London, 8 April 2021 – Portfolio attribution analytics are used by a wide array of buy-side institutions to defend their investment philosophy and practices. Within this practice, fixed income attribution analytics (FIAA) are specialized metrics that a variety of vendors offer. In the face of growing competition from passive alternatives, the examination of portfolio or fund performance is an area both portfolio managers and clients are eager to understand in increasing detail. Investment firms and institutional investors that need to explain performance will increasingly have to do so across all asset classes as portfolios become more complex. As a result, there is a growing need for specialized analytical techniques and third-party providers.

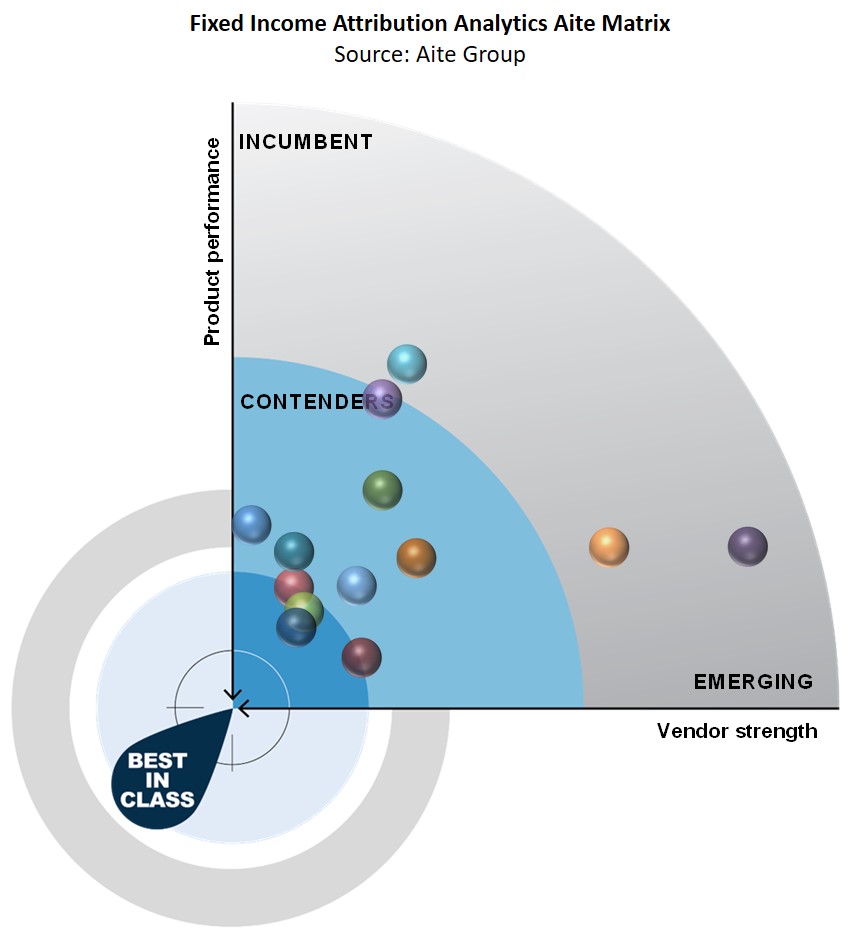

This report explores some of the key trends within the FIAA vendor market and discusses the ways in which technology is evolving to address both historical needs and newer market challenges. Leveraging the Aite Matrix, a proprietary Aite Group vendor assessment framework, this report also evaluates the overall competitive position of 13 vendors, focusing on vendor stability, client strength, product features, and client services. The following vendors participated in this report’s Aite Matrix framework: BlackRock Inc., Bloomberg LP, BNY Mellon Data and Analytics Solutions, Calypso Technology Inc., Clearwater Analytics, CloudAttribution Ltd., Confluence Technologies Inc., FactSet Research Systems Inc., Finastra, Flametree Technologies, MSCI Inc., Ortec Finance, and SS&C Technologies. This report also profiles Charles River Development, FIS, IMTC, and Moody’s Analytics.

This 119-page Impact Report contains 17 figures and 25 tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Achema Investment Management, Allianz Global Investors, Alpha FMC, Amazon Web Services, DevNet, FactSet Research Systems Inc., Federated Hermes, First Derivatives, Halyard Asset Management, IBM, Infosys, JP Morgan Asset Management, M&G, Microsoft, Oracle, PGGM, Phi Partners, Schroders, State Street, Synechron, Tesselate, and Union Investment.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.