The insurance industry is grappling with significant, concurrent changes. But change itself is neither good nor bad. The shifts we see now in our business and economic climates are creating both opportunities and challenges for the industry. Those who ultimately “win” in this space will be those armed with the best combination of navigational and investment savvy.

A few weeks ago, I had the opportunity to speak at DXC Technology’s event in Charleston. While on the road, spring arrived for me. Temperatures raced upward into the 80s, and flowering trees announced that winter was over. White pollen was everywhere. At the same time, however, a blizzard was hitting the Los Angeles area, coating the ground with a different decorative white element. To think that the arrival of March has ushered in a uniform experience would be a mistake.

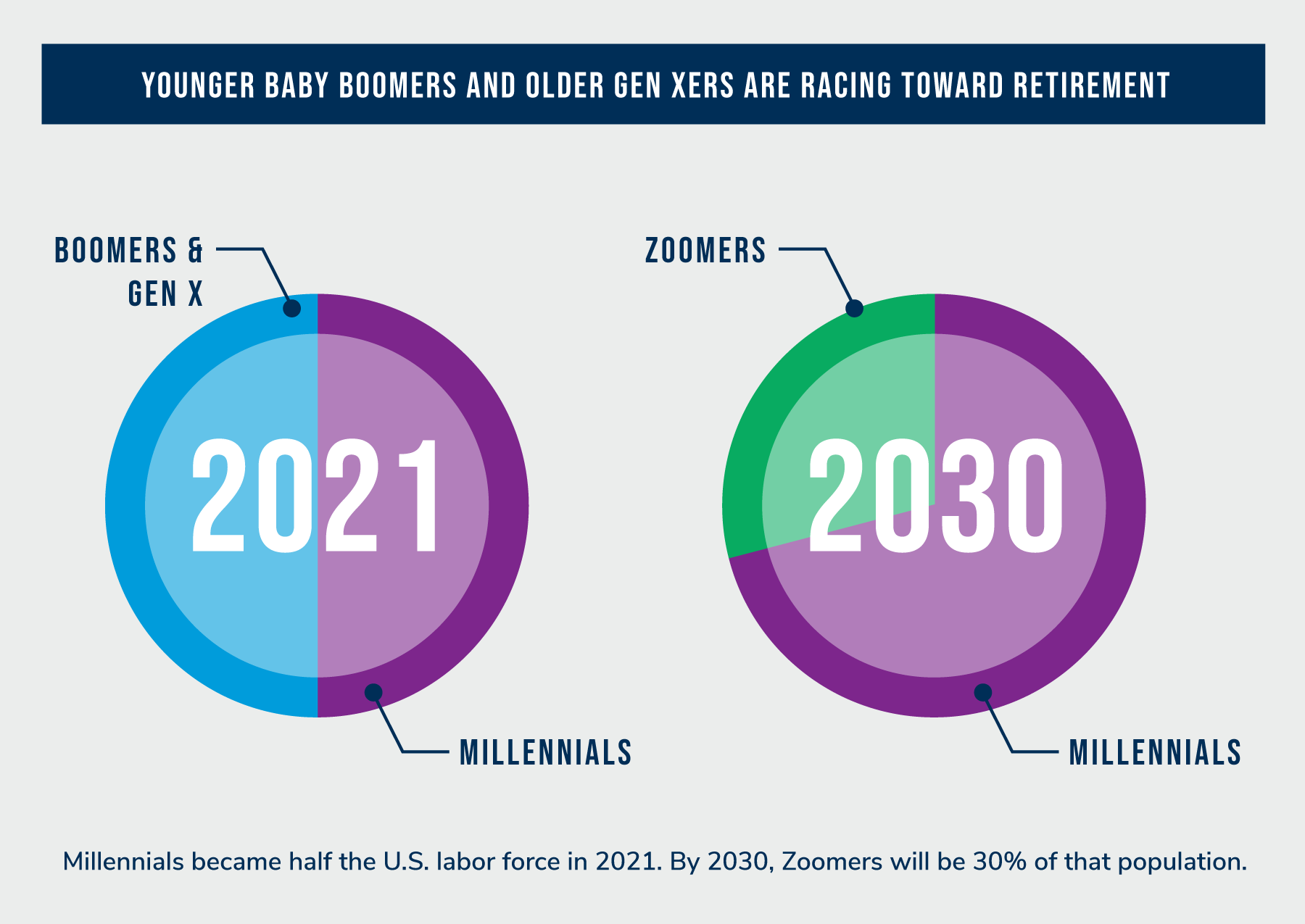

The DXC Technology isn’t the only recent event showcasing that change is in the air. In a webinar Aite-Novarica Group hosted the same week, I shared the tectonic shifts impacting labor markets. Younger baby boomers and older Gen Xers are racing toward retirement eligibility. Millennials became half the US labor force in 2021. By 2030, Zoomers will be 30% of that population.

The Secret Problem Within Talent Issues

With less interest in single-company careers, and moves toward “tours of duty” that last 3-5 years rather than 30-40, companies are facing dual challenges. Talent management is the obvious one; it is creating concerns about how to find, attract, and retain people. However, knowledge management is ultimately even more crucial.

For an example of what happens when the knowledge fades away, look at the Southwest Airlines debacle during the recent holiday season. Plenty of people, lacking knowledge and perspective, can see that this was the corporate equivalent of T-ballers playing baseball. An infield fly that should have been easy to snare hit the dirt while everyone stood around thinking someone else would make the catch. “My bad” doesn’t work when explaining what happened to the Wall Street Journal or as part of a regulatory inquest.

