Earlier this summer, I had the opportunity to moderate an interesting and thought-provoking webinar hosted by NTT DATA to discuss the ongoing transformation of corporate banking that has been underway for several years now and is still growing strong. This transformation is being driven by multiple factors, including evolving regulations, increasing customer-centricity, efficiencies in cross-border transactions, and greater focus from corporations on environmental, social, and governmental (ESG) measures.

Earlier this summer, I had the opportunity to moderate an interesting and thought-provoking webinar hosted by NTT DATA to discuss the ongoing transformation of corporate banking that has been underway for several years now and is still growing strong. This transformation is being driven by multiple factors, including evolving regulations, increasing customer-centricity, efficiencies in cross-border transactions, and greater focus from corporations on environmental, social, and governmental (ESG) measures.

In the roundtable at the webinar, we drilled down on two trends driving vendor selection and ongoing product/service evolution in corporate banking:

- How Banking-as-a-Service (BaaS) is transforming the banking landscape, and

- How banks and their corporate customers are addressing ESG in their supply chain finance policies and decisions.

In this two-part blog series, I’ll dive into how each trend is shaping the banking industry. In this post, I will be focusing on BaaS.

The Pillars and Drivers of Banking-as-a-Service

In my research, I’ve identified three pillars that lay the foundation for BaaS: The first is regulatory compliance that enables only players with a banking license to provide the needed banking capabilities pulled and offered as-a-service. The corporate end user can best integrate and consume these services through technology components, the second pillar. APIs are the best example of connectors that allow the enterprise system to call and consume the applications residing in the bank back office.

The last, but most important, pillar, is user experience. This is where we are really shifting from the notion of BaaS to the wider domain of embedded banking. The user experience pillar builds the front-end orchestration layer with the triggers at the point of use that transparently (to the user) enrich the experience and—at the same time—provides those as-a-service banking capabilities in a contextual manner.

There are three major strategy drivers that make the case for BaaS. The first is that banks are modernizing. To provide the necessary products and services at the point of use, banks have to modernize their infrastructures.

This, of course, is made possible through connectivity—the second driver—because corporate treasurers want to run all the financial supply chain operations directly from the enterprise system, whether that is the ERP or the treasury management system, or even smaller accounting packages. These are systems that belong to the daily working life of a corporate treasurer. The third strategic driver is the need for continuous efficiency and agility to keep up with the ever-changing demands of corporate clients and with the dynamics of the market.

