Boston, February 13, 2019 – Transaction cost analysis has become a ubiquitous practice for equities, but fixed income, currency, and commodities are a source of frustration for managers trying to better understand how their execution choices and market intelligence (or lack thereof) impact trading costs and inform portfolio optimization decisions. FICC TCA solutions were part of nearly every product roadmap for TCA providers in 2018, but buy-side institutions vary widely in their acceptance and use of cost analysis. TCA vendors can build it, but how do they bring in the buy-side?

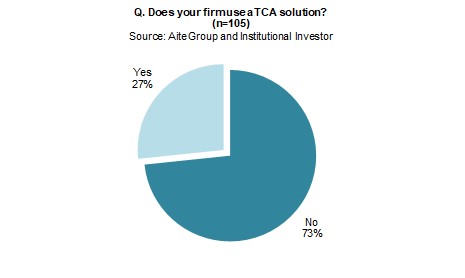

This report examines how the few users of fixed income TCA solutions navigate these challenges and apply cost analysis techniques to their portfolios as well as why the majority of the market is so far behind in adopting TCA for FICC. It is based on an electronic survey of 105 buy-side institutions, launched by Aite Group in partnership with Institutional Investor and conducted from September to October 2018.

This 26-page Impact Report contains 17 figures and two tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Cappitech, IHS Markit, Institutional Investor, and Liquidnet.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.