Growth returned to the global self-checkout market in 2023, with long-time investors in the technology updating their hardware and increasing adoption in developing markets

US market expands with growth at discounters and convenience chains

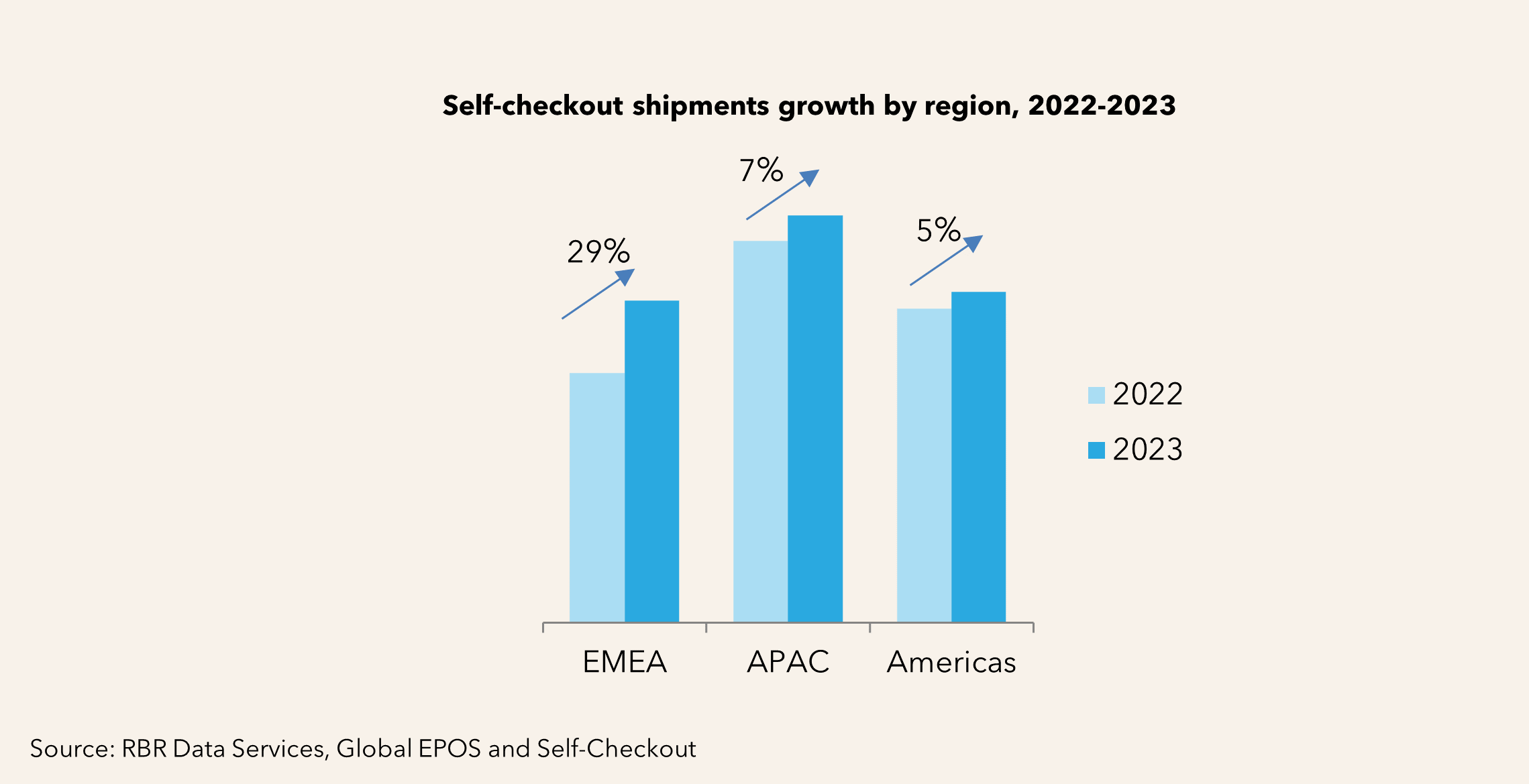

2023 marked a new record year for the global self-checkout market, according to Global EPOS and Self-Checkout, a study from strategic research and consulting firm RBR Data Services, a division of Datos Insights. More than 217,000 terminals were delivered worldwide, up 12% on the previous year.

Activity was up in the USA, the world’s largest self-checkout market, with rollouts continuing at supermarket chains including discounter Aldi and regional fuel convenience operators such as Refuel and Kwik Trip. Existing self-checkout proponents are installing additional terminals to their stores or refreshing older hardware.

Large-scale projects send activity soaring in Europe

Meanwhile, in Europe, the market is also buoyant, with replacement projects at major UK grocery retailers boosting shipments. Deployments are ramping up in Russia and Germany, with supermarket chain Magnit and drugstore firm dm-drogerie markt among those rolling out self-checkout units.

In Asia, the region’s largest market, China, returned to growth following the lifting of COVID-19 lockdowns, while pilots continue in under-penetrated markets, such as the Philippines and India. In other parts of the world, small-scale rollouts and trials are under way; Kenya saw its first ever self-checkout installations, at Carrefour, while Devoto Express was among the grocery retailers to introduce the technology in Uruguay.

Cashless units and computer vision on the rise as self-checkout technology diversifies

Self-checkout technology continues to evolve. An increasing proportion of new terminals are cashless units, meaning they only accept digital payments. Payment options include cards, mobile wallets and even biometric payments in some countries. Meanwhile, some retailers are leveraging RFID tags used to enhance supply chain visibility in self-checkout solutions, most commonly in fashion chains from international firms including UNIQLO to local banners such as Shoprite’s UNIQ in South Africa.

Computer vision-based technology is increasingly used at self-checkout both to identify fresh produce and for loss prevention purposes. Australian grocery firms Kmart and Woolworths are among the retailers introducing camera-based technology to capture mis-scans. Concerns about shrinkage in the USA have led some chains to re-assess their self-checkout offering including introducing measures such as limiting basket sizes.

Self-checkout installations set to top two million by 2029

Despite near-term security concerns, there is still strong demand for self-checkout technology. Countries from Canada to Thailand face labour shortages, while consumers expect a choice of checkout options at stores. By 2029, the number of installations is expected to reach two million globally, with growth across all regions.

Jeni Bloomfield who led RBR Data Services’ Global EPOS and Self-Checkout research, commented: “Self-checkout pilots are popping up in smaller countries and the technology is taking off in major markets that initially had been slow to adopt, such as Germany, showing strong potential for the global market to grow.”.

Notes to editors

About RBR Data Services

RBR Data Services provides clients with independent and reliable data and insights through published research, consulting and bespoke data services. Our global research covers the cards and payments, retail technology and banking automation sectors and is used by the leading market participants, analysts and regulators as the authoritative source of industry and competitor benchmark data. For any questions about this release, please contact [email protected].

About Datos Insights

Datos Insights delivers the most comprehensive and industry-specific data and advice to the companies trusted to protect and grow the world’s assets, and to the technology and service providers who support them. Staffed by experienced industry executives, researchers, and consultants, we support the world’s most progressive banks, insurers, investment firms, and technology companies through a mix of insights and advisory subscriptions, data services, custom projects and consulting, conferences, and executive councils.

The information and data within this press release are the copyright of Datos Insights and may only be quoted with appropriate attribution to RBR Data Services, a division of Datos Insights. The information is provided free of charge and may not be resold.