How Corporate Bankers Are Modernizing

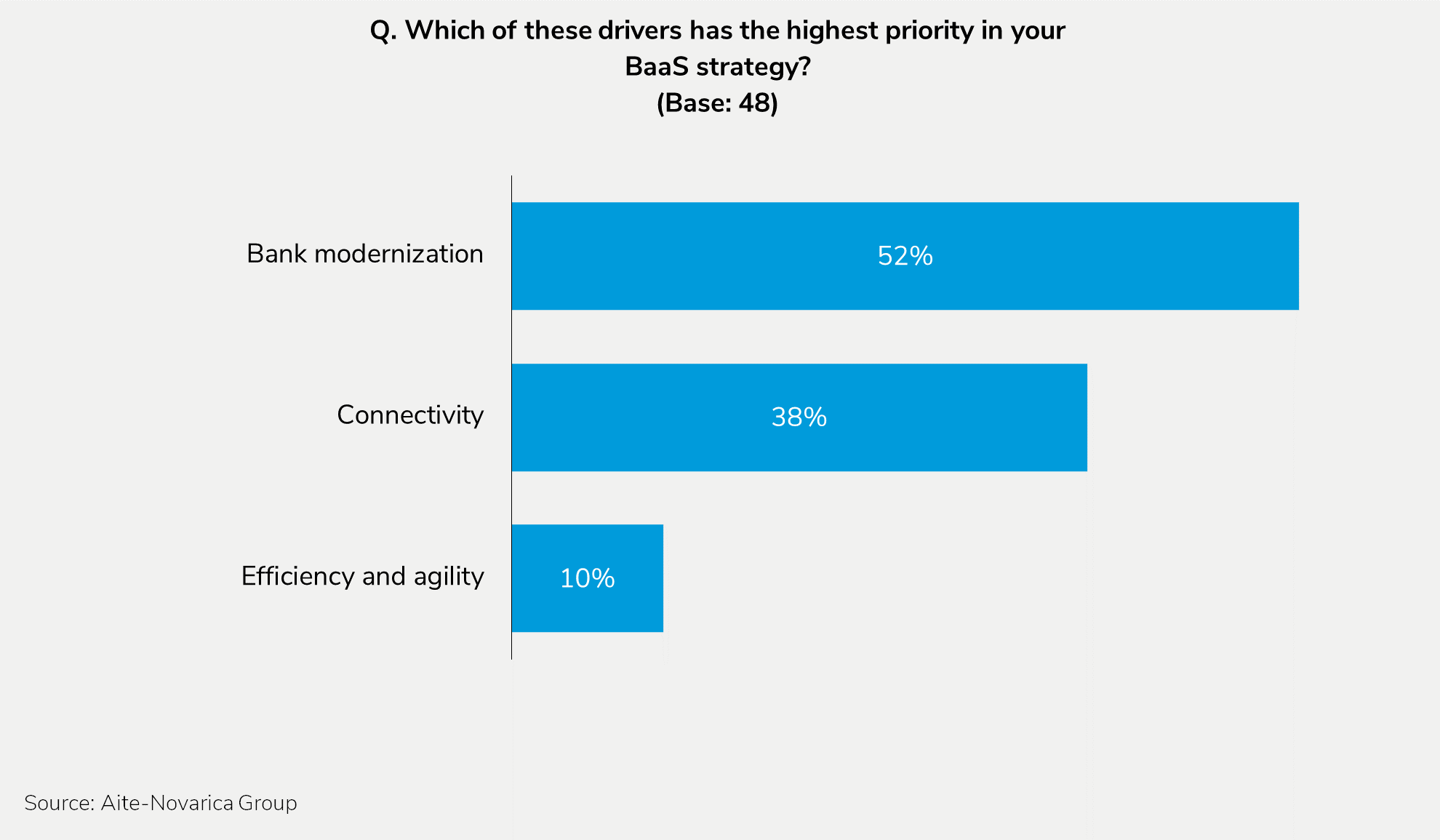

Roundtable participants were polled on how they prioritize the three strategic drivers:

Figure 1: BaaS Drivers

These results show that efforts today are focused on modernizing corporate banking: cloud advances, simple products, artificial-intelligence-based applications, blockchain, and BaaS are all helping banks create value for clients. If banks solely prioritized what helps them internally and only then, as a secondary effect, prioritized the things that help clients do their business, they would be missing the scope of their mission.

The ultimate driver for banks is client experience and client value. Modernization is the strategic driver to deliver cloud-based solutions, roll out faster in those geographies clients want to operate in, move away from other geographies, and steadily move from legacy into cloud. The shift from legacy to more efficient and modernized applications cannot happen without good, clean data. This is a challenge for banks that must do their homework before being capable of throwing innovative technology into the mix.

Solution providers are recommending that their bank clients establish the necessary priorities to modernize themselves, and transaction banking is the major area within corporate banking that demands more permanent innovation, evolution, and transformation from banks.

The problem is that once you start modernizing something, you realize that it is not only about technology. You need to invest in evolving your systems, your platform’s end-to-end capabilities, the connectivity, the resources for implementation, the reporting, and the monitoring. Banks must take a comprehensive approach toward modernizing transaction banking composed of trade, finance, and cash management, with all these moving parts evolving quite fast.

In response to that, there are banks that have decided to take a secondary goal and decided to become mere financiers or funders. Other financial institutions (FIs) instead aim to provide a client with an extended solution, and for that they must modernize across the extremes of their banking capabilities.

What Corporate Users Say

On the corporate side, decision-makers want to make sure that all the services they get from banks are acceptable for corporate needs. Just like banks, corporations are bogged with numerous siloed processes, so things can get quite bureaucratic when onboarding a new bank. Corporate users want this transition to be as smooth as possible, and here is where connectivity (or exchange of information) becomes important: It ensures easy bank onboarding.

The preferred solution for treasurers is to have a very solid ERP system and connectivity with all the banks to execute payments transactions from one central system. However, we are not there yet. There are quite a number of banking products without one consolidated view. When we look at different banks, there are quite a few solutions in the market that provide the opportunity to bring all this information in one platform and have all the information together.

But the lack of interoperability and harmonization of standards creates additional complexity for corporations: They are forced to onboard different third-party platforms to bring data available from different applications and make sure that there is no deviation between the information provided by externally accessed systems and what the company already has in its existing databases. So, there is still a way to go, although there are already workarounds to take out this complexity at some level.

Modernized bank services allow the end user to operate directly from its enterprise suite without having to move from one system to another or from one platform to another. And that requires connecting the bank with the enterprise clients. The need for connectivity demands a bank to adapt to the conditions of the client. There are certain regions where clients prefer uploading files into a website using essentially file interchange, while other clients might be demanding to be connected through APIs.

Sophisticated Connectivity Strategies

When it comes to connectivity, banks must be prepared to be holistic and swing from basic solutions to the most complex ones. In fact, sophisticated clients are already considering API connectivity as “limited.” If you want to go deep, intertwined between the corporate and bank systems, then there must be no layer between those systems. Very forward-thinking corporations do not have barriers in between the systems anymore: Messages get streamed directly from their applications into the bank’s as if they would be communicating directly within the bank IT environment.

That, of course, comes with a certain effort on both sides and requires a particular level of trust. Once the bank becomes an extension of a company’s own ERP system, there is no need for an API gateway to call the APIs of the bank. It is likely that a connectivity layer (i.e., the API gateway) in between the APIs can fail. That’s why forward-thinking corporate users opt for a solution that enables them to initiate payments on their enterprise system then streams the data directly into the bank systems and deep into the FI’s payment processing.

Once the bank’s applications have completed the operations, they kick the data back into the enterprise systems. Banks globally are starting to look to how their current architecture could be transformed to offer APIs for their clients’ needs as well as to offer a single digital platform that allows their corporate customers to operate in a single IT environment without having to access different products in different places.

From a corporate perspective, modernization and connectivity are a “push-and-pull” situation. Technology-intense companies in the beginning may have to push banks to get the level of service required. Moving forward, banks realize they should be happy to have client companies developing at a fast pace, as the bank brings in new features and supports clients in a solution where everyone benefits. The bank has a client to implement new features with, put them in action, launch a new product, and have a reference client. At the same time, it also benefits the corporate client because the client eventually gets the service it has long been asking for.

BaaS, just like any innovative—and potentially disruptive—solution set of financial supply chain features brings value to the bank—and to its corporate clients—only after the FI has matured appropriate strategies to modernize, connect, and be flexibly prepared to offer clients what they need to compete in an ever-changing market. To learn more about how corporate banking and BaaS are evolving in 2022, clients can watch the full recording of my webinar hosted by NTT DATA.