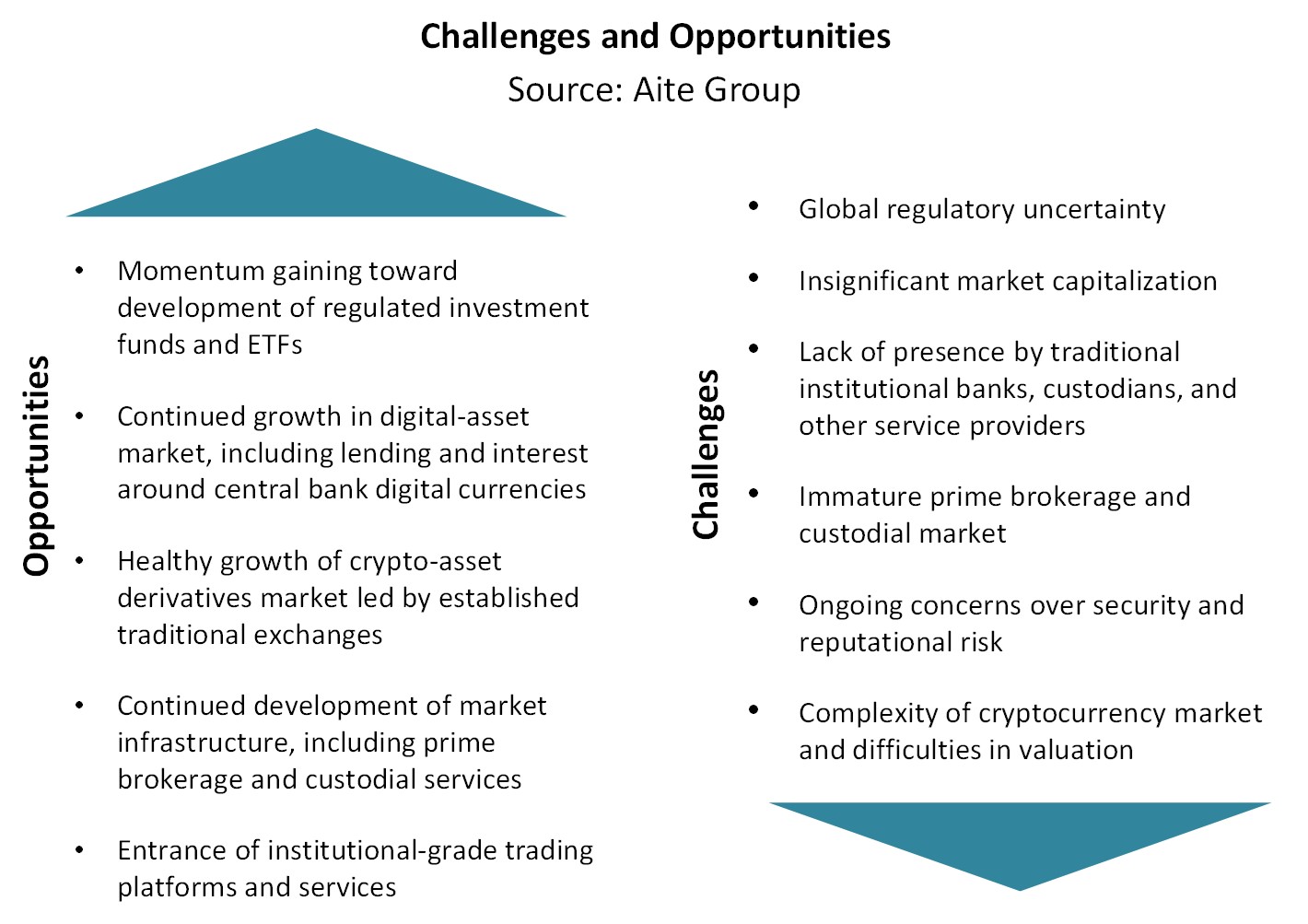

Boston, January 20, 2021 –While the crypto-asset market continues to evolve, it is still immature. Barriers to institutional market adoption include regulatory uncertainty, market capitalization of crypto-assets, immature market infrastructure, and ongoing concerns over reputational risk and security issues. While the market is still dominated by crypto-native players, the interest of traditional banks has gradually increased, driven by growing demand from their private wealth clients for access to digital assets.

This Impact Report examines the key developments and trading landscape of the crypto-asset market and identifies challenges for greater adoption among the institutional asset management and trading community. This report is based on 25 anonymous qualitative interviews with senior executives from leading liquidity providers, brokers, exchanges, crypto-funds, asset managers, and global technology vendors during Q3 2020.

This 32-page Impact Report contains 15 figures and two tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Bakkt, B2C2, Bitcoinity, Bithumb, Bitfinex, bitFlyer, Cboe, CME, Coinbase, Coin Dance, Coin Metrics, CoinGecko, CoinMarketCap, CoinRoutes, Commodity Futures Trading Commission (CFTC), Cumberland, DBS Bank, Fidelity Investments, Financial Crimes Enforcement Network (FinCEN), Genesis, Gibraltar Financial Services Comission (GFSC), Grayscale Investments, Hudson River Trading, International Continential Exchange (ICE), Jump Trading, Kraken, New York State Department of Financial Services (NYSDFS), Nomics, Standard Chartered, U.S. Office of the Comptroller of the Currency (OCC), U.S. Securities and Exchange Commission (SEC), World Bank, and XBTO.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.