The last two years have dramatically impacted the life insurance industry. As the pandemic has gone on, remote work, a talent shortage, social distancing, and direct reminders of mortality have been impacting the daily lives of customers, distribution partners, and insurers.

These factors have led to changes in the processes for underwriting, applying for policies, and distribution. Ongoing changes in demographics across the insurance value chain and a shift to primarily remote work have led insurers to prioritize digital experiences and introduce ancillary benefit solutions as they scramble to prepare themselves for a new, and still emerging, reality.

But these new hurdles have not eliminated the challenges life insurers were facing before the pandemic began. Long product development cycles, growing regulatory complexity, and general economic uncertainty are still key areas of focus for life insurers. Carriers in this space are balancing these activities with investments in both resiliency and innovation.

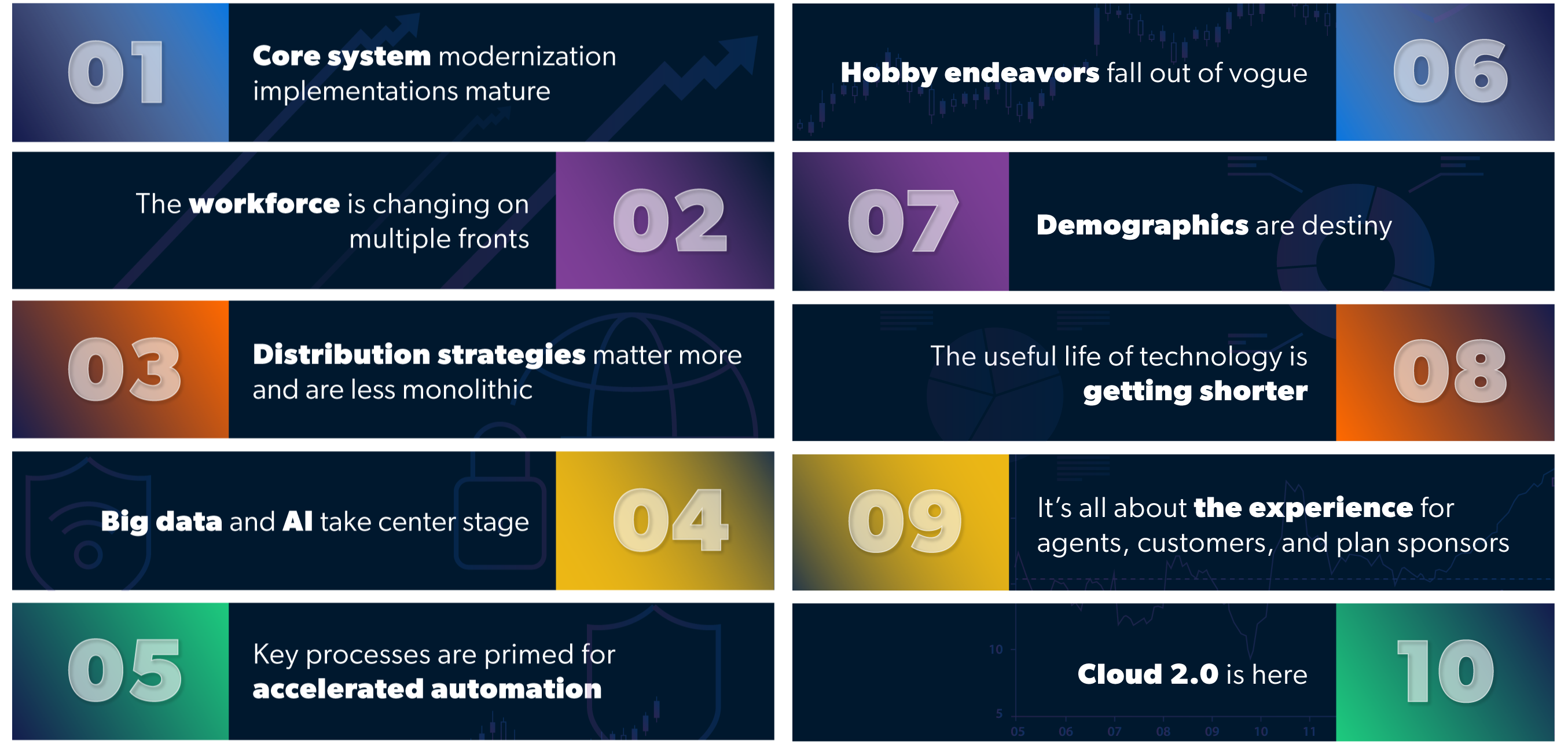

Here are some of the top trends Aite-Novarica Group sees impacting the life, annuities, and benefits space in 2023:

- It will be all about the experience. Customer expectations set by other industries as well as the pandemic have increased demand for improved digital experiences. Carriers are realizing and addressing the importance of user experience, including attractive user interfaces, reliable data, automated processes, and the ability to integrate into producer or employer sales ecosystems.

- Core system modernization efforts will mature. Core system modernizations will remain an important element in the strategic plans of carriers. Opting for a greenfield approach to implementation allows carriers to build a configurable system while optimizing speed to market.

- Talent retention will require creative solutions. Facing a surge of retirements and resignations, carriers need to focus on knowledge management and transference, in addition to attracting and retaining new talent. Keeping talented employees on board will mean focusing on better training programs, flexible work options, and a broader geographical range for finding candidates.

- Cloud, data, and AI will remain at the forefront. While cloud, data, and AI discussions are not new for insurers, these conversations will continue in 2023 with more maturity. Additionally, increased economic pressures will push carriers to be more focused in finding cost-effective, need-based solutions to business challenges.

This year, life insurers will keep prioritizing capabilities that enable growth along with longstanding activities that keep their businesses running. Efforts by carriers in this market will be focused on improving customer engagement and building strong relationships, making it easy for distribution partners to do business, and lowering operating costs.

To learn about the rest of the top 10 trends Aite-Novarica Group foresees impacting the life, annuities, and benefits market in 2023, you can watch the recording of our February 21st webinar: Top 10 Trends in Life Insurance, Annuities, Benefits, 2023: Preparing for a Dynamic and Variable New Reality. You can also read about these areas of the industry in our report Top 10 Trends in Life, Annuities, and Benefits: Preparing for a Dynamic and Variable New Reality or reach out to me at [email protected].