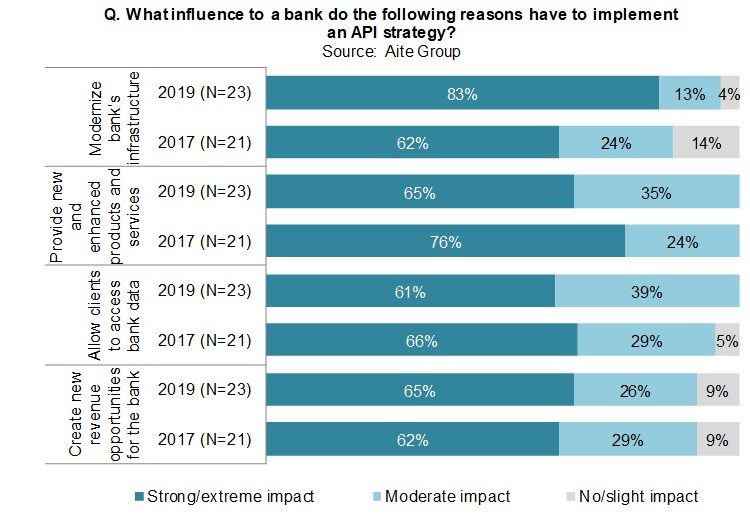

London, 20 June 2019 – Banks’ global application programming interface activities are steadily moving beyond regulatory requirements and are concentrating on a wider corporate transaction banking-based API strategy. The speed at which APIs are evolving in the corporate banking space requires banks to pay attention to the business models that can address their corporate clients’ needs and identify the pricing structures that can monetize the significant effort spent developing an API strategy in the commercial banking landscape.

An update on Aite Group’s 2017 research on API strategies in corporate banking, this report describes how the API market is evolving, discusses possible applications of revenue models for APIs, and addresses how banks are responding to the needs of corporate clients that are more technically focused, agile, and demanding than in the past. It is based on an email survey and telephone interviews that Aite Group conducted from January to March 2019 with 23 major international banks and fintech companies.

This 26-page Impact Report contains eight figures and three tables. Clients of Aite Group’s Wholesale Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.

About the Author

Enrico Camerinelli

Enrico Camerinelli is a Strategic Advisor at Datos Insights specializing in commercial banking, cash and trade finance, and payments. Based in Milan, he brings a strong European focus to the Commercial Banking practice at Datos Insights. Enrico has been widely quoted by publications ranging from American Banker to the Financial Times. He has contributed editorial content to publications such as Supply Chain Europe,...