The Current State of Bank Bill Pay

When it comes to paying bills, online banking bill pay is not the preferred choice for payers. The functionality available with online banking bill pay is limited. Billers offer more bill pay options directly from their websites and mobile apps. Datos Insights research shows that 76% of online bills are paid at the billers’ websites, with only 22% paid using bank bill pay.

Ideally, customers would pay bills from their digital banking platforms. It provides direct access to their banking information and funds availability. However, there are limitations with bank bill pay, which is why adoption is low. When a payer initiates a bill payment from their online banking portal, they have limited information about who the biller is and how the biller wants to get paid. This results in a lag in the payment posting on the biller’s system and does not create an optimal bill pay experience for the payer or the biller.

Request for Payment Offers a Better Experience

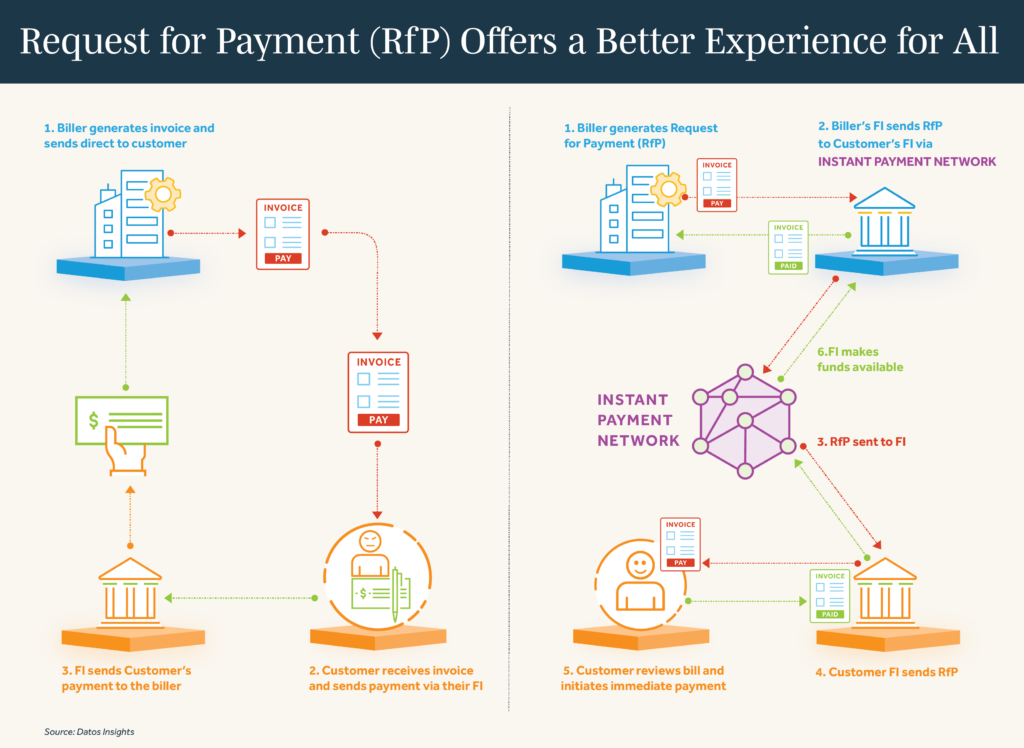

Request for payment (RfP) is a value-added message available on the FedNow and RTP real-time payment networks. An RfP message is essentially a bill, which enables billers to send billing information directly to customers at their financial institutions. FIs must present these bills through online banking portals and mobile apps so the customer can view and pay the bill. It is an alternative to the direct debit models offered with ACH and cards and can replace paper and cash payments with a digital experience.

RfP can reduce manual processes and operational overhead for corporate customers. In addition to the RfP message, there is a remittance message, which contains much-needed billing and reconciliation information that business and corporate customers must exchange to manage their bill-paying processes. A bank’s cash management application can receive RfP and remittance messages for presentment to a corporate cash management customer to review and pay.

Real-Time Payments Adoption is Growing

RTP from The Clearing House (TCH) and FedNow from the Federal Reserve have seen the adoption of their real-time payment services substantially increase since FedNow went live in July 2023. With more banks and credit unions on the networks, demand for real-time payments and value-added services such as RfP will continue to grow.

The focus on RfP is intensifying. TCH announced expanded RfP functionality in August 2023 to include consumer-to-business (C2B), business-to-business, and account-to-account use cases. The Fed took it a step further in September 2023 and published market practices from its RfP industry work group, which makes recommendations for consistent, end-to-end user experiences for C2B bill payments. With both networks offering RfP messaging, there is much work to be done to meet biller and customer expectations. FIs should be embracing this as a significant market opportunity, but many are still behind.

New Use Cases for Request for Payment

According to Datos Insights research, Americans wrote slightly less than 1.9 billion checks to pay their bills in 2023. Many of those payments can be replaced with real-time payments. Two use cases stand out as opportunities to use RfPs, which result in a real-time payment to the biller instead of a paper check:

- B2B payers are heavily dependent on paper checks. Corporate check issuers continue to have funds stolen by fraudsters who can circumvent positive pay and other check fraud prevention schemes. It can take months for corporates to recover funds. An RfP sent from one corporate biller to another corporate payer can prevent loss of funds and provide better cash forecasting and management for both companies.

- RfP can be incorporated into autopay processing, i.e., recurring direct debits using ACH and cards. By sending bills directly to payers who are not enrolled in autopay, a biller can save on sending paper bills and receiving paper checks. The biller has better visibility into when the payment will be received, and the payer controls when funds are taken from their account.

Benefits for FIs and Bill Pay Vendors

FIs now have a compelling reason to enhance their digital banking platforms to incorporate RfP processing. This is good news for businesses who are frustrated with the rate of adoption and the limited functionality available to date.

FIs have invested in the development and connectivity to real-time payment networks. All participants receive incoming payments, and many are starting to offer outgoing payments. The real opportunity is in the value-added services. RfP puts the FI in the bill presentment and payment workflow with the opportunity to capitalize on it. FIs can charge their business customers for sending RfP and remittance messages and for receiving incoming payments.

Making changes to consumer and corporate banking portals to support both sides of the RfP transaction will require investment. Those who offer corporate and consumer banking services are best positioned to bring these capabilities to market early. Knowing that corporations and consumers will change banks to get better digital experiences and real-time payments, FIs who move first can differentiate and lead the market.

A similar opportunity exists for vendors and fintech firms that offer cash management and bill payment solutions. Many FIs use third-party vendors for their banking platforms. Vendors are anxious to partner with FIs and build out this ecosystem and can accelerate an FI’s time to market. Working together, FIs and vendors who address the challenges of adopting RfP will see the benefits with increased revenue and greater customer satisfaction.

For more insight into real-time payments growth and use cases, see Datos Insights report, Real-Time Payments: Growth and Use Cases Looking Into the Future, November 2023.