International fast-food giants as well as domestic restaurant chains and independents are boosting their investment in self-service technology

Burger King and KFC bolster their kiosk deployment worldwide

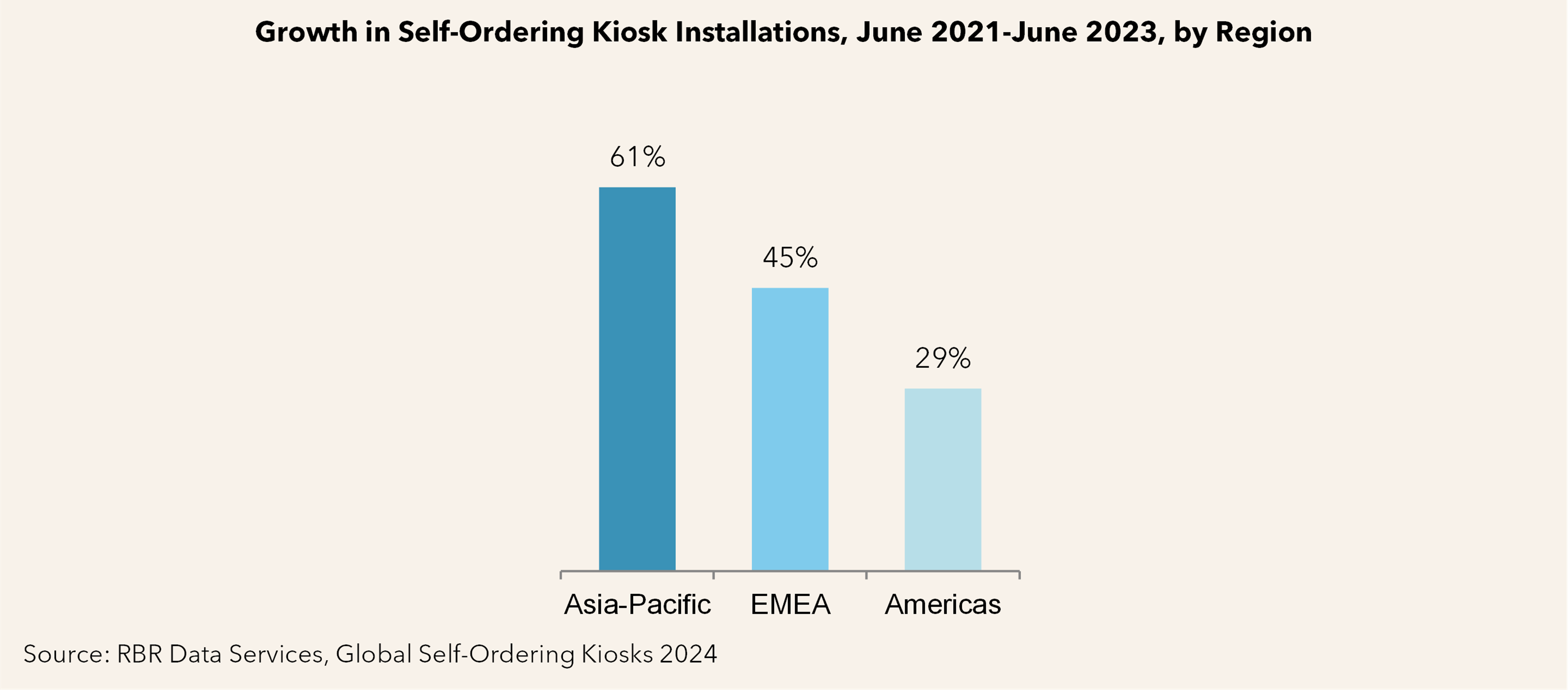

The latest study from strategic research and consulting firm RBR Data Services, a division of Datos Insights, reveals that the total number of restaurant kiosks globally increased by 43% in the two years to June 2023, nearing 350,000 installations.

Global Self-Ordering Kiosks 2024 shows that while McDonald’s remains the world’s largest deployer of the technology with more than 130,000 units installed, Burger King and KFC have each expanded their international kiosk deployment considerably, in countries ranging from Romania to the Philippines.

Asia-Pacific and EMEA see sharp rises in kiosk uptake

The report shows that restaurant kiosk installations in Asia-Pacific increased dramatically, largely owing to Chinese chain Dicos more than doubling the size of its estate, while various South Korean brands such as Lotteria, Mom’s Touch and A Twosome Place have also deployed kiosks widely across their store networks.

In EMEA, local chains as well as global QSR brands are pursuing a digital store model that includes kiosks; among these are France’s BCHEF and Poland’s Pasibus which have rolled out the technology to all their restaurants. North American chains are expanding outside their home markets into EMEA, opening stores with kiosks as standard, including Taco Bell in the UK, Dunkin’ Donuts in Germany, and Pizza Hut in Saudi Arabia.

The largest regional kiosk market is the Americas, with the USA alone being home to more than 110,000 installations. Alongside international QSR giants, domestic chains in the region such as the USA’s Shake Shack, Brazil’s Habibs and Argentina’s Mostaza are also rolling out the technology.

Restaurants are increasingly opting for smaller kiosks

Although the largest-sized standing and double-sided models continue to be favoured by major global chains like McDonald’s, small and medium-sized kiosks including tablet-based solutions are seeing strong growth worldwide. Indeed, kiosks with a screen size between 19″ and 30″ now account for half the global market.

Space and budget constraints mean that countertop kiosks and tablets are gaining significant traction among local restaurant chains including Black Sheep Coffee in the UK, Pokawa in France and Arctic Circle Restaurants in the USA.

Self-ordering is crucial to the future of major restaurant chains

With rising food prices and labour costs as well as supply chain fragility, restaurant chains are seeing a clear business case for kiosk technology as an effective means of cost-cutting. Frequently, fast-food operators also report an increase in average transaction values as a direct result of installing self-ordering kiosks.

These financial benefits, as well as customer demand for the convenience of this technology, give the global kiosk market considerable future growth potential. RBR Data Services forecasts that there will be nearly 700,000 kiosks installed worldwide by 2028.

Chris Allen, who led RBR Data Services’ Global Self-Ordering Kiosks 2024 research, commented: “With hospitality overheads continuing to skyrocket globally, and minimum wage increases planned in many developed countries, restaurant chains of all sizes will introduce kiosks or expand existing rollouts as a way of rationalising their operations and boosting transaction values.”

Notes to editors

About RBR Data Services

RBR Data Services provides clients with independent and reliable data and insights through published research, consulting and bespoke data services. Our global research covers the cards and payments, retail technology and banking automation sectors and is used by the leading market participants, analysts and regulators as the authoritative source of industry and competitor benchmark data. For any questions about this release, please contact [email protected].

About Datos Insights

Datos Insights delivers the most comprehensive and industry-specific data and advice to the companies trusted to protect and grow the world’s assets, and to the technology and service providers who support them. Staffed by experienced industry executives, researchers, and consultants, we support the world’s most progressive banks, insurers, investment firms, and technology companies through a mix of insights and advisory subscriptions, data services, custom projects and consulting, conferences, and executive councils.

The information and data within this press release are the copyright of Datos Insights, and may only be quoted with appropriate attribution to RBR Data Services, a division of Datos Insights. The information is provided free of charge and may not be resold.