Boston, September 3, 2020 – Global financial organizations are dedicating billions of dollars to detecting and preventing financial crime as well as complying with regulatory demands. Solutions for financial crimes case management have been a key weapon in this fight. They are foundational to the efforts of fraud and AML departments, and they continue to evolve to meet FIs’ needs.

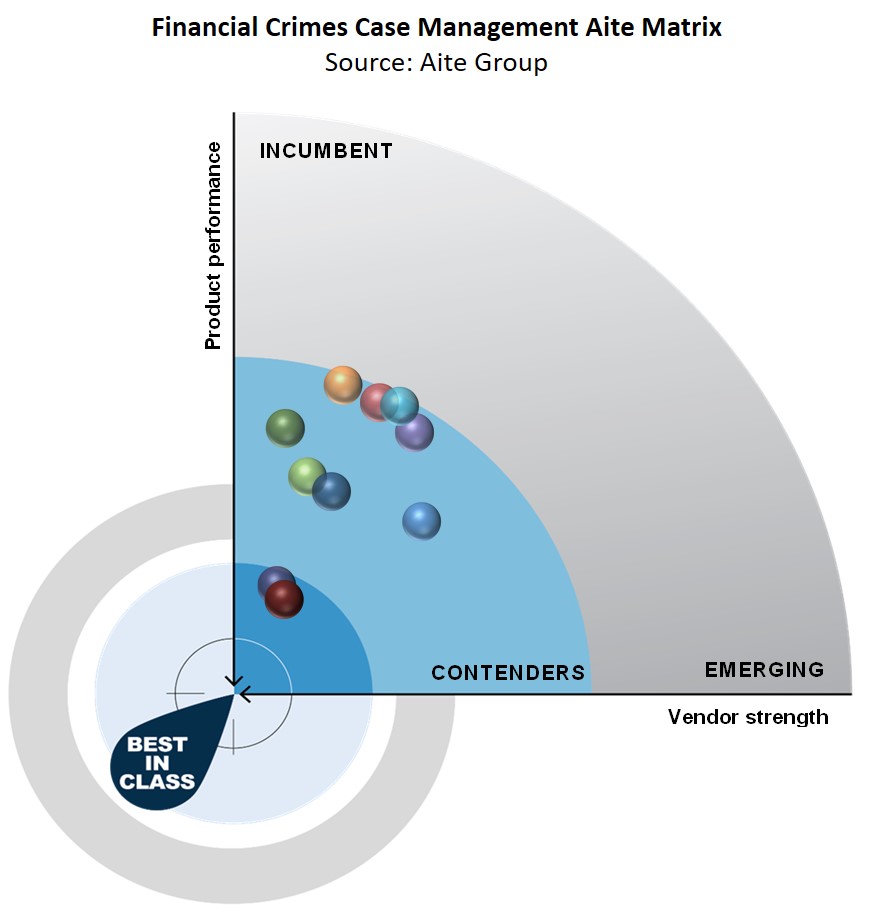

This report explores some of the key trends within the financial crimes case management market and discusses the ways in which technology is evolving to address new market needs and operational challenges. Leveraging the Aite Matrix, a proprietary Aite Group vendor assessment framework, it also evaluates the overall competitive position of 10 vendors, focusing on vendor stability, client strength, product features, and client services. This report profiles Aithent, BAE Systems, Bottomline Technologies, Clari5 (CustomerXPs), Featurespace, FICO, Fiserv, NICE Actimize, Oracle, and SAS.

This 121-page Impact Report contains 38 figures and 27 tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Abrigo, Accenture, Acuant Compliance, Aithent, BAE Systems, Bottomline Technologies, Capgemini, Clari5 (CustomerXPs), Cognizant, DataGear, DataVisor, Deloitte, DXC Technologies, Featurespace, FICO, Fiserv, Hummingbird Regtech, Infosys, KPMG, Matrix-IFS, NICE Actimize, Oracle, SAS, Tata Consultancy Services, Temenos, Wipro, and Zencos.

About the Author

Chuck Subrt

Charles (Chuck) Subrt is the Director of Datos Insights' Fraud & AML practice, and he covers anti-money laundering and compliance issues. Chuck brings 20 years of legal and compliance experience and a deep expertise advising business leaders, driving change, and establishing strong, self-sustaining AML and financial crime compliance and risk management programs at a global financial services company. For the past 10 years, Chuck led multiple compliance functions for Sun...