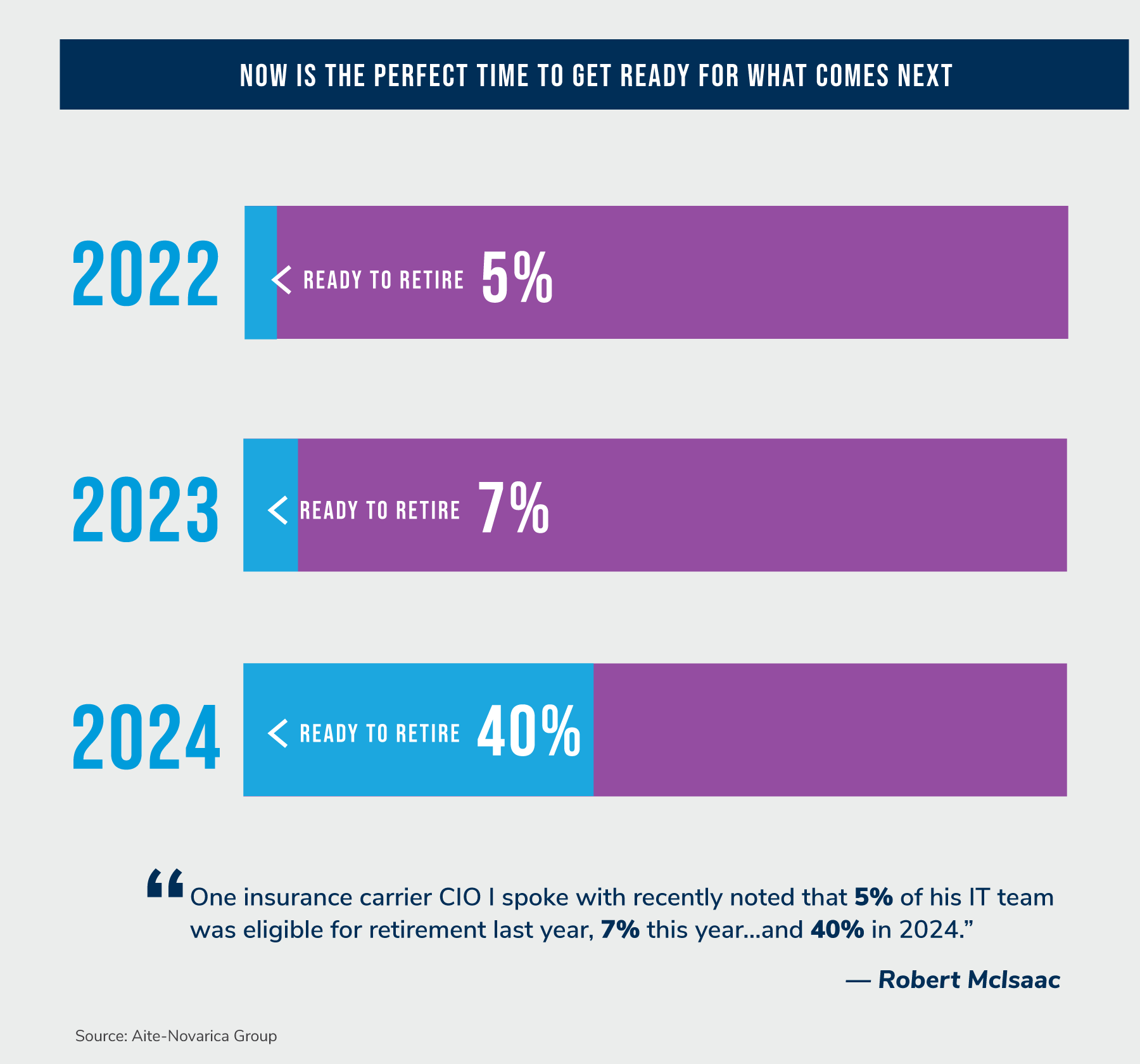

Southwest now has more employees than it did before COVID-19 entered our lexicon. Because they lost so much knowledge due to early retirements and furloughs, however, increased head count and decreased experience may actually have exacerbated underlying issues. This exact same issue is becoming apparent at insurers. One insurance carrier CIO I spoke with recently noted that 5% of his IT team was eligible for retirement last year, 7% this year…and 40% will be eligible in 2024. The knowledge transfer implications are hard to overstate.

The good news is that now is the perfect time to get ready for what comes next! There are a variety of actions carrier IT leaders can take to pave their pathway to the future. Similarly, insurers can start to consider what products, services, and delivery channels will make sense to consumers who are coming of age with different expectations and needs than their siblings, parents, or grandparents. The Aite-Novarica Insurance CIO Council Meeting is but one point of connection for carriers. We also have regional events planned for the summer and an array of other connection options at the ready.

If it feels like we’re on a roller coaster that is cresting a hill, it is because we are. In the post-pandemic era, changes will no doubt accelerate. It is a great time to be in this industry. For more insights on issues impacting the industry, including human capital, product, market, and distribution considerations, our recent Top 10 Trends Webinar, cohosted with Nancy Keating Casbarro, Kenneth Toffolo, CLU ChFC, and John Keddy is a great place to start!