Boston, November 24, 2021 – Physical debit and credit cards may be the most important products banks and credit unions provide to their customers or members. As payments become more digital and card issuers become more digital, some issuers may see less value in in-branch instant issuance. However, the need to get a physical card in account holders’ hands is still critical, because it is still the most accepted and preferred payment device for purchases and will remain so for the foreseeable future.

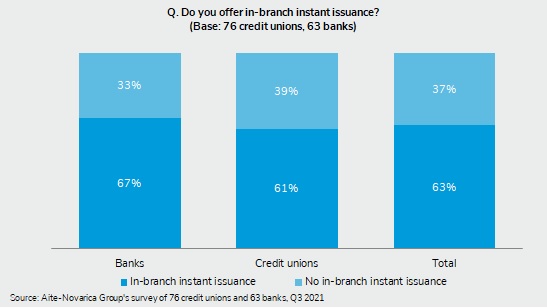

This Impact Report discusses the most common in-branch issuance implementation types, current market penetration of in-branch card issuance, and alternative instant issuance options. It is based on qualitative interviews with 14 bank and credit union card executives in the U.S. and interviews with U.S. vendors, card processors, and core system providers, along with desk research and the author’s experience managing card programs at financial institutions in the U.S.

This 24-page Impact Report contains eight figures and two tables. Clients of Aite-Novarica Group’s Retail Banking & Payments service can download this report and the corresponding charts.

This report mentions AB Corp, American Express, Bass Pro Shop, BPC, Cabela’s, Capital One, CPI Card Group, Diebold, Discover, Entrust, Evolis, FIS, Fiserv, Giesecke+Devrient, Harland Clarke, HID Global, Idemia, IdentiSys, L.L. Bean, Mastercard, Matica, NBS Technologies, OMA Emirates, Panini, and Visa.

About the Author

David Shipper

David Shipper is a Strategic Advisor in the Retail Banking & Payments practice at Datos Insights. His focus is on debit and credit cards. Based in Scottsdale, Arizona, David brings to Datos Insights more than 15 years of experience leading card and payment strategies for financial institutions in the U.S. Prior to joining Datos Insights, David managed the debit card and mobile...