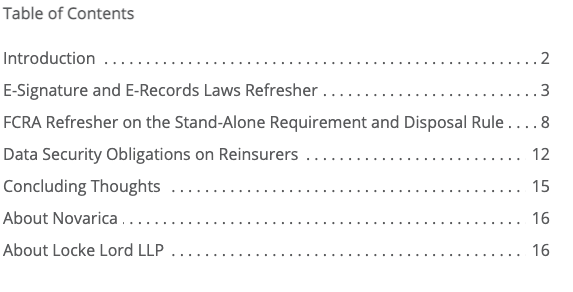

February 2021 – Locke Lord LLP and Novarica look at the technology strategy impact of federal guidelines and specific state regulations that determine the use of e-signatures and e-delivery; the impact of FCRA regulations on the storage of credit and consumer information for employment, insurance, and credit transaction purposes; and the impact of data security on insurers and their third-party service providers, including reinsurers.

February 2021 – Locke Lord LLP and Novarica look at the technology strategy impact of federal guidelines and specific state regulations that determine the use of e-signatures and e-delivery; the impact of FCRA regulations on the storage of credit and consumer information for employment, insurance, and credit transaction purposes; and the impact of data security on insurers and their third-party service providers, including reinsurers.

E-signatures and e-delivery have become a key enabling technology in the insurance industry’s rush to digitize everything due to the pandemic. There are federal guidelines and specific state regulations that insurers need to be mindful of as they expand use of e-signatures.

Fair Credit Reporting Act regulations have an impact on the storage of an individual’s credit and consumer information for both employment, insurance, and credit transaction purposes.

Data security obligations continue to impact insurers and their third-party service providers including reinsurers, who must comply as well despite the operational and contractual complexities this entails.

About the Author

Mitch Wein

Mitch Wein is an Executive Principal in the Insurance Practice at Datos Insights. He has expertise in international IT leadership and transformation as well as technology strategy for banking, insurance (life, annuities, personal, commercial, specialty), and wealth management. Prior to joining Datos Insights, Mitch served in senior technology management positions at numerous financial institutions. At Bankers Trust (now Deutsche Bank), he automated...