March 24, 2022 – To serve high-net-worth and affluent clients, many banks have established a dedicated private client group staffed by wealth advisors, private bankers, portfolio managers, trust officers, and other specialists. In the low interest rate environment of recent years, these private client groups have been under extra pressure from their parent banks to deliver growth; at the same time, they have faced (and continue to face) increasing competition from more nimble registered investment advisors (RIAs), traditional full-service brokerages, and—increasingly—the large online brokerages.

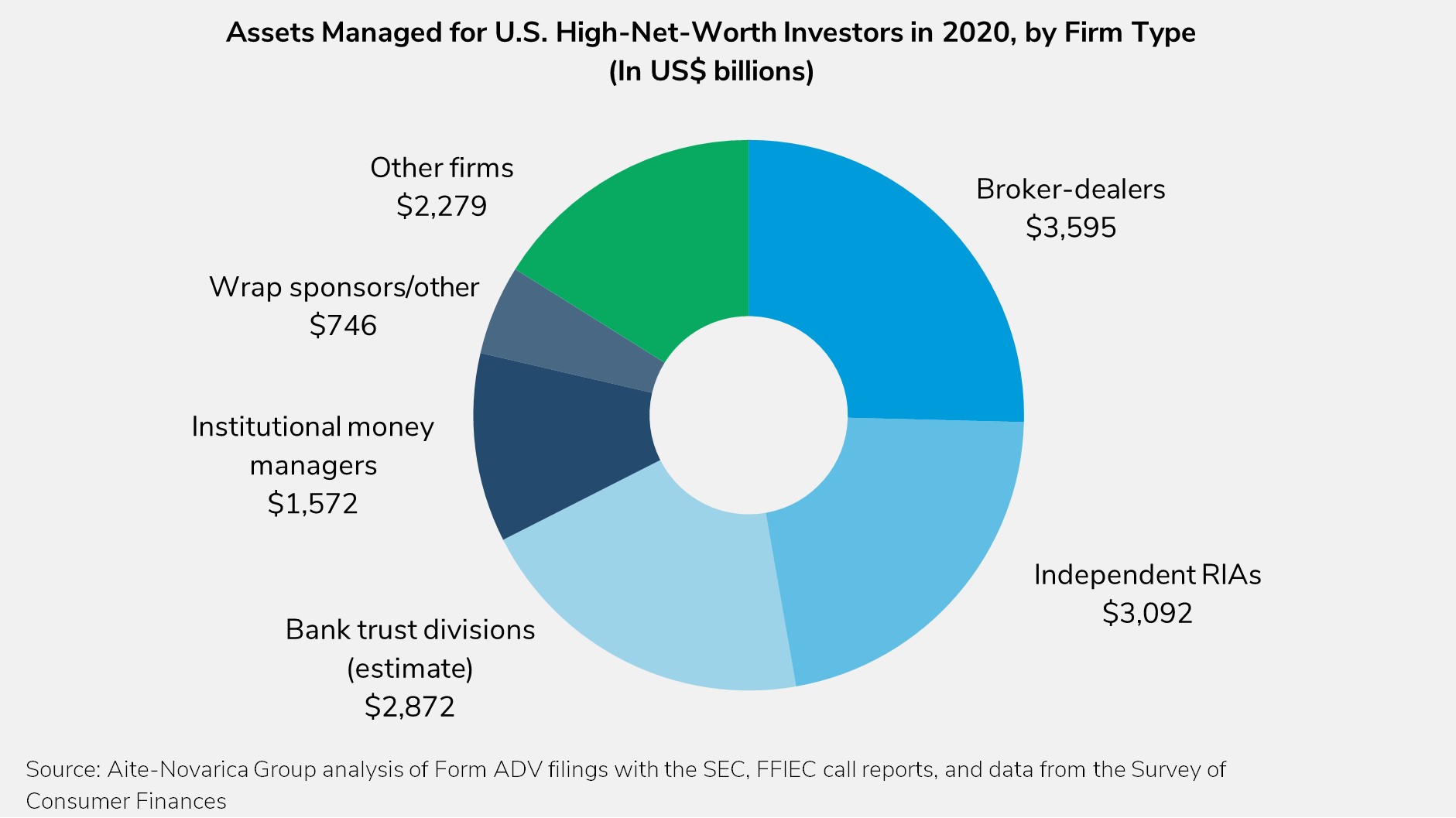

This Impact Report examines the major challenges banks face in growing their private client business and highlights strategies that innovative firms are employing to address these challenges. Aite-Novarica Group interviewed 14 private client executives at large and midsize commercial banks and at global investment banks, as well as studied data gleaned from public filings with the U.S. Securities and Exchange Commission (SEC), data on banks’ fiduciary business from filings with the Federal Financial Institutions Examination Council (FFIEC), and data from surveys conducted by Aite-Novarica Group and by the Federal Reserve.

This 35-page Impact Report contains 10 figures and one table. Clients of Aite-Novarica Group’s Wealth Management service can download this report and the corresponding charts.

This report mentions J.P. Morgan Chase.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.