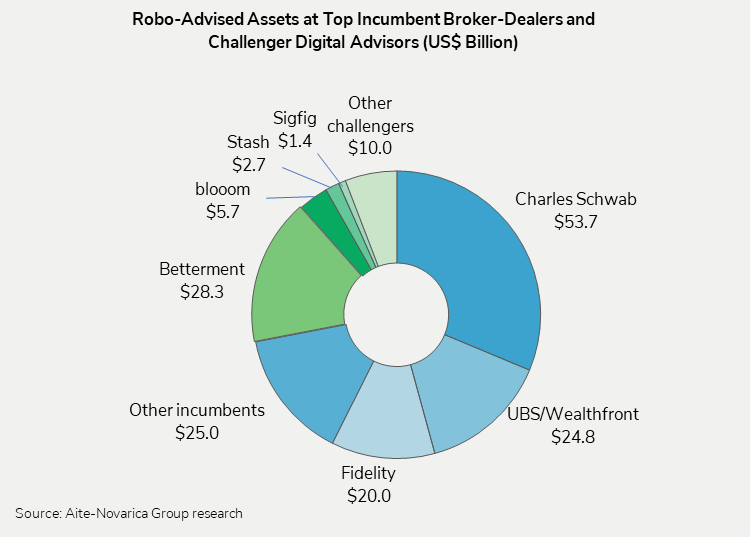

The big boys have now taken over the digital advice space. As recently as 2014, no established players had entered the space, and startups managed 100% of the robo-advised assets. Fast forward to today: With UBS’s acquisition of Wealthfront, the number of challenger robo-advisors of any significant size has been reduced to a single firm—Betterment, which advises on US$28 billion of client assets.

The big incumbent brokerages—both through acquisition and through their ability to leverage their powerful distribution networks—now dominate the digital advice space. At the top are Schwab’s robo-offerings, Intelligent Portfolios and Intelligent Portfolios Premium, which oversee US$54 billion in client assets.

Once the acquisition of Wealthfront closes, UBS will stand third behind Schwab and Betterment with US$25 billion of client assets. Ranking fourth is Fidelity and its two robo-offerings, Fidelity Go and Personalized Planning & Advice, which Aite-Novarica Group estimates have more than US$20 billion in client assets. Rounding out the group of incumbents, we estimate that the robo-advisors at the three other big broker-dealers—Wells Fargo’s Intuitive Investor, Merrill Lynch’s Guided Investing, and Morgan Stanley/E*Trade’s Core Portfolios—collectively advise on US$20-$30 billion of client assets.

Robo-advised assets at these incumbent broker-dealers will total over US$120 billion when the Wealthfront acquisition closes, leaving less than US$50 billion of robo-advised client assets at the challenger firms.

Figure 1: Top Robo-Advisors in the United States, by Client Assets (in US$ Billion)

Thus, in eight years the incumbent share will have grown from nothing to more than 70%. What are the reasons for the aggressive move by the incumbents into the space? Apart from the need to address a truly disruptive threat from the challengers, the incumbents—as seen in UBS’s deal for Wealthfront—are pursuing three goals in building out their digital advice offerings:

- Building relationships through workplace plans.

The incumbents are using digital advice as a way to build relationships with participants in the workplace stock and retirement plans that they manage for large U.S. companies. Through these workplace plans, the incumbents theoretically have access to tens, if not hundreds, of thousands of affluent households. By making digital advice available to plan participants, the incumbents enhance the value proposition of their offering and are therefore more likely to hold on to relationships with participants even after participants change employers.

- Optimizing their small account strategy.

The incumbents in this space are also using digital advice as part of their small account strategy. Over the past decade, all the wirehouses have strong-armed their FAs into moving small accounts to centralized servicing teams. Giving these centralized teams digital advice capabilities has two benefits: It reduces the cost to serve small accounts by automating more of the account management process, and it creates a stronger value proposition for the clients served by these teams.

- Establishing connections with younger generations.

Last but not least, the incumbents are attracted to digital advice for the same reason that the challengers are: It is a low-cost way to establish relationships with young professionals who are at the beginning of their careers and who will likely be ready to work with an advisor 10-15 years down the road once they’ve accumulated significant savings and have more complicated financial lives.

The incumbent broker-dealers have asserted themselves and established their dominance in the digital advice space. They have a clear lead over the challengers, but that doesn’t mean they can rest easy. They will need to continue to innovate their digital advisory offerings—allowing for more personalized investing options, including ESG-focused portfolios—in order to hold onto the digital advice clients that they have today.

Have thoughts on this topic? Please reach out to me at [email protected].