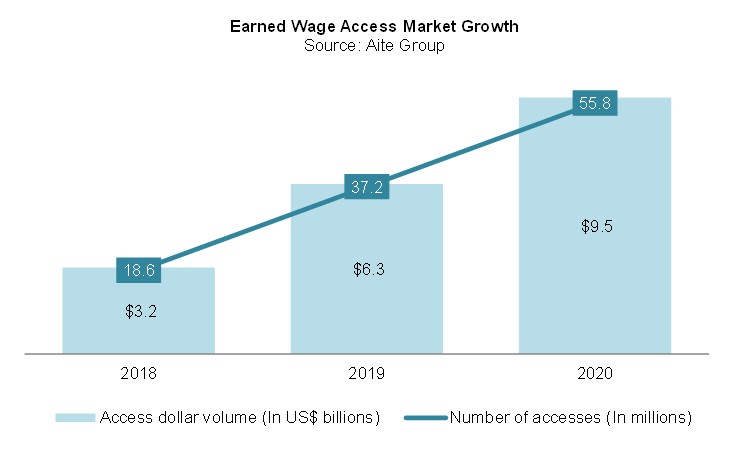

This 27-page Impact Report contains five figures and six tables. Clients of Aite Group’s Retail Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Albert, BMG Money, Branch, Brigit, Ceridian, Cleo, DailyPay, Dave, Earnin, Empower, Even, FinFit, FlexWage, FloatMe, Gusto, HoneyBee, Instant Financial, Kashable, Klover, MoneyLion, PayActiv, Salary Finance, and TrueConnect.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.