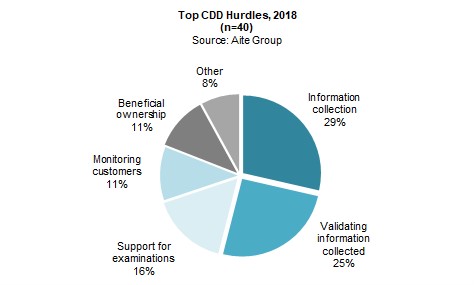

Boston, April 30, 2019 – In efforts to meet the Know Your Customer requirements of an anti-money laundering program, the processes for gathering and validating customer data are the most prominent CDD concerns. Beneficial ownership, support for examinations, and monitoring customer behavior also make the list of top concerns. Regulators will compare peer organizations during an examination; falling behind in automation is not an option for a successful AML CDD program.

This report examines the current state of AML CDD by identifying the three leading CDD process concerns and examining the technologies needed to meet these concerns. It is based on Aite Group interviews conducted between August and December 2018 of 40 AML leaders at financial services firms and experts from 21 vendors from around the globe.

This 26-page Impact Note contains nine figures and four tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions ACI Worldwide, Arachnys, Automation Anywhere, Ayasdi, BAE Systems, Blue Prism, Bottomline Technologies, Brighterion, DataVisor, Digital Reasoning, Featurespace, Feedzai, Fenergo, FICO Tonbeller, Giact, Guardian Analytics, IBM, IdentityMind, Kofax, LexisNexis Risk Solutions, Nice Actimize, QuantaVerse, Quantexa, Quantiply, Risk Ident, Safe Banking Systems (an Accuity Company), SAS, Simility, ThetaRay, Tookitaki, UiPath, and Wipro.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.